U-Haul 2016 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

Fiscal 2017 Outlook

We will continue to focus our attention on increasing transaction volume and improving pricing,

product and utilization for self-moving equipment rentals. Maintaining an adequate level of new

investment in our truck fleet is an important component of our plan to meet our operational goals.

Revenue in the U-Move program could be adversely impacted should we fail to execute in any of these

areas. Even if we execute our plans, we could see declines in revenues primarily due to unforeseen

events including the continuation of adverse economic conditions or heightened competition that is

beyond our control.

With respect to our storage business, we have added new locations and expanded at existing

locations. In fiscal 2017, we are actively looking to acquire new locations, complete current projects and

increase occupancy in our existing portfolio of locations. New projects and acquisitions will be considered

and pursued if they fit our long-term plans and meet our financial objectives. We will continue to invest

capital and resources in the U-Box program throughout fiscal 2017.

Property and Casualty Insurance will continue to provide loss adjusting and claims handling for U-Haul

and underwrite components of the Safemove, Safetow, Safemove Plus, Safestor, and Safestor Mobile

protection packages to U-Haul customers.

Life Insurance is pursuing its goal of expanding its presence in the senior market through the sales of

its Medicare supplement, life and annuity policies. This strategy includes growing its agency force,

expanding its new product offerings, and pursuing business acquisition opportunities.

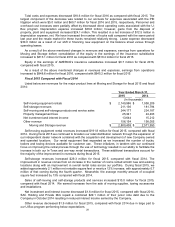

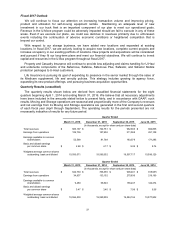

Quarterly Results (unaudited)

The quarterly results shown below are derived from unaudited financial statements for the eight

quarters beginning April 1, 2014 and ending March 31, 2016. We believe that all necessary adjustments

have been included in the amounts stated below to present fairly, and in accordance with GAAP, such

results. Moving and Storage operations are seasonal and proportionally more of the Company’s revenues

and net earnings from its Moving and Storage operations are generated in the first and second quarters

of each fiscal year (April through September). The operating results for the periods presented are not

necessarily indicative of results for any future period.

Quarter Ended

March 31, 2016

December 31, 2015

September 30, 2015

June 30, 2015

(In thousands, except for share and per share data)

Total revenues

$

683,197

$

744,751

$

962,903

$

884,805

Earnings from operations

106,736

157,902

311,068

291,108

Earnings available to common

shareholders

52,568

81,769

183,379

171,285

Basic and diluted earnings

per common share

$

2.68

$

4.17

$

9.36

$

8.74

Weighted average common shares

outstanding: basic and diluted

19,593,071

19,599,352

19,597,717

19,596,129

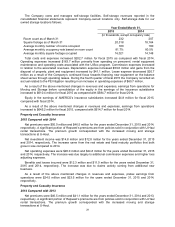

Quarter Ended

March 31, 2015

December 31, 2014

September 30, 2014

June 30, 2014

(In thousands, except for share and per share data)

Total revenues

$

642,730

$

706,355

$

906,491

$

818,955

Earnings from operations

34,837

133,152

275,836

219,199

Earnings available to common

shareholders

9,480

66,540

156,247

124,474

Basic and diluted earnings

per common share

$

0.47

$

3.40

$

7.98

$

6.36

Weighted average common shares

outstanding: basic and diluted

19,594,530

19,590,555

19,584,194

19,577,802