U-Haul 2016 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-23

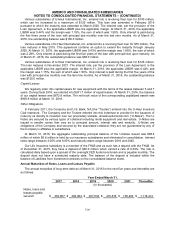

Gains or losses recognized in income on derivatives are recorded as interest expense in the

statements of operations. During fiscal 2016, we recognized an increase in the fair value of our cash

flows hedges of $6.0 million, net of taxes. Embedded in this change was $12.6 million of losses

reclassified from accumulated other comprehensive income to interest expense during the year, net of

taxes. At March 31, 2016, we expect to reclassify $9.0 million of net losses on interest rate contracts from

accumulated other comprehensive income (loss) to earnings as interest expense over the next twelve

months. Please see Note 3, Accounting Policies in the Notes to Consolidated Financial Statements.

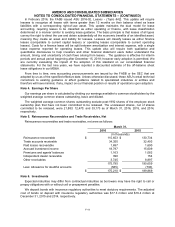

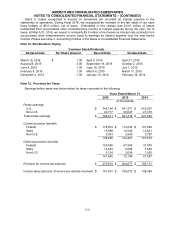

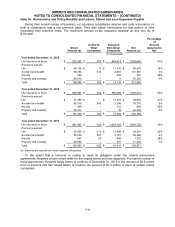

Note 12. Stockholders’ Equity

Common Stock Dividends

Declared Date

Per Share Amount

Record Date

Dividend Date

March 15, 2016

$

1.00

April 5, 2016

April 21, 2016

August 28, 2015

3.00

September 16, 2015

October 2, 2015

June 4, 2015

1.00

June 19, 2015

July 1, 2015

February 4, 2015

1.00

March 6, 2015

March 17, 2015

December 4, 2013

1.00

January 10, 2014

February 14, 2014

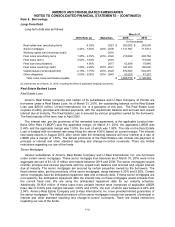

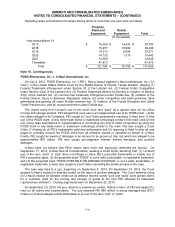

Note 13. Provision for Taxes

Earnings before taxes and the provision for taxes consisted of the following:

Years Ended March 31,

2016

2015

2014

(In thousands)

Pretax earnings:

U.S.

$

745,194

$

541,371

$

516,207

Non-U.S.

23,717

20,047

21,315

Total pretax earnings

$

768,911

$

561,418

$

537,522

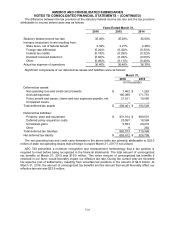

Current provision (benefit)

Federal

$

118,974

$

112,634

$

131,246

State

15,988

14,248

12,641

Non-U.S.

3,303

2,599

3,787

138,265

129,481

147,674

Deferred provision (benefit)

Federal

125,950

67,306

37,979

State

12,561

5,256

7,553

Non-U.S.

3,134

2,634

1,925

141,645

75,196

47,457

Provision for income tax expense

$

279,910

$

204,677

$

195,131

Income taxes paid (net of income tax refunds received)

$

141,901

$

195,072

$

138,384