U-Haul 2016 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.17

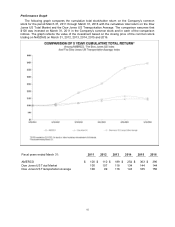

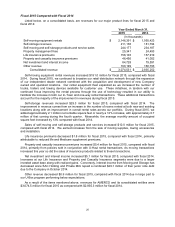

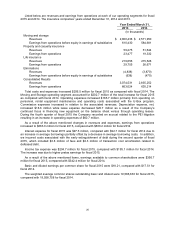

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

We begin this MD&A with the overall strategy of AMERCO, followed by a description of, and strategy

related to, our operating segments to give the reader an overview of the goals of our businesses and the

direction in which our businesses and products are moving. We then discuss our critical accounting

policies and estimates that we believe are important to understanding the assumptions and judgments

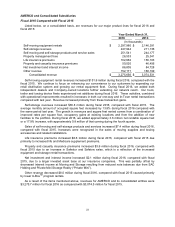

incorporated in our reported financial results. Next, we discuss our results of operations for fiscal 2016

compared with fiscal 2015, and for fiscal 2015 compared with fiscal 2014 which are followed by an

analysis of changes in our balance sheets and cash flows, and a discussion of our financial commitments

in the sections entitled Liquidity and Capital Resources and Disclosures about Contractual Obligations

and Commercial Commitments. We conclude this MD&A by discussing our outlook for fiscal 2017.

This MD&A should be read in conjunction with the other sections of this Annual Report, including Item

1: Business, Item 6: Selected Financial Data and Item 8: Financial Statements and Supplementary Data.

The various sections of this MD&A contain a number of forward-looking statements, as discussed under

the caption, Cautionary Statements Regarding Forward-Looking Statements, all of which are based on

our current expectations and could be affected by the uncertainties and risk factors described throughout

this Annual Report and particularly under the section Item 1A: Risk Factors. Our actual results may differ

materially from these forward-looking statements.

AMERCO has a fiscal year that ends on the 31st of March for each year that is referenced. Our

insurance company subsidiaries have fiscal years that end on the 31st of December for each year that is

referenced. They have been consolidated on that basis. Our insurance companies’ financial reporting

processes conform to calendar year reporting as required by state insurance departments. Management

believes that consolidating their calendar year into our fiscal year financial statements does not materially

affect the presentation of financial position or results of operations. We disclose all material events, if any,

occurring during the intervening period. Consequently, all references to our insurance subsidiaries’ years

2015, 2014 and 2013 correspond to fiscal 2016, 2015 and 2014 for AMERCO.

Overall Strategy

Our overall strategy is to maintain our leadership position in the North American “do-it-yourself”

moving and storage industry. We accomplish this by providing a seamless and integrated supply chain to

the “do-it-yourself” moving and storage market. As part of executing this strategy, we leverage the brand

recognition of U-Haul with our full line of moving and self-storage related products and services and the

convenience of our broad geographic presence.

Our primary focus is to provide our customers with a wide selection of moving rental equipment,

convenient self-storage rental facilities and portable moving and storage units and related moving and

self-storage products and services. We are able to expand our distribution and improve customer service

by increasing the amount of moving equipment and storage rooms and portable moving and storage units

available for rent, expanding the number of independent dealers in our network and expanding and taking

advantage of our eMove capabilities.

Property and Casualty Insurance is focused on providing and administering property and casualty

insurance to U-Haul and its customers, its independent dealers and affiliates.

Life Insurance is focused on long-term capital growth through direct writing and reinsuring of life,

Medicare supplement and annuity products in the senior marketplace.

Description of Operating Segments

AMERCO’s three reportable segments are:

Moving and Storage, comprised of AMERCO, U-Haul, and Real Estate and the subsidiaries of U-

Haul and Real Estate,

Property and Casualty Insurance, comprised of Repwest and its subsidiaries and ARCOA, and

Life Insurance, comprised of Oxford and its subsidiaries.

See Note 1, Basis of Presentation, Note 21, Financial Information by Geographic Area and Note 21A,

Consolidating Financial Information by Industry Segment of the Notes to Consolidated Financial

Statements included in Item 8: Financial Statements and Supplementary Data of this Annual Report.