U-Haul 2016 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-22

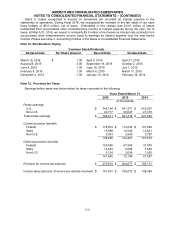

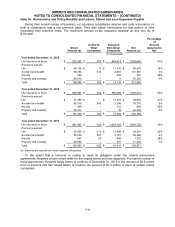

Note 11. Derivatives

We manage exposure to changes in market interest rates. Our use of derivative instruments is limited

to highly effective interest rate swaps to hedge the risk of changes in cash flows (future interest

payments) attributable to changes in LIBOR swap rates, the designated benchmark interest rate being

hedged on certain of our LIBOR indexed variable rate debt and a variable rate operating lease. The

interest rate swaps effectively fix our interest payments on certain LIBOR indexed variable rate debt. We

monitor our positions and the credit ratings of its counterparties and do not currently anticipate non-

performance by the counterparties. Interest rate swap agreements are not entered into for trading

purposes.

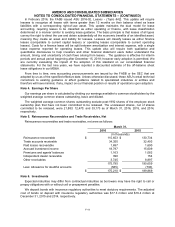

Original variable

rate debt and

lease amount

Agreement Date

Effective

Date

Expiration Date

Designated

cash flow

hedge date

(In millions)

$

300.0

8/16/2006

8/18/2006

8/10/2018

8/4/2006

14.7

(a)

7/6/2010

8/15/2010

7/15/2017

7/6/2010

25.0

(a)

4/26/2011

6/1/2011

6/1/2018

6/1/2011

50.0

(a)

7/29/2011

8/15/2011

8/15/2018

7/29/2011

20.0

(a)

8/3/2011

9/12/2011

9/10/2018

8/3/2011

15.1

(b)

3/27/2012

3/28/2012

3/28/2019

3/26/2012

25.0

4/13/2012

4/16/2012

4/1/2019

4/12/2012

44.3

1/11/2013

1/15/2013

12/15/2019

1/11/2013

(a) forward swap

(b) operating lease

As of March 31, 2016, the total notional amount of our variable interest rate swaps on debt and an

operating lease was $282.1 million and $9.3 million, respectively.

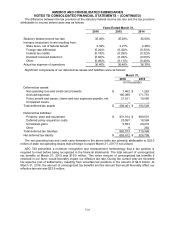

The derivative fair values located in Accounts payable and accrued expenses in the balance sheets

were as follows:

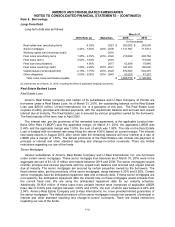

Liability Derivative Fair Value as of

March 31, 2016

March 31, 2015

(In thousands)

Interest rate contracts designated as hedging instruments

$

14,845

$

24,484

The Effect of Interest Rate

Contracts on the Statements of Operations

Years Ended March 31,

2016

2015

2014

(In thousands)

Loss recognized in income on interest rate contracts

$

12,699

$

14,329

$

17,174

Gain recognized in AOCI on interest rate contracts (effective

portion)

$

(9,721)

$

(8,203)

$

(19,317)

Loss reclassified from AOCI into income (effective portion)

$

12,616

$

14,358

$

16,691

(Gain) loss recognized in income on interest rate contracts

(ineffective portion and amount excluded from effectiveness

testing)

$

83

$

(29)

$

483