U-Haul 2016 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

AMERCO AND CONSOLIDATED SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – (CONTINUED)

F-26

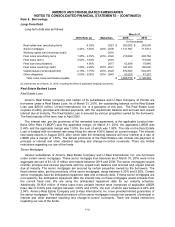

Leveraged contributions to the Plan Trust during fiscal 2016, 2015 and 2014 were $0.4 million, $1.0

million and $0.7 million, respectively. In fiscal 2016 and 2015, the Company made non-leveraged

contributions of $4.0 and $8.0 million, respectively to the Plan Trust. In fiscal 2014, $0.6 million of

common stock dividends paid to unallocated shares was applied towards debt service.

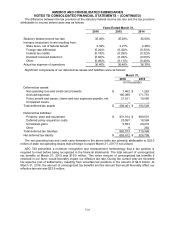

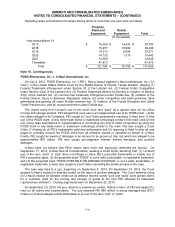

Shares held by the Plan were as follows:

Years Ended March 31,

2016

2015

(In thousands)

Allocated shares

1,203

1,249

Unreleased shares - leveraged

22

14

Fair value of unreleased shares - leveraged

$

8,072

$

4,781

Unreleased shares - non-leveraged

8

25

Fair value of unreleased shares - non-leveraged

$

2,756

$

8,242

The fair value of unreleased shares issued prior to 1992 is defined as the historical cost of such

shares. The fair value of unreleased shares issued subsequent to December 31, 1992 is defined as the

trading value of such shares as of March 31, 2016 and March 31, 2015, respectively.

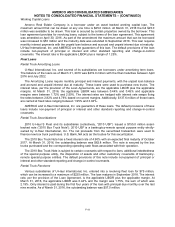

Post Retirement and Post Employment Benefits

We provide medical and life insurance benefits to our eligible employees and their dependents upon

retirement from the Company. The retirees must have attained age sixty-five and earned twenty years of

full-time service upon retirement for coverage under the medical plan. The medical benefits are capped at

a $20,000 lifetime maximum per covered person. The benefits are coordinated with Medicare and any

other medical policies in force. Retirees who have attained age sixty-five and earned at least ten years of

full-time service upon retirement from the Company are entitled to group term life insurance benefits. The

life insurance benefit is $2,000 plus $100 for each year of employment over ten years. The plan is not

funded and claims are paid as they are incurred. We use a March 31 measurement date for our post

retirement benefit disclosures.

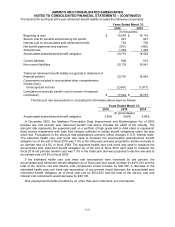

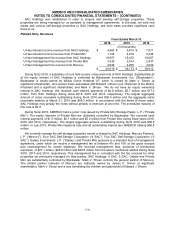

The components of net periodic post retirement benefit cost were as follows:

Years Ended March 31,

2016

2015

2014

(In thousands)

Service cost for benefits earned during the period

$

961

$

827

$

726

Interest cost on accumulated postretirement benefit

752

720

564

Other components

35

14

19

Net periodic postretirement benefit cost

$

1,748

$

1,561

$

1,309