U-Haul 2016 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

The Company owns and manages self-storage facilities. Self-storage revenues reported in the

consolidated financial statements represent Company-owned locations only. Self-storage data for our

owned storage locations follows:

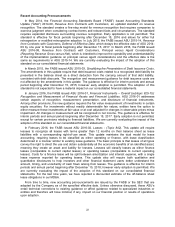

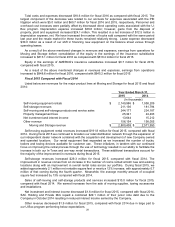

Year Ended March 31,

2015

2014

(In thousands, except occupancy rate)

Room count as of March 31

232

207

Square footage as of March 31

20,318

18,164

Average monthly number of rooms occupied

180

160

Average monthly occupancy rate based on room count

81.7%

80.5%

Average monthly square footage occupied

16,021

14,148

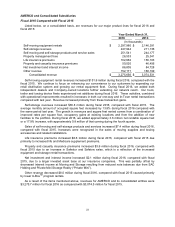

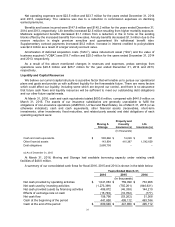

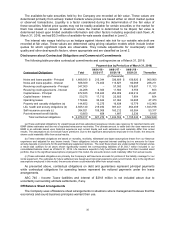

Total costs and expenses increased $202.7 million for fiscal 2015 as compared with fiscal 2014.

Operating expenses increased $163.7 million primarily from spending on personnel, rental equipment

maintenance and operating costs associated with the U-Box program. Commission expenses increased

in relation to the associated revenues. Depreciation expense increased $59.6 million and gains from the

disposal of property, plant and equipment increased by $41.1 million. Lease expense decreased $20.7

million as a result of the Company’s continued focus towards financing new equipment on the balance

sheet versus through operating leases. During the fourth quarter of fiscal 2015 the Company recorded an

accrual related to the PEI litigation resulting in an increase in operating expenses of $60.7 million.

As a result of the above mentioned changes in revenues and expenses, earnings from operations for

Moving and Storage before consolidation of the equity in the earnings of the insurance subsidiaries

increased to $610.4 million for fiscal 2015 as compared with $584.7 million for fiscal 2014.

Equity in the earnings of AMERCO’s insurance subsidiaries increased $4.8 million for fiscal 2015,

compared with fiscal 2014.

As a result of the above mentioned changes in revenues and expenses, earnings from operations

increased to $645.2 million for fiscal 2015, compared with $614.7 million for fiscal 2014.

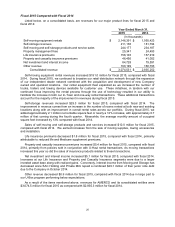

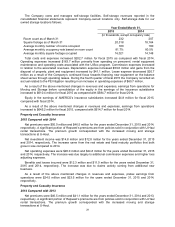

Property and Casualty Insurance

2015 Compared with 2014

Net premiums were $50.0 million and $46.5 million for the years ended December 31, 2015 and 2014,

respectively. A significant portion of Repwest’s premiums are from policies sold in conjunction with U-Haul

rental transactions. The premium growth corresponded with the increased moving and storage

transactions at U-Haul.

Net investment income was $14.8 million and $12.8 million for the years ended December 31, 2015

and 2014, respectively. The increase came from the real estate and fixed maturity portfolios that both

grew in size compared to 2014.

Net operating expenses were $28.0 million and $24.8 million for the years ended December 31, 2015

and 2014, respectively. The increase was due largely to additional commission expenses and higher loss

adjusting expenses.

Benefits and losses incurred were $12.3 million and $11.0 million for the years ended December 31,

2015 and 2014, respectively. The increase was due to claims activity coming from additional new

business.

As a result of the above mentioned changes in revenues and expenses, pretax earnings from

operations were $24.5 million and $23.5 million for the years ended December 31, 2015 and 2014,

respectively.

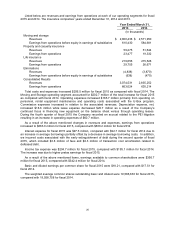

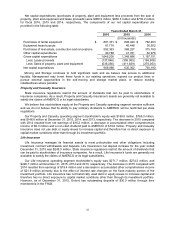

Property and Casualty Insurance

2014 Compared with 2013

Net premiums were $46.5 million and $41.1 million for the years ended December 31, 2014 and 2013,

respectively. A significant portion of Repwest’s premiums are from policies sold in conjunction with U-Haul

rental transactions. The premium growth corresponded with the increased moving and storage

transactions at U-Haul.