U-Haul 2016 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

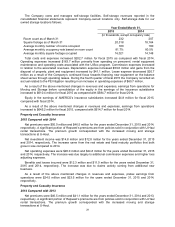

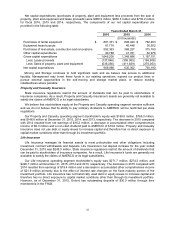

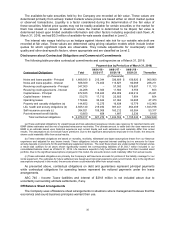

Net capital expenditures (purchases of property, plant and equipment less proceeds from the sale of

property, plant and equipment and lease proceeds) were $969.9 million, $630.3 million and $730.2 million

for fiscal 2016, 2015 and 2014, respectively. The components of our net capital expenditures are

provided in the following table:

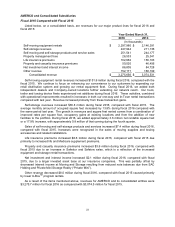

Years Ended March 31,

2016

2015

2014

(In thousands)

Purchases of rental equipment

$

881,331

$

898,420

$

782,463

Equipment lease buyouts

81,718

40,448

36,552

Purchases of real estate, construction and renovations

592,363

368,257

315,160

Other capital expenditures

90,788

41,761

62,976

Gross capital expenditures

1,646,200

1,348,886

1,197,151

Less: Lease proceeds

(137,046)

(306,955)

(196,908)

Less: Sales of property, plant and equipment

(539,256)

(411,629)

(270,053)

Net capital expenditures

969,898

630,302

730,190

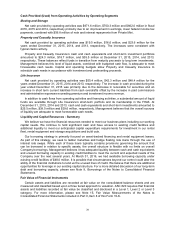

Moving and Storage continues to hold significant cash and we believe has access to additional

liquidity. Management may invest these funds in our existing operations, expand our product lines or

pursue external opportunities in the self-moving and storage market place, or reduce existing

indebtedness where possible.

Property and Casualty Insurance

State insurance regulations restrict the amount of dividends that can be paid to stockholders of

insurance companies. As a result, Property and Casualty Insurance's assets are generally not available to

satisfy the claims of AMERCO or its legal subsidiaries.

We believe that stockholders equity at the Property and Casualty operating segment remains sufficient

and we do not believe that its ability to pay ordinary dividends to AMERCO will be restricted per state

regulations.

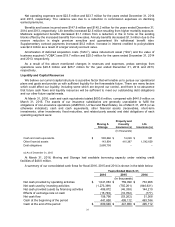

Our Property and Casualty operating segment stockholder’s equity was $160.6 million, $169.3 million,

and $146.8 million at December 31, 2015, 2014, and 2013, respectively. The decrease in 2015 compared

with 2014 resulted from net earnings of $16.2 million, a decrease in accumulated other comprehensive

income of $5.3 million and a non-cash dividend paid to AMERCO of $19.6 million. Property and Casualty

Insurance does not use debt or equity issues to increase capital and therefore has no direct exposure to

capital market conditions other than through its investment portfolio.

Life Insurance

Life Insurance manages its financial assets to meet policyholder and other obligations including

investment contract withdrawals and deposits. Life Insurance's net deposit increase for the year ended

December 31, 2015 was $245.3 million. State insurance regulations restrict the amount of dividends that

can be paid to stockholders of insurance companies. As a result, Life Insurance's funds are generally not

available to satisfy the claims of AMERCO or its legal subsidiaries.

Our Life Insurance operating segment stockholder’s equity was $271.7 million, $274.2 million, and

$226.7 million at December 31, 2015, 2014 and 2013, respectively. The decrease in 2015 compared with

2014 resulted from earnings of $19.4 million and a decrease in accumulated other comprehensive income

of $21.9 million primarily due to the effect of interest rate changes on the fixed maturity portion of the

investment portfolio. Life Insurance has not historically used debt or equity issues to increase capital and

therefore has no direct exposure to capital market conditions other than through its investment portfolio.

However, as of December 31, 2015, Oxford has outstanding deposits of $30.0 million through their

membership in the FHLB.