U-Haul 2016 Annual Report Download

Download and view the complete annual report

Please find the complete 2016 U-Haul annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL

REPORT

20

16

Table of contents

-

Page 1

20 16 ANNUAL REPORT -

Page 2

... of real estate and dedicated to locations that best position U-Haul for the long-term. Our U-Box, Moving Help, and Storage Affiliate programs continue to grow. Our opportunity is to increase the public's awareness of these products and services. Repwest Insurance is on program. Oxford Life... -

Page 3

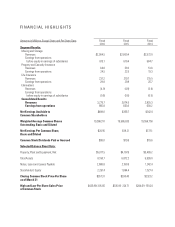

...Earnings Per Common Share, Basic and Diluted Common Stock Dividends Paid or Accrued Selected Balance Sheet Data: Property, Plant and Equipment, Net Total Assets Notes, Loans and Leases Payable Stockholders' Equity Closing Common Stock Price Per Share as of March 31 High and Low Per Share Sales Price... -

Page 4

... 2016 or [] TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934. For the transition period from _____ to _____ Commission File Number Registrant, State of Incorporation Address and Telephone Number I.R.S. Employer Identification No. 1-11255 AMERCO (A Nevada... -

Page 5

... [X] The aggregate market value of AMERCO common stock held by non-affiliates on September 30, 2015 was $2,392,872,853. The aggregate market value was computed using the closing price for the common stock trading on NASDAQ on such date. Shares held by executive officers, directors and persons owning... -

Page 6

...Item 9. Changes in and Disagreements With Accountants on Accounting and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...Item 5. PART III Item 10. Directors, Executive Officers and Corporate Governance ...Item 11. Executive Compensation ...Item 12. Security... -

Page 7

... storage units and sell moving and self-storage products and services to complement our independent dealer network. We rent our distinctive orange and white U-Haul trucks and trailers as well as offer self-storage rooms through a network of approximately 1,700 Company operated retail moving stores... -

Page 8

... products and services are available through our network of managed retail moving stores and independent U-Haul dealers. Independent U-Haul dealers receive rental equipment from the Company, act as rental agents and are paid a commission based on gross revenues generated from their U-Haul rentals... -

Page 9

...customers with a damage waiver, cargo protection and medical and life insurance coverage. Safestor provides protection for storage customers from loss on their goods in storage. Safestor Mobile provides protection for customers stored belongings when using our U-Box portable and moving storage units... -

Page 10

...of trucks, trailers, portable moving and storage units, specialty rental items and self-storage spaces primarily to the household mover as well as sales of moving supplies, towing accessories and propane. Operations are ® conducted under the registered trade name U-Haul throughout the United States... -

Page 11

...utilization of an on line reservation and sales system, through uhaul.com and our 24-hour 1-800-GO-U-HAUL telephone reservations system. These points of contact are prominently featured and are a major driver of customer lead sources. Competition Moving and Storage Operating Segment The truck rental... -

Page 12

...alternative vehicle manufacturers, our estimates of the residual values of our equipment fleet, our plans with respect to offbalance sheet arrangements, our plans to continue to invest in the U-Box program, the impact of interest rate and foreign currency exchange rate changes on our operations, the... -

Page 13

...of storage rental locations, cleanliness, security and price. Competition in the market areas in which we operate is significant and affects the occupancy levels, rental rates and operating expenses of our facilities. Competition might cause us to experience a decrease in occupancy levels, limit our... -

Page 14

..., U-Haul maintains a large fleet of rental equipment. Our rental truck fleet rotation program is funded internally through operations and externally from debt and lease financing. Our ability to fund our routine fleet rotation program could be adversely affected if financial market conditions limit... -

Page 15

... the effective date of such withdrawal, which is expected to occur before our next annual meeting of stockholders. The withdrawal of such shares from the Stockholder Agreement will result in us no longer being a "controlled company" pursuant to the Nasdaq listing rules as of July 1, 2016. However... -

Page 16

...may limit our ability to serve certain markets with our products and services. Our insurance companies are heavily regulated by state insurance departments and the NAIC. These insurance regulations are primarily in place to protect the interests of our policyholders and not our investors. Changes in... -

Page 17

...are utilized in the manufacturing, repair and rental of U-Haul equipment and storage space, as well as providing office space for us. Such facilities exist throughout the United States and Canada. We also manage storage facilities owned by others. We operate approximately 1,700 U-Haul retail centers... -

Page 18

... its U -Box moving and storage product. PEI alleged that such use is an inappropriate use of its PODS mark. Under the claims alleged in its Complaint, PEI sought a Court Order permanently enjoining U-Haul from: (1) the use of the PODS mark, or any other trade name or trademark confusingly similar to... -

Page 19

... injunction is limited to "advertising, promoting, marketing, or describing any products or services" and (ii) use of the terms "pod" and "pods" in comparative advertising is not prohibited, thereby allowing "nominative fair use" and truthful communications in customer dialogue and making clear that... -

Page 20

... 2016, there were approximately 2,900 holders of record of our common stock. We derived the number of our stockholders using internal stock ledgers and utilizing Mellon Investor Services Stockholder listings. AMERCO's common stock is listed on the NASDAQ Global Select Market under the trading symbol... -

Page 21

... comparison indices. The graph reflects the value of the investment based on the closing price of the common stock trading on NASDAQ on March 31, 2012, 2013, 2014, 2015 and 2016. Fiscal years ended March 31: AMERCO Dow Jones US Total Market Dow Jones US Transportation Average $ 2011 100 $ 100 100... -

Page 22

... Annual Report. Listed below is selected financial data for AMERCO and consolidated subsidiaries for each of the last five years: Years Ended March 31, 2016 2015 2014 2013 2012 (In thousands, except share and per share data) Summary of Operations: Self-moving equipment rentals Self-storage revenues... -

Page 23

... life, Medicare supplement and annuity products in the senior marketplace. Description of Operating Segments AMERCO's three reportable segments are: ï,· Moving and Storage, comprised of AMERCO, U-Haul, and Real Estate and the subsidiaries of UHaul and Real Estate, ï,· Property and Casualty Insurance... -

Page 24

...of trucks, trailers, portable moving and storage units, specialty rental items and self-storage spaces primarily to the household mover as well as sales of moving supplies, towing accessories and propane. Operations are conducted under the registered trade ® name U-Haul throughout the United States... -

Page 25

... values (i.e., the price at which we ultimately expect to dispose of revenue earning equipment) or useful lives will result in an increase in depreciation expense over the remaining life of the equipment. Reviews are performed based on vehicle class, generally subcategories of trucks and trailers... -

Page 26

... the life of the truck. Although we intend to sell our used vehicles for prices approximating book value, the extent to which we realize a gain or loss on the sale of used vehicles is dependent upon various factors including but not limited to, the general state of the used vehicle market, the age... -

Page 27

...market prices, dealer quotes or discounted cash flows, industry factors, financial factors, and issuer specific information such as credit strength. Other-than-temporary impairment in value is recognized in the current period operating results. There were no write downs in fiscal 2016, 2015 and 2014... -

Page 28

... than 12 months on their balance sheet as lease liabilities with a corresponding right-of-use asset. This update maintains the dual model for lease accounting, requiring leases to be classified as either operating or finance, with lease classification determined in a manner similar to existing... -

Page 29

... dealers and Company-owned locations further extending our network reach. Our truck, trailer and towing device fleets experienced net additions during fiscal 2016. These activities, combined with operational improvements resulted in increases in both our one-way and In-Town rental transactions... -

Page 30

... increased the number of trucks sold compared with the same period last year and the resale market for these trucks remained relatively strong. Lease expense decreased $30.0 million as a result of our shift in financing new equipment on the balance sheet versus through operating leases. Total costs... -

Page 31

... the expansion of our independent dealer network combined with the acquisition and development of new Company owned and operated locations. Our rental equipment fleet expanded as we increased the number of trucks, trailers and towing devices available for customer use. These initiatives, in tandem... -

Page 32

... new equipment on the balance sheet versus through operating leases. During the fourth quarter of fiscal 2015 the Company recorded an accrual related to the PEI litigation resulting in an increase in operating expenses of $60.7 million. As a result of the above mentioned changes in revenues and... -

Page 33

... lower U-Box program rentals. The Company owns and manages self-storage facilities. Self-storage revenues reported in the consolidated financial statements represent Company-owned locations only. Self-storage data for our owned storage locations follows: Year Ended March 31, 2016 2015 (In thousands... -

Page 34

... the expansion of our independent dealer network combined with the acquisition and development of new Company owned and operated locations. Our rental equipment fleet expanded as we increased the number of trucks, trailers and towing devices available for customer use. These initiatives, in tandem... -

Page 35

The Company owns and manages self-storage facilities. Self-storage revenues reported in the consolidated financial statements represent Company-owned locations only. Self-storage data for our owned storage locations follows: Year Ended March 31, 2015 2014 (In thousands, except occupancy rate) 232 ... -

Page 36

... amortization due to a prior year DAC balance write off on older blocks. As a result of the above mentioned changes in revenues and expenses, pretax earnings from operations were $29.8 million for both years ended December 31, 2015 and 2014. Life Insurance 2014 Compared with 2013 Net premiums were... -

Page 37

... on March 31, 2015. The assets of our insurance subsidiaries are generally unavailable to fulfill the obligations of non-insurance operations (AMERCO, U-Haul and Real Estate). As of March 31, 2016 (or as otherwise indicated), cash and cash equivalents, other financial assets (receivables, short-term... -

Page 38

... our internally generated funds will be used to service the existing debt and fund operations. U-Haul estimates that during fiscal 2017 the Company will reinvest in its truck and trailer rental fleet approximately $600 million, net of equipment sales and excluding any lease buyouts. For fiscal 2016... -

Page 39

... our product lines or pursue external opportunities in the self-moving and storage market place, or reduce existing indebtedness where possible. Property and Casualty Insurance State insurance regulations restrict the amount of dividends that can be paid to stockholders of insurance companies. As... -

Page 40

Cash Provided (Used) from Operating Activities by Operating Segments Moving and Storage Net cash provided by operating activities was $971.6 million, $700.3 million and $662.0 million in fiscal 2016, 2015 and 2014, respectively primarily due to an improvement in earnings, lower federal income tax ... -

Page 41

...-for-sale securities held by the Company are recorded at fair value. These values are determined primarily from actively traded markets where prices are based either on direct market quotes or observed transactions. Liquidity is a factor considered during the determination of the fair value of... -

Page 42

...space for marketing company offices, vehicle repair shops and hitch installation centers from subsidiaries of SAC Holdings, 5 SAC and Galaxy. Total lease payments pursuant to such leases were $2.6 million for each of fiscal years 2016, 2015 and 2014, respectively. The terms of the leases are similar... -

Page 43

... attention on increasing transaction volume and improving pricing, product and utilization for self-moving equipment rentals. Maintaining an adequate level of new investment in our truck fleet is an important component of our plan to meet our operational goals. Revenue in the U-Move program could be... -

Page 44

...security to changes in interest rates. As part of our insurance companies' asset and liability management, actuaries estimate the cash flow patterns of our existing liabilities to determine their duration. These outcomes are compared to the characteristics of the assets that are currently supporting... -

Page 45

...this Annual Report, our Disclosure Controls were effective related to the above stated design purposes. Inherent Limitations on Effectiveness of Controls The Company's management, including the CEO and CAO, does not expect that our Disclosure Controls or our internal control over financial reporting... -

Page 46

... of the fiscal year 2016. We reviewed the results of management's assessment with the Audit Committee of our Board. Our independent registered public accounting firm, BDO USA, LLP, has audited the Company's internal control over financial reporting and has issued their report, which is included on... -

Page 47

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of the Company as of March 31, 2016 and 2015, and the related consolidated statements of operations, changes in stockholders' equity, comprehensive income (loss), and... -

Page 48

... close of the 2016 fiscal year. The Company has adopted a Code of Ethics that applies to all directors, officers and employees of the Company, including the Company's principal executive officer and principal accounting officer. A copy of our Code of Ethics is posted on AMERCO's web site at amerco... -

Page 49

...are not required, inapplicable, or the information is otherwise shown in the financial statements or notes thereto. Exhibits: Exhibit Number 3.1 Description Restated Articles of Incorporation of AMERCO Page or Method of Filing Incorporated by reference to AMERCO's Current Report on Form 8-K filed on... -

Page 50

... Twenty-fourth Supplemental Indenture, dated April 22, 2014 by and between AMERCO and U.S. Bank National Association Incorporated by reference to AMERCO's Current Report on Form 8-K, filed on September 4, 2012, file no. 1-11255 Incorporated by reference to AMERCO's Current Report on Form 8-K, filed... -

Page 51

... Real Estate Current Report on Form 8-K, filed June 14, Company, Amerco Real Estate Company of 2005, file no. 1-11255 Texas, Inc., Amerco Real Estate Company of Alabama Inc., U-Haul Co. of Florida, Inc., UHaul International, Inc. and Merrill Lynch Commercial Finance Corp. Security Agreement dated... -

Page 52

... and Security Agreement, dated as of August 18, 2006, to the Amended and Restated Credit Agreement, dated as of June 8, 2005, among Amerco Real Estate Company of Texas, Inc., Amerco Real Estate Company of Alabama, Inc., U-Haul Co. of Florida, Inc., U-Haul International, Inc. and the Marketing... -

Page 53

... trustee. Pledge and Security Agreement, dated February 17, 2011, by and among AMERCO, UHaul Leasing and Sales Co. and U.S. Bank National Association Amended and Restated Property Management Agreement among Eighteen SAC Self-Storage Corporation and subsidiaries of U-Haul International, Inc. Amended... -

Page 54

... Property Management Agreement among Three-D SAC Self-Storage Corporation and subsidiaries of U-Haul International, Inc. Incorporated by reference to AMERCO's Annual Report on Form 10-K for the year ended March 31, 2012, file no. 1-11255 Incorporated by reference to AMERCO's Annual Report on... -

Page 55

... Management Agreement dated December 11, 2014 between Three SAC SelfStorage Corporation and U-Haul Co. (Canada), Ltd Property Management Agreement dated December 16, 2014 among Galaxy Storage Two, L.P. and certain subsidiaries of AMERCO Property Management Agreement dated June 25, 2015 among 2015... -

Page 56

...Oxley Act of 2002 Certificate of Jason A. Berg, Principal Financial Officer and Chief Accounting Officer of AMERCO pursuant to Section 906 of the Sarbanes-Oxley Act of 2002... herewith Furnished herewith Furnished herewith Furnished herewith * Indicates management plan or compensatory arrangement. 50 -

Page 57

Report of Independent Registered Public Accounting Firm Board of Directors and Stockholders AMERCO Reno, Nevada We have audited the accompanying consolidated balance sheets of AMERCO and consolidated subsidiaries (the "Company") as of March 31, 2016 and 2015 and the related consolidated statements ... -

Page 58

... Furniture and equipment Rental trailers and other rental equipment Rental trucks Less: Accumulated depreciation Total property, plant and equipment Total assets LIABILITIES AND STOCKHOLDERS' EQUITY Liabilities: Accounts payable and accrued expenses Notes, loans and leases payable Policy benefits... -

Page 59

...-moving and self-storage products and service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits and losses... -

Page 60

...2016 Comprehensive income: Net earnings Other comprehensive income: Foreign currency translation Unrealized net loss on investments Change in fair value of cash flow hedges Postretirement benefit...,639) 9,721 (1,029) 731,491 $ Pre-tax 489,001 (4,473) (27,066) 6,027 (648) 462,841 Net $ $ 561,418 ... -

Page 61

..., net of tax - - Fair market value of cash flow hedges, net of tax - - Adjustment to post retirement benefit obligation - - Net earnings - - Common stock dividend: ($1.00 per share for fiscal 2014) - - Net activity - 6,042 Balance as of March 31, 2014 $ 10,497 $ 444,210 $ Increase in market value of... -

Page 62

...on credit facilities Debt issuance costs Capital lease payments Purchases of Employee Stock Ownership Plan Shares Securitization deposits Common stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate... -

Page 63

... Storage, Property and Casualty Insurance and Life Insurance. Moving and Storage includes AMERCO, U-Haul, and Real Estate and the wholly-owned subsidiaries of U-Haul and Real Estate. Operations consist of the rental of trucks and trailers, sales of moving supplies, sales of towing accessories, sales... -

Page 64

...-for-sale investments are reported at fair value, with unrealized gains or losses recorded net of taxes and applicable adjustments to deferred policy acquisition costs in stockholders' equity. Fair value for these investments is based on quoted market prices, dealer quotes or discounted cash flows... -

Page 65

... when earned. Dividends on common and preferred stocks are recognized on the ex-dividend dates. Realized gains and losses on the sale or exchange of investments are recognized at the trade date. Derivative Financial Instruments Our objective for holding derivative financial instruments is to manage... -

Page 66

... of surplus real estate, which is lower than market value at the balance sheet date, was $14.1 million for both fiscal 2016 and 2015 and is included in Investments, other. Receivables Trade receivables include trade accounts from moving and self-storage customers and dealers, insurance premiums and... -

Page 67

... for applicable reinsurance arrangements. Management reviews each claim bi-annually to determine if the estimated life-time claim costs have increased and then adjusts the reserve estimate accordingly at that time. We have factored in an estimate of what the potential cost increases could be in our... -

Page 68

...certain public liability and property damage programs related to our rental equipment. The consolidated balance sheets include $386.4 million and $363.6 million of liabilities related to these programs as of March 31, 2016 and 2015, respectively. These liabilities are recorded in Policy benefits and... -

Page 69

..., the change in fair value of cash flow hedges and the change in postretirement benefit obligations. Recent Accounting Pronouncements In May 2014, the Financial Accounting Standards Board ("FASB") issued Accounting Standards Update ("ASU") 2014-09, Revenue from Contracts with Customers, an... -

Page 70

... than 12 months on their balance sheet as lease liabilities with a corresponding right-of-use asset. This update maintains the dual model for lease accounting, requiring leases to be classified as either operating or finance, with lease classification determined in a manner similar to existing... -

Page 71

... Cost U.S. treasury securities and government obligations U.S. government agency mortgagebacked securities Obligations of states and political subdivisions Corporate securities Mortgage-backed securities Redeemable preferred stocks Common stocks $ Gross Unrealized Gains Estimated Market Value... -

Page 72

.... There were no credit losses recognized in earnings for which a portion of an other-than-temporary impairment was recognized in accumulated other comprehensive loss for fiscal 2016 or 2015. The adjusted cost and estimated market value of available-for-sale investments by contractual maturity... -

Page 73

... cost, which approximates fair value. Real estate obtained through foreclosure and held for sale is carried at the lower of fair value at time of foreclosure or current estimated fair value less cost to sell. Other equity investments are carried at cost and assessed for impairment. Insurance policy... -

Page 74

... of the Real Estate Loan include non-payment of principal or interest and other standard reporting and change-in-control covenants. There are limited restrictions regarding our use of the funds. Senior Mortgages Various subsidiaries of Amerco Real Estate Company and U-Haul International, Inc. are... -

Page 75

..., 2016, the outstanding balance was $62.8 million. The note is secured by the box trucks purchased and the corresponding operating cash flows associated with their operation. The 2010 Box Truck Note is subject to certain covenants with respect to liens, additional indebtedness of the special purpose... -

Page 76

... rate is calculated daily based upon a spread of the overnight FED funds benchmark and is payable monthly. The deposit does not have a scheduled maturity date. The balance of the deposit is included within the balance of Liabilities from investment contracts on the consolidated balance sheet. Annual... -

Page 77

... paid $3.8 million of fees associated with the early extinguishment of debt. Interest Rates Interest rates and our revolving credit borrowings were as follows: Revolving Credit Activity Years Ended March 31, 2016 2015 2014 (In thousands, except interest rates) 1.67% 1.70% 1.10% 1.82% 1.65% 1.78% 347... -

Page 78

... date 8/4/2006 7/6/2010 6/1/2011 7/29/2011 8/3/2011 3/26/2012 4/12/2012 1/11/2013 $ As of March 31, 2016, the total notional amount of our variable interest rate swaps on debt and an operating lease was $282.1 million and $9.3 million, respectively. The derivative fair values located in Accounts... -

Page 79

... 16, 2015 June 19, 2015 March 6, 2015 January 10, 2014 Dividend Date April 21, 2016 October 2, 2015 July 1, 2015 March 17, 2015 February 14, 2014 AMERCO AND CONSOLIDATED SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Note 13. Provision for Taxes Earnings before taxes and the... -

Page 80

... income before taxes was as follows: 2016 Statutory federal income tax rate Increase (reduction) in rate resulting from: State taxes, net of federal benefit Foreign rate differential Federal tax credits Dividend received deduction Other Actual tax expense of operations Years Ended March 31, 2015 35... -

Page 81

... is recorded based on the current market price at the end of the month. These shares then become outstanding for the earnings per share computations. ESOP compensation expense was $11.6 million, $6.9 million and $6.6 million for fiscal 2016, 2015 and 2014, respectively. Listed below is a summary... -

Page 82

... Post Retirement and Post Employment Benefits We provide medical and life insurance benefits to our eligible employees and their dependents upon retirement from the Company. The retirees must have attained age sixty-five and earned twenty years of full-time service upon retirement for coverage under... -

Page 83

... post retirement benefit obligation as of the end of fiscal 2015 (and used to measure the fiscal 2016 net periodic benefit cost) was 7.3% in the initial year and was projected to decline annually to an ultimate rate of 4.5% in fiscal 2029. If the estimated health care cost trend rate assumptions... -

Page 84

... available-for-sale, long term investments, mortgage loans and notes on real estate, and interest rate swap contracts are based on quoted market prices, dealer quotes or discounted cash flows. Fair values of trade receivables approximate their recorded value. Our financial instruments that... -

Page 85

...31, 2016 and 2015, that are subject to ASC 820 and the valuation approach applied to each of these items. Year Ended March 31, 2016 Assets Short-term investments Fixed maturities - available for sale Preferred stock Common stock Derivatives Total Liabilities Guaranteed residual values of TRAC leases... -

Page 86

... December 31, 2014 Life insurance in force Premiums earned: Life Accident and health Annuity Property and casualty Total Year ended December 31, 2013 Life insurance in force Premiums earned: Life Accident and health Annuity Property and casualty Total Ceded to Other Companies Assumed from Other... -

Page 87

... facilities under operating leases with terms that expire at various dates substantially through 2019. As of March 31, 2016, we have guaranteed $22.3 million of residual values for these rental equipment assets at the end of the respective lease terms. Certain leases contain renewal and fair market... -

Page 88

... Enterprises, Inc. v. U-Haul International, Inc. On July 3, 2012, PODS Enterprises, Inc. ("PEI"), filed a lawsuit against U -Haul International, Inc. ("UHaul"), in the United States District Court for the Middle District of Florida, Tampa Division, alleging (1) Federal Trademark Infringement under... -

Page 89

... rate of 0.25% while the case proceeds; (iv) doubling of the damages award to $121.4 million; and (v) the entry of an order directing the Patent and Trademark Office to dismiss the cancellation proceedings that U-Haul filed, which sought cancellation of the PODS trademarks. On April 27, 2015, U-Haul... -

Page 90

... requirements of federal, state and local governments may significantly affect Real Estate's business operations. Among other things, these requirements regulate the discharge of materials into the air, land and water and govern the use and disposal of hazardous substances. Real Estate is aware... -

Page 91

... to management agreements. In the past, we sold real estate and various self-storage properties to SAC Holdings, and such sales provided significant cash flows to us. Related Party Revenues 2016 U-Haul interest income revenue from SAC Holdings U-Haul interest income revenue from Private Mini U-Haul... -

Page 92

...to SAC Holdings U-Haul commission expenses to Private Mini $ Years Ended March 31, 2015 2014 (In thousands) 2,648 $ 2,618 $ 2,619 51,036 48,833 46,886 3,684 3,258 3,047 57,368 $ 54,709 $ 52,552 $ We lease space for marketing company offices, vehicle repair shops and hitch installation centers from... -

Page 93

...Haul notes, receivables and interest from Private Mini U-Haul note receivable from SAC Holding Corporation U-Haul interest receivable from SAC Holdings U-Haul receivable from SAC Holdings U-Haul receivable from Mercury Other (a) $ $ (a) Timing differences for intercompany balances with insurance... -

Page 94

...December 31, 2015 that could be distributed as ordinary dividends was $12.0 million. Oxford did not pay a dividend to AMERCO in fiscal 2016, 2015 or 2014. After receiving approval from the Arizona Department of Insurance, Repwest paid a $19.6 million non-cash dividend to AMERCO in fiscal 2016. F-38 -

Page 95

... Life Insurance, comprised of Oxford and its subsidiaries. Management tracks revenues separately, but does not report any separate measure of the profitability for rental vehicles, rentals of self-storage spaces and sales of products that are required to be classified as a separate operating segment... -

Page 96

... and improvements Furniture and equipment Rental trailers and other rental equipment Rental trucks Less: Accumulated depreciation Total property, plant and equipment Total assets (a) Balances as of December 31, 2015 (b) Eliminate investment in subsidiaries (c) Eliminate intercompany receivables and... -

Page 97

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Consolidating balance sheets by industry segment as of March 31, 2016 are as follows: Moving & Storage Consolidated Liabilities: Accounts payable and accrued expenses Notes, loans and leases payable Policy benefits and losses, claims and loss... -

Page 98

... March 31, 2015 are as follows: Moving & Storage Consolidated Assets: Cash and cash equivalents Reinsurance recoverables and trade receivables, net Inventories, net Prepaid expenses Investments, fixed maturities and marketable equities Investments, other Deferred policy acquisition costs, net Other... -

Page 99

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - (CONTINUED) Consolidating balance sheets by industry segment as of March 31, 2015 are as follows: Moving & Storage Consolidated Liabilities: Accounts payable and accrued expenses Notes, loans and leases payable Policy benefits and losses, claims and loss... -

Page 100

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 101

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 102

... revenues Self-moving & self-storage products & service sales Property management fees Life insurance premiums Property and casualty insurance premiums Net investment and interest income Other revenue Total revenues Costs and expenses: Operating expenses Commission expenses Cost of sales Benefits... -

Page 103

...earnings to the cash provided by operations: Depreciation Amortization of deferred policy acquisition costs Interest credited to policyholders Change in allowance for losses on trade receivables Change in allowance for inventory reserve Net gain on sale of real and personal property Net gain on sale... -

Page 104

...on credit facilities Debt issuance costs Capital lease payments Purchases of Employee Stock Ownership Plan Shares Securitization deposits Common stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate... -

Page 105

...earnings to the cash provided by operations: Depreciation Amortization of deferred policy acquisition costs Interest credited to policyholders Change in allowance for losses on trade receivables Change in allowance for inventory reserve Net gain on sale of real and personal property Net gain on sale... -

Page 106

... on credit facilities Debt issuance costs Capital lease payments Purchases of Employee Stock Ownership Plan Shares Common stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate on cash Increase... -

Page 107

...earnings to the cash provided by operations: Depreciation Amortization of deferred policy acquisition costs Interest credited to policyholders Change in allowance for losses on trade receivables Change in allowance for inventory reserve Net gain on sale of real and personal property Net gain on sale... -

Page 108

...on credit facilities Debt issuance costs Capital lease payments Purchases of Employee Stock Ownership Plan Shares Securitization deposits Common stock dividends paid Investment contract deposits Investment contract withdrawals Net cash provided (used) by financing activities Effects of exchange rate... -

Page 109

... I CONDENSED FINANCIAL INFORMATION OF AMERCO BALANCE SHEETS March 31, 2016 (In thousands) ASSETS Cash and cash equivalents Investment in subsidiaries Related party assets Other assets Total assets $ 381,690 $ 1,185,021 1,249,835 94,128 2,910,674 $ 291,550 813,735 1,225,044 85,409 2,415,738 2015... -

Page 110

CONDENSED FINANCIAL INFORMATION OF AMERCO STATEMENTS OF OPERATIONS Years Ended March 31, 2016 2015 2014 (In thousands, except share and per share data) Revenues: Net interest income and other revenues $ Expenses: Operating expenses Other expenses Total expenses Equity in earnings of subsidiaries ... -

Page 111

... FINANCIAL INFORMATION OF AMERCO STATEMENTS OF CASH FLOW Years Ended March 31, 2016 2015 2014 (In thousands) Cash flows from operating activities: Net earnings Change in investments in subsidiaries Adjustments to reconcile net earnings to cash provided by operations: Depreciation Net gain on sale... -

Page 112

... FINANCIAL INFORMATION MARCH 31, 2016, 2015, AND 2014 1. Summary of Significant Accounting Policies AMERCO, a Nevada corporation, was incorporated in April, 1969, and is the holding Company for UHaul International, Inc., Amerco Real Estate Company, Repwest Insurance Company and Oxford Life Insurance... -

Page 113

SCHEDULE II AMERCO AND CONSOLIDATED SUBSIDIARIES VALUATION AND QUALIFYING ACCOUNTS Balance at Beginning of Year Year ended March 31, 2016 Allowance for doubtful accounts (deducted from trade receivable... March 31, 2014 Allowance for doubtful accounts (deducted from trade receivable) Allowance for ... -

Page 114

... SUBSIDIARIES SUPPLEMENTAL INFORMATION (FOR PROPERTY-CASUALTY INSURANCE OPERATIONS) YEARS ENDED DECEMBER 31, 2015, 2014 AND 2013 Fiscal Year Affiliation with Registrant $ Deferred Policy Acquisition Cost $ - $ - $ Reserves for Unpaid Claims and Adjustment Expenses $ 251,964 Discount if any... -

Page 115

... of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. AMERCO Date: May 25, 2016 /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board (Duly Authorized Officer) Date: May 25... -

Page 116

... R. Mullen Daniel R. Mullen /s/ Samuel J. Shoen Samuel J. Shoen Title Chief Accounting Officer (Principal Financial Officer) Date May 25, 2016 Director May 25, 2016 Director Director Director Director Director May 25, 2016 May 25, 2016 May 25, 2016 May 25, 2016 May 25, 2016 Director May 25... -

Page 117

...Insurance Company Christian Fidelity Life Insurance Company Amerco Real Estate Company Amerco Real Estate Company of Alabama, Inc. Amerco Real Estate Company of Texas, Inc. Amerco Real Estate Services, Inc. AREC 905, LLC Rainbow-Queen Properties, LLC One PAC Company Two PAC Company Three PAC Company... -

Page 118

... LLC 106 W Avenue D, LLC 125 Beechwood, LLC 344 Erie, LLC 365 Cherry, LLC 370 Orange Street, LLC 380 Union, LLC 407 Park, LLC 500 Cermack, LLC 560 Waterbury, LLC 1000 13th, LLC 1020 Randolph, LLC 1315 3rd,...DE DE NV NV NV NV NV NV DE NV DE NV NV NV AZ NV NV NV NV NV NV NV NV NV NV NV NV NV NV NV NV ... -

Page 119

... U-Haul R Fleet 3, LLC 2013 NYCB-BE, LLC U-Box, LLC U-Haul Moving Partners, Inc. U-Haul Self-Storage Corporation U-Haul Self-Storage Management (WPC), Inc. U-Haul Co. of Alabama, Inc. U-Haul Co. of Alaska U-Haul Co. of Arizona Boxman Rentals, LLC U-Haul Titling, LLC 2010 U-Haul Titling 2, LLC 2010... -

Page 120

... of Mississippi U-Haul Company of Missouri U-Haul Co. of Montana, Inc. U-Haul Co. of Nebraska U-Haul Co. of Nevada, Inc. U-Haul Co. of New Hampshire, Inc. U-Haul Co. of New Jersey, Inc. U-Haul Co. of New Mexico, Inc. U-Haul Co. of New York and Vermont, Inc. U-Haul Co. of North Carolina U-Haul Co. of... -

Page 121

... 21, LLC UHIL 22, LLC UHIL RW, LLC Canada: U-Haul Co. (Canada) Ltd. U-Haul Co. (Canada) Ltee U-Haul Inspections, Ltd. 239 Station (Canada), Ltd. 900 Water (Canada), Ltd. 2100 Norman (Canada), Ltd. 4605 Kent (Canada), Ltd. 9082 Tecumseh (Canada), Ltd. 1508 Walker (Canada), Ltd. WI WY DE DE DE DE DE... -

Page 122

... PUBLIC ACCOUNTING FIRM AMERCO Reno, Nevada We hereby consent to the incorporation by reference in the Registration Statements on Form S-3 (No. 33-56571 and 333-193427) of AMERCO and consolidated subsidiaries (the "Company") of our reports dated May 25, 2016, relating to the consolidated financial... -

Page 123

... information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial re porting. /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board of AMERCO (b) Date: May 25, 2016 -

Page 124

...; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the Registrant's internal control over financial reporting. /s/ Jason A. Berg Jason A. Berg Principal Financial Officer and Chief Accounting Officer of AMERCO (b) Date: May 25, 2016 -

Page 125

... of the Securities Exchange Act of 1934, and 2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ Edward J. Shoen Edward J. Shoen President and Chairman of the Board of AMERCO Date: May 25, 2016 -

Page 126

... Exchange Act of 1934, and 2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. /s/ Jason A. Berg Jason A. Berg Principal Financial Officer and Chief Accounting Officer of AMERCO Date: May 25, 2016 -

Page 127

... Life Insurance Company Samuel J. Shoen Project Manager U-Box Division John C. Taylor President of U-Haul Mary K. Thompson Chief Accounting Ofï¬cer of AMERCO Carlos Vizcarra President of Amerco Real Estate Company Compensation Committee John P. Brogan John M. Dodds James E. Acridge Executive... -

Page 128

... rental of trucks, trailers and related equipment to the do-it-yourself mover. The Company also sells related moving products and services, and rents self-storage facilities and general rental items. In addition, the Company's insurance subsidiaries engage in the life and property/casualty insurance... -

Page 129

-

Page 130

® UH-6000-2016(0) ©2016 U-Haul International