Time Warner Cable 2008 Annual Report Download - page 96

Download and view the complete annual report

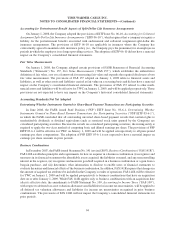

Please find page 96 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.programming vendor is required to be allocated to the various services received based upon their respective fair

values. Because multiple services from the same programming vendor may be received over different contractual

periods and may have different contractual rates, the allocation of consideration to the individual services will have

an impact on the timing of the Company’s expense recognition.

Pension Plans

TWC has both funded and unfunded noncontributory defined benefit pension plans covering a majority of its

employees. Pension benefits are based on formulas that reflect the employees’ years of service and compensation

during their employment period. The Company recognized pension expense associated with these plans of

$91 million, $64 million and $77 million in 2008, 2007 and 2006, respectively. The Company expects pension

expense to be approximately $150 million in 2009. The pension expense recognized by the Company is determined

using certain assumptions, including the expected long-term rate of return on plan assets, the interest factor implied

by the discount rate and the rate of compensation increases. TWC uses a December 31 measurement date for its

plans. See Notes 3 and 13 to the accompanying consolidated financial statements for additional discussion. The

determination of these assumptions is discussed in more detail below.

The Company used a discount rate of 6% to compute 2008 pension expense. The discount rate for the plan year

ended December 31, 2007 was determined by comparison against the Moody’s Aa Corporate Index rate, adjusted

for coupon frequency and duration of the obligation, consistent with prior periods. The resulting discount rate was

supported by periodic matching of plan liability cash flows to a pension yield curve constructed of a large

population of high-quality corporate bonds. Effective for the plan year ending on December 31, 2008, the Company

refined the discount rate determination process to rely on the matching of plan liability cash flows to a pension yield

curve constructed of a large population of high-quality corporate bonds, without comparison against the Moody’s

Aa Corporate Index rate. A decrease in the discount rate of 25 basis points, from 6.00% to 5.75%, while holding all

other assumptions constant, would have resulted in an increase in the Company’s pension expense of approximately

$13 million in 2008.

The Company’s expected long-term rate of return on plan assets used to compute 2008 pension expense was

8%. In developing the expected long-term rate of return on assets, the Company considered the pension portfolio’s

composition, past average rate of earnings and discussions with portfolio managers. The expected long-term rate of

return is based on an asset allocation assumption of 75% equity securities and 25% fixed-income securities. A

decrease in the expected long-term rate of return of 25 basis points, from 8.00% to 7.75%, while holding all other

assumptions constant, would have resulted in an increase in the Company’s pension expense of approximately

$3 million in 2008.

The Company used an estimated rate of future compensation increases of 4.5% to compute 2008 pension

expense. An increase in the rate of 25 basis points while holding all other assumptions constant would have resulted

in an increase in the Company’s domestic pension expense of approximately $4 million in 2008.

Property, Plant and Equipment

TWC incurs expenditures associated with the construction of its cable systems. Costs associated with the

construction of the cable transmission and distribution facilities and new cable service installations are capitalized.

TWC uses standard capitalization rates to capitalize installation activities. Significant judgment is involved in the

development of these capitalization standards, including the average time required to perform an installation and the

determination of the nature and amount of indirect costs to be capitalized. Additionally, the development of

capitalization standards for new products involves more estimates than those used for established products because

the Company has less historical data related to the installation of new products. The capitalization standards are

reviewed at least annually and adjusted, if necessary, based on comparisons to actual costs incurred.

86

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)