Time Warner Cable 2008 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

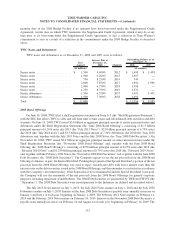

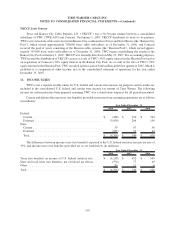

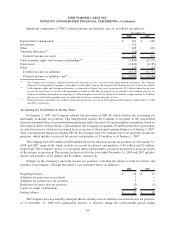

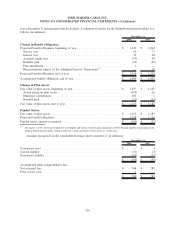

Significant components of TWC’s deferred income tax liabilities, net, are as follows (in millions):

2008 2007

December 31,

Equity-based compensation......................................... $ 161 $ 148

Investments .................................................... 152 —

Other ......................................................... 449 423

Valuation allowances

(a)

............................................ (76) —

Deferred income tax assets ....................................... 686 571

Cable franchise rights and customer relationships

(b)

....................... (5,886) (11,573)

Fixed assets .................................................... (2,824) (2,185)

Other ......................................................... (13) (13)

Deferred income tax liabilities .................................... (8,723) (13,771)

Deferred income tax liabilities, net

(c)

................................ $ (8,037) $ (13,200)

(a)

The Company has recorded a valuation allowance for deferred tax assets associated with equity-method investments. The valuation

allowance is based upon the Company’s assessment it is more likely than not that a portion of the deferred tax asset will not be realized.

(b)

Cable franchise rights and customer relationships is comprised of deferred tax assets (approximately $1.2 billion) where the tax basis

exceeds the book basis as a result of the impairment recorded in 2008 that are expected to be realized as the Company receives tax

deductions from the amortization, for tax purposes, of the intangible assets offset by deferred tax liabilities (approximately $7.0 billion)

that are associated with intangible assets for which the book basis is greater than the tax basis.

(c)

Deferred income tax liabilities, net, includes current deferred income tax assets of $156 million and $91 million as of December 31, 2008

and 2007, respectively.

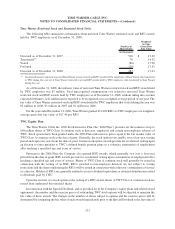

Accounting for Uncertainty in Income Taxes

On January 1, 2007, the Company adopted the provisions of FIN 48, which clarifies the accounting for

uncertainty in income tax positions. This interpretation requires the Company to recognize in the consolidated

financial statements those tax positions determined more likely than not to be sustained upon examination, based on

the technical merits of the positions. Upon adoption, the Company recognized a $3 million reduction of previously

recorded tax reserves, which was accounted for as an increase to the retained earnings balance as of January 1, 2007.

After considering the impact of adopting FIN 48, the Company had a $17 million reserve for uncertain income tax

positions, which includes an accrual for interest and penalties of $1 million, as of January 1, 2007.

The Company had a $27 million and $20 million reserve for uncertain income tax positions as of December 31,

2008 and 2007, respectively, which includes an accrual for interest and penalties of $5 million and $2 million,

respectively. The Company’s policy is to recognize interest and penalties accrued on uncertain tax positions as part

of the income tax provision. The income tax provision for the year ended December 31, 2008 and 2007 includes

interest and penalties of $2 million and $1 million, respectively.

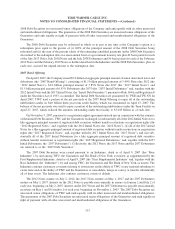

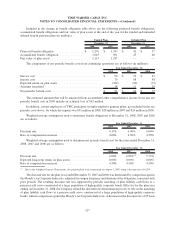

Changes in the Company’s uncertain income tax positions, excluding the related accrual for interest and

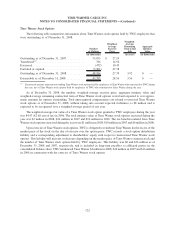

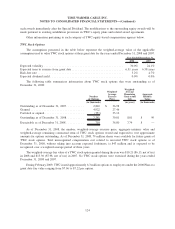

penalties, from January 1 through December 31 are presented below (in millions):

2008 2007

Beginning balance ............................................... $ 18 $ 16

Additions for prior year tax positions . . ............................... 3 —

Additions for current year tax positions. ............................... 5 3

Reductions for prior year tax positions . ............................... (2) (1)

Lapses in statute of limitations ...................................... (2) —

Ending balance ................................................. $ 22 $ 18

The Company does not currently anticipate that its existing reserves related to uncertain income tax positions

as of December 31, 2008 will significantly increase or decrease during the twelve-month period ending

120

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)