Time Warner Cable 2008 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

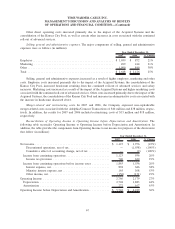

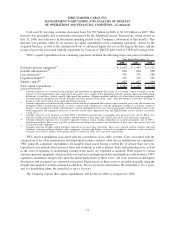

Operating Income before Depreciation and Amortization. Operating Income before Depreciation and Amor-

tization increased principally due to revenue growth (particularly growth in high margin high-speed data revenues),

partially offset by higher costs of revenues and selling, general and administrative expenses, as discussed above.

Depreciation expense. Depreciation expense increased primarily due to the impact of the Acquired Systems,

the consolidation of the Kansas City Pool and demand-driven increases in recent years of purchases of customer

premise equipment, which generally has a shorter useful life compared to the mix of assets previously purchased.

Amortization expense. Amortization expense increased primarily as a result of the amortization of intangible

assets related to customer relationships associated with the Acquired Systems. This was partially offset by the

absence after the first quarter of 2007 of amortization expense associated with customer relationships recorded in

connection with the 2003 restructuring of TWE, which were fully amortized as of the end of the first quarter of

2007.

Operating Income. Operating Income increased primarily due to the increase in Operating Income before

Depreciation and Amortization, partially offset by increases in both depreciation and amortization expense, as

discussed above.

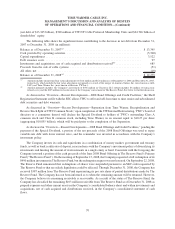

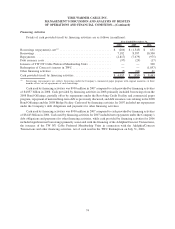

Interest expense, net. Interest expense, net, increased primarily due to an increase in long-term debt and

mandatorily redeemable preferred membership units issued by a subsidiary in connection with the Adelphia/

Comcast Transactions, partially offset by a decrease in mandatorily redeemable preferred equity issued by a

subsidiary as a result of ATC’s contribution in 2006 of its 1% common equity interest and $2.4 billion preferred

equity interest in TWE to TW NY in exchange for a 12.43% non-voting common stock interest in TW NY (the

“ATC Contribution”).

Minority interest expense, net. Minority interest expense, net, increased primarily reflecting the change in the

ownership structure of the Company and TWE as a result of the ATC Contribution and the redemption of Comcast’s

interest in TWC and TWE.

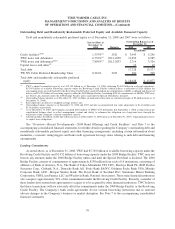

Other income, net. Other income, net, detail is shown in the table below (in millions):

2007 2006

Year Ended December 31,

Investment gains

(a)

............................................. $ (146) $ —

Income from equity investments, net ............................... (11) (129)

Other ...................................................... 1 (2)

Other income, net ............................................. $ (156) $ (131)

(a)

2007 amount consists of the TKCCP Gain recorded as a result of the distribution of TKCCP’s assets.

Income from equity investments, net, decreased primarily due to the Company no longer treating TKCCP as an

equity-method investment.

Income tax provision. TWC’s income tax provision has been prepared as if the Company operated as a stand-

alone taxpayer for all periods presented. In 2007 and 2006, the Company recorded income tax provisions of

$740 million and $620 million, respectively. The effective tax rate was approximately 40% in both 2007 and 2006.

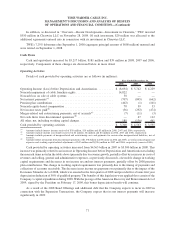

Income from continuing operations. Income from continuing operations was $1.123 billion in 2007 compared

to $936 million in 2006. Basic and diluted income per common share from continuing operations were $1.15 in

2007 compared to $0.95 in 2006. These increases were due to an increase in Operating Income and other income,

net, partially offset by increases in interest expense, net, income tax provision and minority interest expense, net,

and a decrease in income from equity investments, net.

Discontinued operations, net of tax. Discontinued operations, net of tax, in 2006 reflected the impact of

treating the systems transferred to Comcast in connection with the Adelphia/Comcast Transactions as discontinued

68

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)