Time Warner Cable 2008 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TKCCP Joint Venture

Texas and Kansas City Cable Partners, L.P. (“TKCCP”) was a 50-50 joint venture between a consolidated

subsidiary of TWC (TWE-A/N) and Comcast. On January 1, 2007, TKCCP distributed its assets to its partners.

TWC received certain cable assets located in Kansas City, south and west Texas and New Mexico (the “Kansas City

Pool”), which served approximately 788,000 basic video subscribers as of December 31, 2006, and Comcast

received the pool of assets consisting of the Houston cable systems (the “Houston Pool”), which served approx-

imately 795,000 basic video subscribers as of December 31, 2006. TWC began consolidating the results of the

Kansas City Pool on January 1, 2007. TKCCP was formally dissolved on May 15, 2007. For accounting purposes,

TWC treated the distribution of TKCCP’s assets as a sale of TWC’s 50% equity interest in the Houston Pool and as

an acquisition of Comcast’s 50% equity interest in the Kansas City Pool. As a result of the sale of TWC’s 50%

equity interest in the Houston Pool, TWC recorded a pretax gain of $146 million in the first quarter of 2007, which is

included as a component of other income, net, in the consolidated statement of operations for the year ended

December 31, 2007.

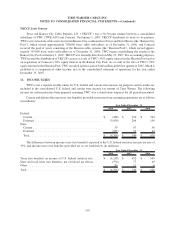

11. INCOME TAXES

TWC is not a separate taxable entity for U.S. federal and various state income tax purposes and its results are

included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The following

income tax information has been prepared assuming TWC was a stand-alone taxpayer for all periods presented.

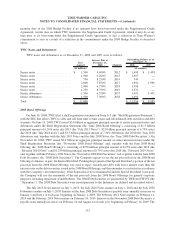

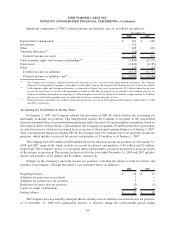

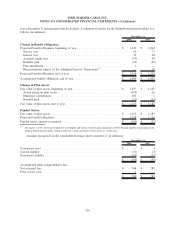

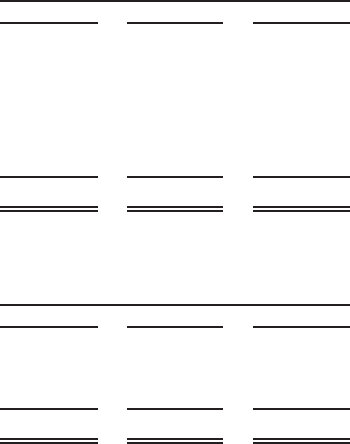

Current and deferred income taxes (tax benefits) provided on income from continuing operations are as follows

(in millions):

2008 2007 2006

Year Ended December 31,

Federal:

Current .......................................... $ (188) $ 356 $ 324

Deferred ......................................... (3,636) 266 196

State:

Current .......................................... 39 67 56

Deferred ......................................... (921) 51 44

Total ............................................ $ (4,706) $ 740 $ 620

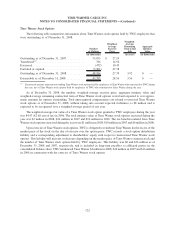

The differences between income taxes (tax benefits) expected at the U.S. federal statutory income tax rate of

35% and income taxes (tax benefits) provided are as set forth below (in millions):

2008 2007 2006

Year Ended December 31,

Taxes (tax benefits) on income at U.S. federal statutory rate ..... $ (4,218) $ 652 $ 545

State and local taxes (tax benefits), net of federal tax effects..... (574) 77 69

Other ............................................. 86 11 6

Total .............................................. $ (4,706) $ 740 $ 620

119

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)