Time Warner Cable 2008 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

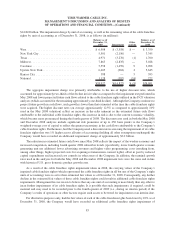

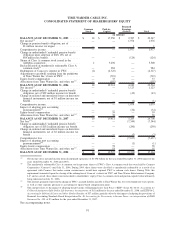

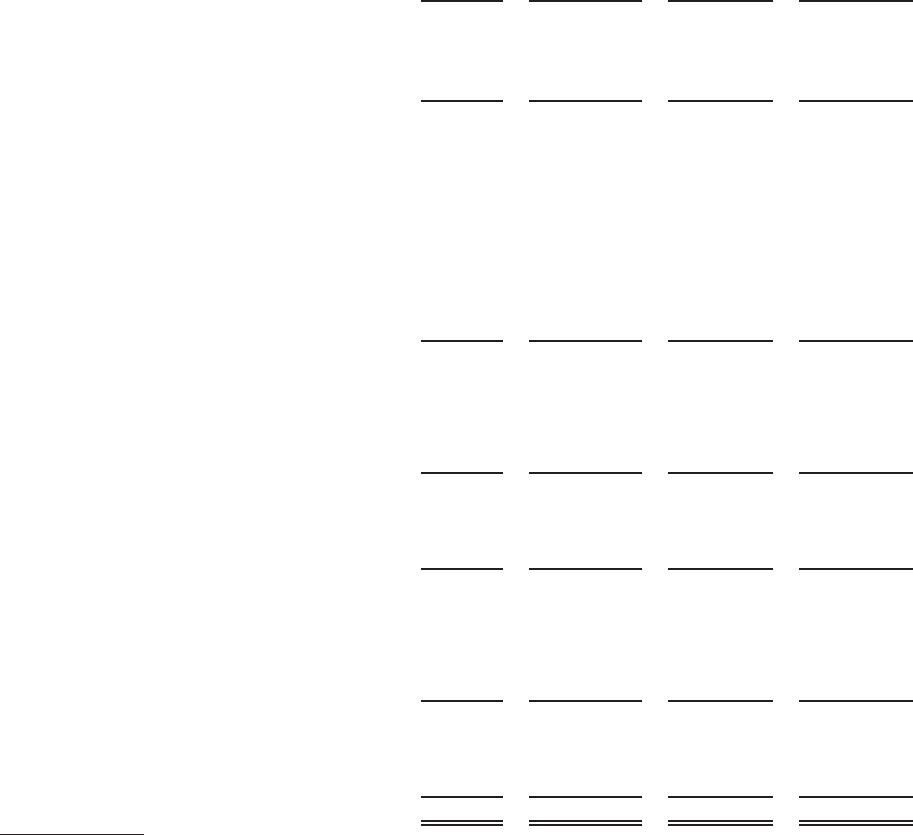

TIME WARNER CABLE INC.

CONSOLIDATED STATEMENT OF SHAREHOLDERS’ EQUITY

Common

Stock

Paid-in-

Capital

Retained

Earnings

(Deficit) Total

(in millions)

BALANCE AS OF DECEMBER 31, 2005 . . . . . . . $ 10 $ 17,950 $ 2,387 $ 20,347

Net income

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,976 1,976

Change in pension benefit obligation, net of

$1 million income tax impact . . . . . . . . . . . . . . . . — — 1 1

Comprehensive income . . . . . . . . . . . . . . . . . . . . . . — — 1,977 1,977

Change in underfunded / unfunded pension benefit

obligation upon adoption of FAS 158, net of

$84 million tax benefit. . . . . . . . . . . . . . . . . . . . . — — (124) (124)

Shares of Class A common stock issued in the

Adelphia acquisition . . . . . . . . . . . . . . . . . . . . . . 2 5,498 — 5,500

Reclassification of mandatorily redeemable Class A

common stock

(b)

......................... — 984 — 984

Redemption of Comcast’s interest in TWC . . . . . . . . (2) (4,325) — (4,327)

Adjustment to goodwill resulting from the pushdown

of Time Warner Inc.’s basis in TWC . . . . . . . . . . . — (719) — (719)

Equity-based compensation . . . . . . . . . . . . . . . . . . . — 33 — 33

Allocations from Time Warner Inc. and other, net

(c)

. . — (107) — (107)

BALANCE AS OF DECEMBER 31, 2006 . . . . . . . 10 19,314 4,240 23,564

Net income

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — 1,123 1,123

Change in underfunded / unfunded pension benefit

obligation, net of $29 million income tax benefit . . — — (43) (43)

Change in realized and unrealized losses on derivative

financial instruments, net of $1 million income tax

benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (1) (1)

Comprehensive income . . . . . . . . . . . . . . . . . . . . . . — — 1,079 1,079

Impact of adopting new accounting

pronouncements

(d)

. . . . . . . . . . . . . . . . . . . . . . . . — — (34) (34)

Equity-based compensation . . . . . . . . . . . . . . . . . . . — 59 — 59

Allocations from Time Warner Inc. and other, net

(c)

.. — 38 — 38

BALANCE AS OF DECEMBER 31, 2007 . . . . . . . 10 19,411 5,285 24,706

Net loss

(a)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (7,344) (7,344)

Change in underfunded / unfunded pension benefit

obligation, net of $192 million income tax benefit. . — — (290) (290)

Change in realized and unrealized losses on derivative

financial instruments, net of $2 million income tax

benefit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — — (3) (3)

Comprehensive loss . . . . . . . . . . . . . . . . . . . . . . . . — — (7,637) (7,637)

Impact of adopting new accounting

pronouncements

(d)

........................ — — (1) (1)

Equity-based compensation . . . . . . . . . . . . . . . . . . . — 78 — 78

Allocations from Time Warner Inc. and other, net

(c)

.. — 18 — 18

BALANCE AS OF DECEMBER 31, 2008 . . . . . . . $ 10 $ 19,507 $ (2,353) $ 17,164

(a)

Net income (loss) included income from discontinued operations of $1.038 billion for the year ended December 31, 2006 (none for the

years ended December 31, 2008 and 2007).

(b)

The mandatorily redeemable Class A common stock represents shares of TWC’s Class A common stock that were held by Comcast

Corporation (“Comcast”) until July 31, 2006. During 2004, these shares were classified as mandatorily redeemable as a result of an

agreement with Comcast that under certain circumstances would have required TWC to redeem such shares. During 2006, this

requirement terminated upon the closing of the redemption of Comcast’s interest in TWC and Time Warner Entertainment Company,

L.P., and as a result, these shares were reclassified to shareholders’ equity (Class A common stock and paid-in-capital) before ultimately

being redeemed on July 31, 2006.

(c)

The amounts primarily represent the change in TWC’s accrued liability payable to Time Warner Inc. for vested employee stock options,

as well as other amounts pursuant to accounting for equity-based compensation plans.

(d)

The amount relates to the impact of adopting the provisions of Emerging Issues Task Force (“EITF”) Issue No. 06-10, Accounting for

Collateral Assignment Split-Dollar Life Insurance Arrangements, of $(1) million for the year ended December 31, 2008, and EITF 06-2,

Accounting for Sabbatical Leave and Other Similar Benefits, of $37 million, partially offset by the impact of adopting the provisions of

Financial Accounting Standards Board Interpretation No. 48, Accounting for Uncertainty in Income Taxes—an interpretation of FASB

Statement No. 109, of $3 million for the year ended December 31, 2007.

See accompanying notes.

91