Time Warner Cable 2008 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The 2007 Debt Securities may be redeemed in whole or in part at any time at TWC’s option at a redemption

price equal to the greater of (i) 100% of the principal amount of the 2007 Debt Securities being redeemed and (ii) the

sum of the present values of the remaining scheduled payments on the 2007 Debt Securities discounted to the

redemption date on a semi-annual basis at a government treasury rate plus 20 basis points for the 2012 Notes,

30 basis points for the 2017 Notes and 35 basis points for the 2037 Debentures as further described in the Indenture

and the 2007 Debt Securities, plus, in each case, accrued but unpaid interest to the redemption date.

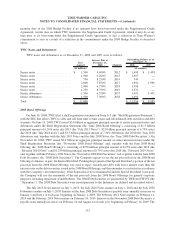

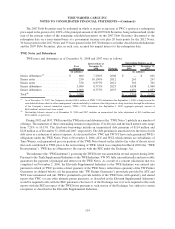

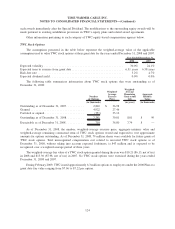

TWE Notes and Debentures

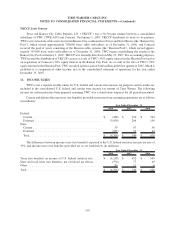

TWE notes and debentures as of December 31, 2008 and 2007 were as follows:

Face

Amount

Interest Rate at

December 31,

2008 Maturity

December 31,

2008

December 31,

2007

(in millions)(in millions)

Outstanding Balance as of

Senior debentures

(a)

.............. $ 600 7.250% 2008 $ — $ 601

Senior notes ................... 250 10.150% 2012 263 267

Senior notes ................... 350 8.875% 2012 362 365

Senior debentures ............... 1,000 8.375% 2023 1,038 1,040

Senior debentures ............... 1,000 8.375% 2033 1,051 1,053

Total

(b)

....................... $ 3,200 $ 2,714 $ 3,326

(a)

As of December 31, 2007, the Company classified $601 million of TWE 7.25% debentures due September 1, 2008 as long-term in the

consolidated balance sheet to reflect management’s intent and ability to refinance the obligation on a long-term basis through the utilization

of the Company’s unused committed capacity. TWE’s 7.25% debentures due September 1, 2008 (aggregate principal amount of

$600 million) matured and were retired.

(b)

Outstanding balance amount as of December 31, 2008 and 2007 includes an unamortized fair value adjustment of $114 million and

$126 million, respectively.

During 1992 and 1993, TWE issued the TWE notes and debentures (the “TWE Notes”) publicly in a number of

offerings. The maturities of these outstanding issuances ranged from 15 to 40 years and the fixed interest rates range

from 7.25% to 10.15%. The fixed-rate borrowings include an unamortized debt premium of $114 million and

$126 million as of December 31, 2008 and 2007, respectively. The debt premium is amortized over the term of each

debt issue as a reduction of interest expense. As discussed below, TWC and TW NY have each guaranteed TWE’s

obligations under the TWE Notes. Prior to November 2, 2006, ATC and WCI, which entities are subsidiaries of

Time Warner, each guaranteed pro rata portions of the TWE Notes based on the relative fair value of the net assets

that each contributed to TWE prior to the restructuring of TWE, which was completed in March 2003 (the “TWE

Restructuring”). TWE has no obligation to file reports with the SEC under the Exchange Act.

The indenture (the “TWE Indenture”) governing the TWE Notes was amended in several respects during 2006.

Pursuant to the Tenth Supplemental Indenture to the TWE Indenture, TW NY fully, unconditionally and irrevocably

guarantees the payment of principal and interest on the TWE Notes. As a result of a consent solicitation that was

completed on November 2, 2006, the Eleventh Supplemental Indenture to the TWE Indenture was entered into

pursuant to which (i) TWC provides a direct guaranty of the TWE Notes, rather than a guaranty of the TW Partner

Guaranties (as defined below), (ii) the guaranties (the “TW Partner Guaranties”) previously provided by ATC and

WCI were terminated and (iii) TWE is permitted to provide holders of the TWE Notes with quarterly and annual

reports that TWC (or any other ultimate parent guarantor, as described in the Eleventh Supplemental Indenture)

would be required to file with the SEC pursuant to Section 13 of the Exchange Act, if it were required to file such

reports with the SEC in respect of the TWE Notes pursuant to such section of the Exchange Act, subject to certain

exceptions as described in the Eleventh Supplemental Indenture.

114

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)