Time Warner Cable 2008 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

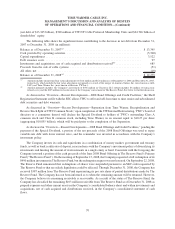

The Company expects to make discretionary cash contributions of at least $150 million to its defined benefit

pension plans during 2009, subject to market conditions and other considerations. See Note 13 to the accompanying

consolidated financial statements for additional discussion of the funded status of the Company’s defined benefit

pension plans.

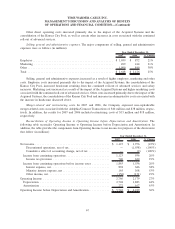

Cash provided by operating activities increased from $3.595 billion in 2006 to $4.563 billion in 2007. This

increase was primarily related to an increase in Operating Income before Depreciation and Amortization (due to

revenue growth, partially offset by increases in costs of revenues and selling, general and administrative expenses,

as described above) and a decrease in net income taxes paid (primarily as a result of the timing of tax-related

payments to Time Warner under the Company’s tax sharing arrangement, as well as tax benefits related to the

Adelphia/Comcast Transactions) and a decrease in pension plan contributions, which were partially offset by a

change in working capital requirements, an increase in net interest payments reflecting the increase in debt levels

attributable to the Adelphia/Comcast Transactions and a decrease in cash relating to discontinued operations. The

change in working capital requirements was primarily due to the timing of payments and collections of accounts

receivable.

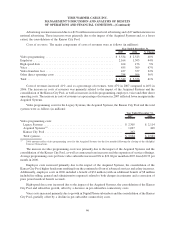

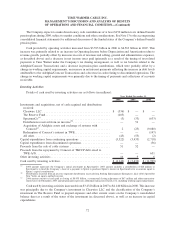

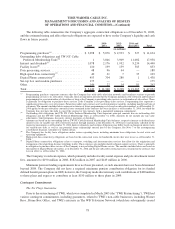

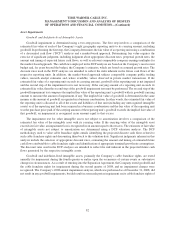

Investing Activities

Details of cash used by investing activities are as follows (in millions):

2008 2007 2006

Year Ended December 31,

Investments and acquisitions, net of cash acquired and distributions

received:

Clearwire LLC .......................................... $ (536) $ — $ —

The Reserve Fund ........................................ (103) — —

SpectrumCo

(a)

........................................... (3) (33) (633)

Distributions received from an investee

(b)

....................... — 51 —

Acquisition of Adelphia assets and exchange of systems with

Comcast

(c)

............................................ 2 (25) (9,080)

Redemption of Comcast’s interest in TWE ...................... — — (147)

All other ............................................... (45) (53) (2)

Capital expenditures from continuing operations ................... (3,522) (3,433) (2,718)

Capital expenditures from discontinued operations .................. — — (56)

Proceeds from the sale of cable systems ......................... 51 52 —

Proceeds from the repayment by Comcast of TKCCP debt owed to

TWE-A/N.............................................. — — 631

Other investing activities ..................................... 16 9 6

Cash used by investing activities ............................... $ (4,140) $ (3,432) $ (11,999)

(a)

2006 amount represents the Company’s initial investment in SpectrumCo. 2007 amount includes a contribution of $28 million to

SpectrumCo to fund the Company’s share of a payment to Sprint to purchase Sprint’s interest in SpectrumCo for an amount equal to

Sprint’s capital contributions.

(b)

Distributions received from an investee represent distributions received from Sterling Entertainment Enterprises, LLC (d/b/a SportsNet

New York), an equity-method investee.

(c)

2006 amount consists of cash paid at closing of $8.935 billion, a contractual closing adjustment of $67 million and other transaction-

related costs of $78 million. 2007 amount primarily represents additional transaction-related costs, including working capital adjustments.

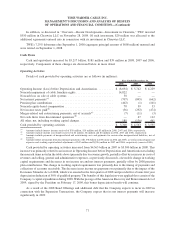

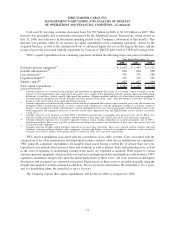

Cash used by investing activities increased from $3.432 billion in 2007 to $4.140 billion in 2008. This increase

was principally due to the Company’s investment in Clearwire LLC and the classification of the Company’s

investment in The Reserve Fund as prepaid expenses and other current assets on the Company’s consolidated

balance sheet as a result of the status of the investment (as discussed above), as well as an increase in capital

expenditures.

72

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)