Time Warner Cable 2008 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.becomes available and adjusts liabilities as appropriate. The actual cost of resolving a claim may be substantially

different from the amount of the liability recorded. Differences between the estimated and actual amounts

determined upon ultimate resolution, individually or in the aggregate, are not expected to have a material adverse

effect on the Company’s consolidated financial position but could possibly be material to the Company’s

consolidated results of operations or cash flow for any one period.

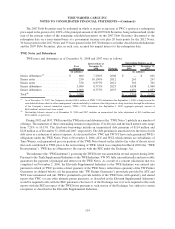

Income Taxes

TWC is not a separate taxable entity for U.S. federal and various state income tax purposes and its results are

included in the consolidated U.S. federal and certain state income tax returns of Time Warner. The income tax

benefits and provisions, related tax payments, and current and deferred tax balances have been prepared as if TWC

operated as a stand-alone taxpayer for all periods presented in accordance with the tax sharing arrangement between

TWC and Time Warner. Under the tax sharing arrangement, TWC is obligated to make tax sharing payments to

Time Warner as if it were a separate payer. Income taxes are provided using the asset and liability method prescribed

by FAS 109. Under this method, income taxes (i.e., deferred tax assets, deferred tax liabilities, taxes currently

payable/refunds receivable and tax expense) are recorded based on amounts refundable or payable in the current

year and include the results of any difference between GAAP and tax reporting. Deferred income taxes reflect the

tax effect of net operating losses, capital losses, and general business credit carryforwards and the net tax effects of

temporary differences between the carrying amount of assets and liabilities for financial statement and income tax

purposes, as determined under enacted tax laws and rates. Valuation allowances are established when management

determines that it is more likely than not that some portion or all of the deferred tax asset will not be realized. The

financial effect of changes in tax laws or rates is accounted for in the period of enactment.

The Company made cash tax payments to Time Warner of $9 million in 2008, $263 million in 2007 and

$444 million in 2006.

On January 1, 2007, the Company adopted the provisions of FASB Interpretation No. 48, Accounting for

Uncertainty in Income Taxes — an interpretation of FASB Statement No. 109 (“FIN 48”), which clarifies the

accounting for uncertainty in income tax positions. This interpretation requires the Company to recognize in the

consolidated financial statements those tax positions determined to be “more likely than not” of being sustained

upon examination, based on the technical merits of the positions.

From time to time, the Company engages in transactions in which the tax consequences may be subject to

uncertainty. Examples of such transactions include business acquisitions and dispositions, including dispositions

designed to be tax free, issues related to consideration paid or received, and certain financing transactions.

Significant judgment is required in assessing and estimating the tax consequences of these transactions. The

Company prepares and files tax returns based on interpretation of tax laws and regulations. In the normal course of

business, the Company’s tax returns are subject to examination by various taxing authorities. Such examinations

may result in future tax and interest assessments by these taxing authorities. In determining the Company’s tax

provision for financial reporting purposes, the Company establishes a reserve for uncertain tax positions unless such

positions are determined to be “more likely than not” of being sustained upon examination, based on their technical

merits. That is, for financial reporting purposes, the Company only recognizes tax benefits taken on the tax return

that it believes are “more likely than not” of being sustained. There is considerable judgment involved in

determining whether positions taken on the tax return are “more likely than not” of being sustained.

The Company adjusts its tax reserve estimates periodically because of ongoing examinations by, and

settlements with, the various taxing authorities, as well as changes in tax laws, regulations and interpretations.

The consolidated tax provision of any given year includes adjustments to prior year income tax accruals that are

considered appropriate and any related estimated interest. The Company’s policy is to recognize, when applicable,

interest and penalties on uncertain tax positions as part of income tax expense. Refer to Note 11 for further details.

104

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)