Time Warner Cable 2008 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.10. INVESTMENTS AND JOINT VENTURES

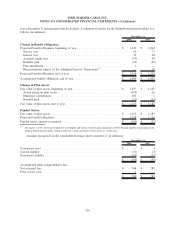

The Company had investments of $895 million and $735 million as of December 31, 2008 and 2007,

respectively. These investments are comprised almost entirely of equity-method investees.

As of December 31, 2008, investments accounted for using the equity method, and the respective ownership

percentage held by TWC, primarily consisted of Clearwire LLC (as defined below) (3.8% owned) in which TWC

invested $550 million in 2008, and SpectrumCo (as defined below), (27.8% owned) in which TWC invested an

additional $3 million in 2008. During the fourth quarter of 2008, the Company recorded a noncash pretax

impairment of $367 million on its investment in Clearwire LLC as a result of a significant decline in the estimated

fair value of Clearwire, reflecting the Clearwire Corp stock price decline from May 2008, when TWC agreed to

make its investment. As of December 31, 2008, the Company’s recorded investment for Clearwire LLC and

SpectrumCo approximates the Company’s equity interests in the underlying net assets of these equity-method

investments.

As of December 31, 2007, investments accounted for using the equity method, and the respective ownership

percentage held by TWC, primarily consisted of SpectrumCo (27.8% owned) in which TWC invested $33 million

in 2007.

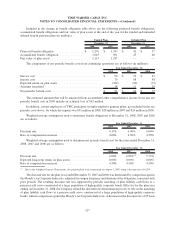

Investment in Clearwire

In November 2008, TWC, Intel Corporation, Google Inc., Comcast Corporation (together with its subsidiaries,

“Comcast”) and Bright House Networks, LLC collectively invested $3.2 billion in Clearwire Corporation, a

wireless broadband communications company (“Clearwire Corp”), and one of its operating subsidiaries (“Clear-

wire LLC,” and, collectively with Clearwire Corp, “Clearwire”). TWC invested $550 million for membership

interests in Clearwire LLC and received voting and board of director nomination rights in Clearwire Corp.

Clearwire LLC was formed by the combination of Sprint Nextel Corporation’s (“Sprint”) and Clearwire Corp’s

respective wireless broadband businesses and is focused on deploying the first nationwide fourth-generation

wireless network to provide mobile broadband services to wholesale and retail customers. In connection with the

transaction, TWC entered into a wholesale agreement with Sprint that allows TWC to offer wireless services

utilizing Sprint’s second-generation and third-generation network and a wholesale agreement with Clearwire that

will allow TWC to offer wireless services utilizing Clearwire’s mobile broadband wireless network. The Company

allocated $20 million of its $550 million investment in Clearwire LLC to its rights under these agreements, which

the Company believes represents the fair value of favorable pricing provisions contained in the agreements. Such

assets are included in other assets in the consolidated balance sheet as of December 31, 2008 and will be amortized

over the estimated lives of the agreements. The Company’s investment in Clearwire LLC is being accounted for

under the equity method of accounting. The Company expects that Clearwire will incur losses in its early periods of

operation.

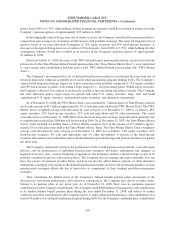

SpectrumCo Joint Venture

TWC is a participant in a joint venture with certain other cable companies (“SpectrumCo”) that holds

advanced wireless spectrum (“AWS”) licenses. Under certain circumstances, the members of SpectrumCo have the

ability to exit the venture and receive from the venture, subject to certain limitations and adjustments, AWS licenses

covering the areas in which they provide cable services. In January 2009, SpectrumCo redeemed the 10.9% interest

held by an affiliate of Cox Communications, Inc. (“Cox”) and Cox received AWS licenses, principally covering

areas in which Cox has cable services, and approximately $70 million in cash (of which TWC’s share was

$22 million). Following the closing of the Cox transaction, SpectrumCo’s AWS licenses cover 20 MHz over 80% of

the continental United States and Hawaii.

118

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)