Time Warner Cable 2008 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

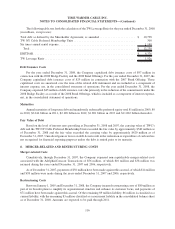

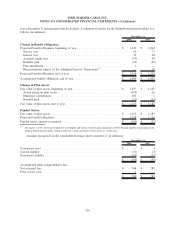

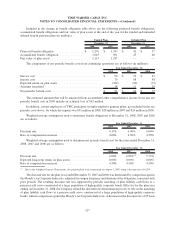

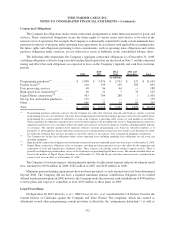

uses a December 31 measurement date for its plans. A summary of activity for the defined benefit pension plans is as

follows (in millions):

2008 2007

December 31,

Change in Benefit Obligation:

Projected benefit obligation, beginning of year .......................... $ 1,220 $ 1,042

Service cost .................................................. 96 75

Interest cost .................................................. 79 68

Actuarial (gain) loss ............................................ (57) 38

Benefits paid ................................................. (21) (21)

Plan amendment ............................................... 1 —

Remeasurement impact of the Adelphia/Comcast Transactions

(a)

........... — 18

Projected benefit obligation, end of year ............................... $ 1,318 $ 1,220

Accumulated benefit obligation, end of year ............................ $ 1,090 $ 1,001

Change in Plan Assets:

Fair value of plan assets, beginning of year ............................. $ 1,187 $ 1,142

Actual return on plan assets ...................................... (455) 65

Employer contributions .......................................... 402 1

Benefits paid ................................................. (21) (21)

Fair value of plan assets, end of year . . ............................... $ 1,113 $ 1,187

Funded Status:

Fair value of plan assets ........................................... $ 1,113 $ 1,187

Projected benefit obligation ........................................ 1,318 1,220

Funded status, amount recognized.................................... $ (205) $ (33)

(a)

On August 1, 2007, the former employees of Adelphia and Comcast who became employees of TWC became eligible to participate in the

defined benefit pension plans, which resulted in a remeasurement of those plans as of that date.

Amounts recognized in the consolidated balance sheet consisted of (in millions):

2008 2007

December 31,

Noncurrent asset ................................................ $ — $ 4

Current liability ................................................. (11) (2)

Noncurrent liability .............................................. (194) (35)

$ (205) $ (33)

Accumulated other comprehensive loss:

Net actuarial loss ................................................ $ 768 $ 287

Prior service cost ................................................ 1 —

$ 769 $ 287

126

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)