Time Warner Cable 2008 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

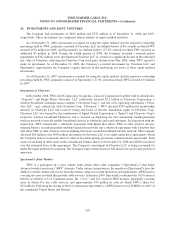

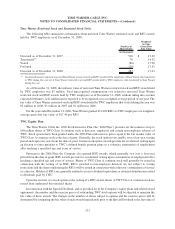

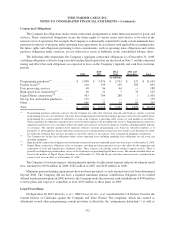

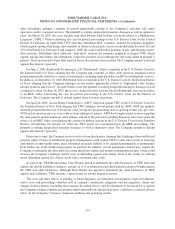

Included in the change in benefit obligation table above are the following projected benefit obligations,

accumulated benefit obligations and fair value of plan assets at the end of the year for the funded and unfunded

defined benefit pension plans (in millions):

2008 2007 2008 2007

December 31, December 31,

Funded Plans Unfunded Plan

Projected benefit obligation ................. $ 1,276 $ 1,183 $ 42 $ 37

Accumulated benefit obligation ............... 1,045 961 45 40

Fair value of plan assets .................... 1,113 1,187 — —

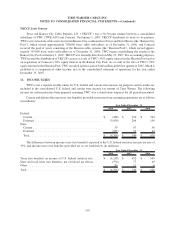

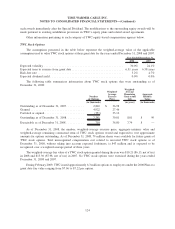

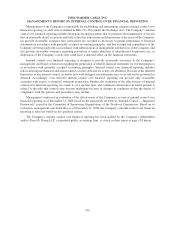

The components of net periodic benefit costs from continuing operations are as follows (in millions):

2008 2007 2006

Year Ended December 31,

Service cost ........................................ $ 96 $ 75 $ 63

Interest cost ........................................ 79 68 58

Expected return on plan assets ........................... (102) (90) (73)

Amounts amortized ................................... 18 11 29

Net periodic benefit costs .............................. $ 91 $ 64 $ 77

The estimated amounts that will be amortized from accumulated other comprehensive income (loss) into net

periodic benefit cost in 2009 include an actuarial loss of $63 million.

In addition, certain employees of TWC participate in multi-employer pension plans, not included in the net

periodic costs above, for which the expense was $31 million in 2008, $28 million in 2007 and $24 million in 2006.

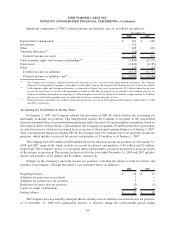

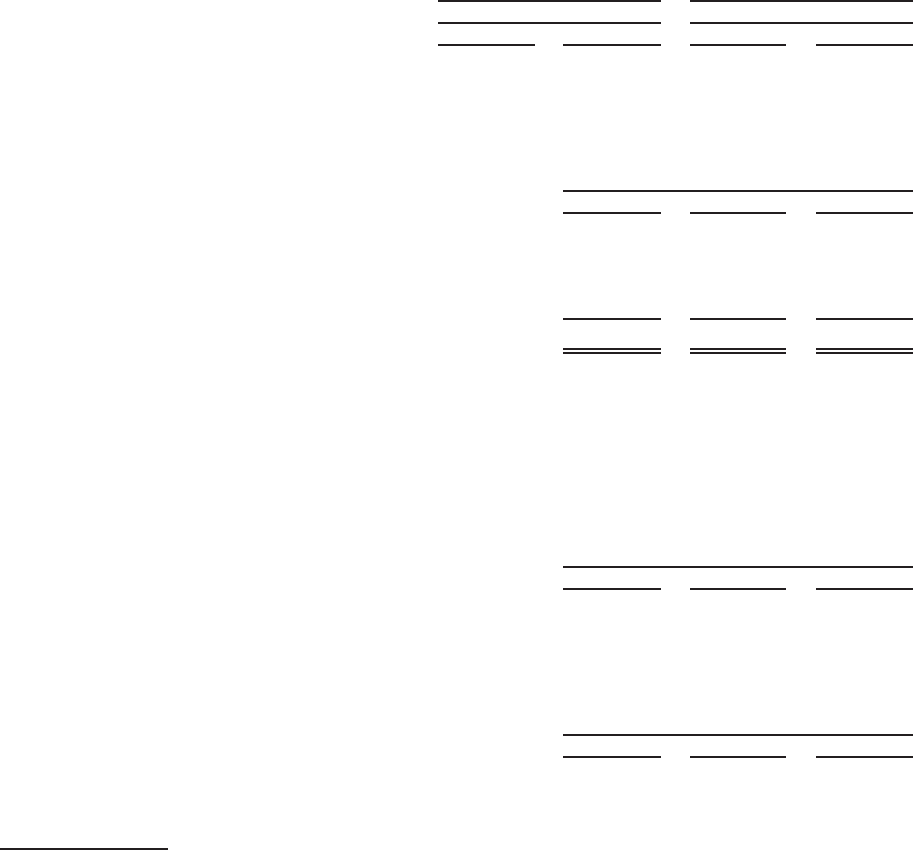

Weighted-average assumptions used to determine benefit obligations at December 31, 2008, 2007 and 2006

are as follows:

2008 2007 2006

Year Ended December 31,

Discount rate........................................ 6.17% 6.00% 6.00%

Rate of compensation increase ........................... 4.00% 4.50% 4.50%

Weighted-average assumptions used to determine net periodic benefit cost for the years ended December 31,

2008, 2007 and 2006 are as follows:

2008 2007 2006

Year Ended December 31,

Discount rate........................................ 6.00% 6.00%

(a)

5.75%

Expected long-term return on plan assets ................... 8.00% 8.00% 8.00%

Rate of compensation increase ........................... 4.50% 4.50% 4.50%

(a)

Due to the Adelphia/Comcast Transactions, the pension plans were remeasured on August 1, 2007 using a discount rate of 6.25%.

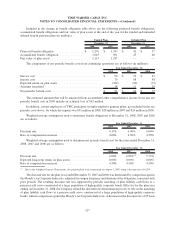

The discount rate for the plan years ended December 31, 2007 and 2006 was determined by comparison against

the Moody’s Aa Corporate Index rate, adjusted for coupon frequency and duration of the obligation, consistent with

prior periods. The resulting discount rate was supported by periodic matching of plan liability cash flows to a

pension yield curve constructed of a large population of high-quality corporate bonds. Effective for the plan year

ending on December 31, 2008, the Company refined the discount rate determination process to rely on the matching

of plan liability cash flows to a pension yield curve constructed of a large population of high-quality corporate

bonds, without comparison against the Moody’s Aa Corporate Index rate. A decrease in the discount rate of 25 basis

127

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)