Time Warner Cable 2008 Annual Report Download - page 155

Download and view the complete annual report

Please find page 155 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172

|

|

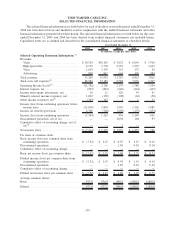

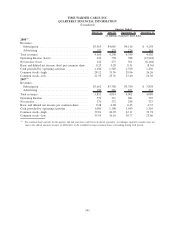

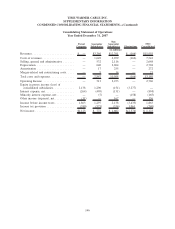

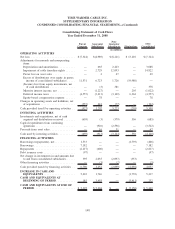

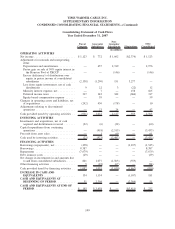

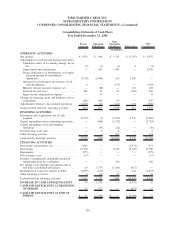

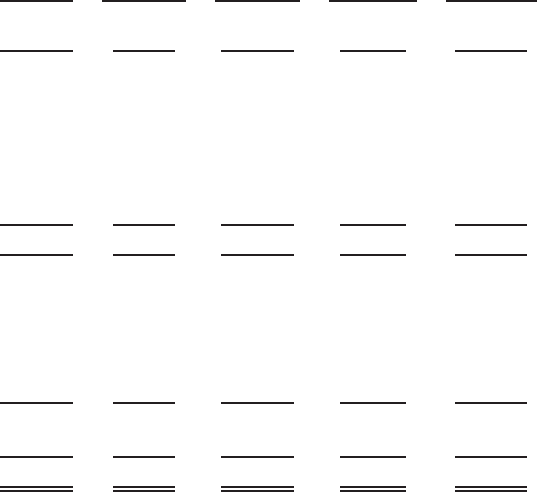

Consolidating Statement of Operations

Year Ended December 31, 2008

Parent

Company

Guarantor

Subsidiaries

Non-

Guarantor

Subsidiaries Eliminations

TWC

Consolidated

(in millions)

Revenues ......................... $ — $3,324 $ 14,050 $ (174) $ 17,200

Costs of revenues ................... — 1,783 6,536 (174) 8,145

Selling, general and administrative....... — 425 2,429 — 2,854

Depreciation ....................... — 664 2,162 — 2,826

Amortization ....................... — 1 261 — 262

Restructuring costs .................. — 4 11 — 15

Impairment of cable franchise rights ..... — 2,729 12,093 — 14,822

Loss on sale of cable systems .......... — 11 47 — 58

Total costs and expenses .............. — 5,617 23,539 (174) 28,982

Operating Loss ..................... — (2,293) (9,489) — (11,782)

Equity in pretax loss of consolidated

subsidiaries ...................... (11,531) (6,723) (1,726) 19,980 —

Interest income (expense), net .......... (504) (466) 47 — (923)

Minority interest income, net ........... — 1,227 — (205) 1,022

Other income (expense), net ........... (15) 11 (363) — (367)

Loss before income taxes ............. (12,050) (8,244) (11,531) 19,775 (12,050)

Income tax benefit .................. 4,706 3,255 3,310 (6,565) 4,706

Net loss .......................... $ (7,344) $(4,989) $ (8,221) $13,210 $ (7,344)

145

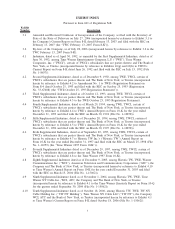

TIME WARNER CABLE INC.

SUPPLEMENTARY INFORMATION

CONDENSED CONSOLIDATING FINANCIAL STATEMENTS—(Continued)