Time Warner Cable 2008 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

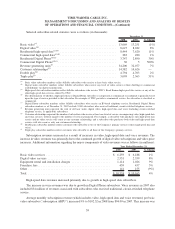

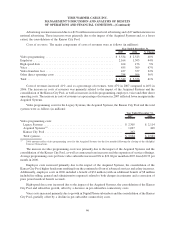

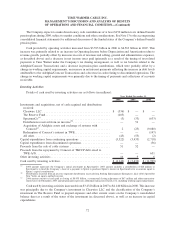

Selected subscriber-related statistics were as follows (in thousands):

2007 2006 % Change 2007 2006 % Change

Consolidated Subscribers

as of December 31,

Managed Subscribers

(a)

as of December 31,

Basic video

(b)

........................ 13,251 12,614 5% 13,251 13,402 (1%)

Digital video

(c)

....................... 8,022 6,938 16% 8,022 7,270 10%

Residential high-speed data

(d)(e)

........... 7,620 6,270 22% 7,620 6,644 15%

Commercial high-speed data

(d)(e)

.......... 280 230 22% 280 245 14%

Residential Digital Phone

(e)(f)

............ 2,890 1,719 68% 2,890 1,860 55%

Commercial Digital Phone

(e)(f)

........... 5 — NM 5 — NM

Revenue generating units

(g)

.............. 32,077 27,877 15% 32,077 29,527 9%

Customer relationships

(h)

............... 14,626 13,710 7% 14,626 14,565 —

Double play

(i)

........................ 4,703 4,406 7% 4,703 4,647 1%

Triple play

(j)

......................... 2,363 1,411 67% 2,363 1,523 55%

NM—Not meaningful.

(a)

For 2006, managed subscribers included TWC’s consolidated subscribers and subscribers in the Kansas City Pool of TKCCP, which TWC

received on January 1, 2007 in the TKCCP asset distribution. Beginning January 1, 2007, subscribers in the Kansas City Pool are included

in both managed and consolidated subscriber results as a result of the consolidation of the Kansas City Pool.

(b)

Basic video subscriber numbers reflect billable subscribers who receive at least basic video service.

(c)

Digital video subscriber numbers reflect billable subscribers who receive any level of video service at their dwelling or commercial

establishment via digital transmissions.

(d)

High-speed data subscriber numbers reflect billable subscribers who receive TWC’s Road Runner high-speed data service or any of the

other high-speed data services offered by TWC.

(e)

The determination of whether a high-speed data or Digital Phone subscriber is categorized as commercial or residential is generally based

upon the type of service provided to that subscriber. For example, if TWC provides a commercial service, the subscriber is classified as

commercial.

(f)

Digital Phone subscriber numbers reflect billable subscribers who receive an IP-based telephony service. Residential Digital Phone

subscriber numbers as of December 31, 2007 and 2006 exclude 9,000 and 106,000 subscribers, respectively, who received traditional,

circuit-switched telephone service.

(g)

Revenue generating units represent the total of all basic video, digital video, high-speed data and voice (including circuit-switched

telephone service) subscribers.

(h)

Customer relationships represent the number of subscribers who receive at least one level of service, encompassing video, high-speed data

and voice services, without regard to the number of services purchased. For example, a subscriber who purchases only high-speed data

service and no video service will count as one customer relationship, and a subscriber who purchases both video and high-speed data

services will also count as only one customer relationship.

(i)

Double play subscriber numbers reflect customers who subscribe to two of the Company’s primary services (video, high-speed data and

voice).

(j)

Triple play subscriber numbers reflect customers who subscribe to all three of the Company’s primary services.

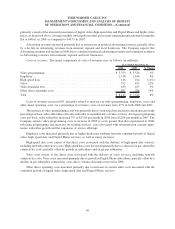

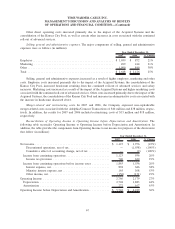

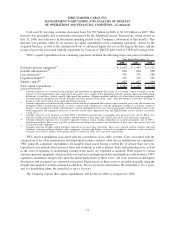

Subscription revenues increased as a result of increases in video, high-speed data and voice revenues. The

increase in video revenues was primarily due to the impact of the Acquired Systems, the consolidation of the Kansas

City Pool, the continued penetration of digital video services and video price increases. Digital video revenues

represented 23% and 22% of video revenues in 2007 and 2006, respectively.

High-speed data revenues increased primarily due to the impact of the Acquired Systems, the consolidation of

the Kansas City Pool and growth in high-speed data subscribers.

The increase in voice revenues was primarily due to growth in Digital Phone subscribers and the consolidation

of the Kansas City Pool. Voice revenues for the Acquired Systems also included revenues associated with

subscribers acquired from Comcast who received traditional, circuit-switched telephone service of $34 million

and $27 million in 2007 and 2006, respectively.

Subscription ARPU increased 5% to $94.09 in 2007 from $89.75 in 2006. This increase was primarily a result

of the increased penetration of advanced services (including digital video, high-speed data and Digital Phone) in the

Legacy Systems and higher video prices, as discussed above, partially offset by lower penetration of advanced

services in both the Acquired Systems and the Kansas City Pool as compared to the Legacy Systems.

65

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)