Time Warner Cable 2008 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6. SALE OF CERTAIN CABLE SYSTEMS

In December 2008, the Company sold a group of small cable systems, serving 78,000 basic video subscribers

and 126,000 revenue generating units as of November 30, 2008, located in areas outside of the Company’s core

geographic clusters. The sale price was $54 million, of which $3 million is included in receivables in the

consolidated balance sheet as of December 31, 2008. The Company does not expect that the sale of these systems

will have a material impact on the Company’s future financial results. The Company recorded a pretax loss of

$58 million on the sale of these systems during 2008, of which $13 million (primarily post-closing and working

capital adjustments) was recorded during the fourth quarter.

The closing of the Adelphia/Comcast Transactions, which included the Company’s acquisition from Adelphia

of certain cable systems in Mooresville, Cornelius, Davidson and unincorporated Mecklenburg County, North

Carolina, triggered a right of first refusal under the franchise agreements covering these systems. These munic-

ipalities exercised their right to acquire these systems. As a result, on December 19, 2007, these cable systems,

serving approximately 14,000 basic video subscribers and approximately 30,000 revenue generating units as of the

closing date, were sold for $52 million. The sale of these systems did not have a material impact on the Company’s

results of operations or cash flows.

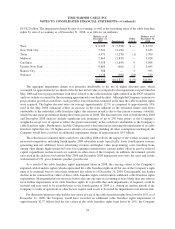

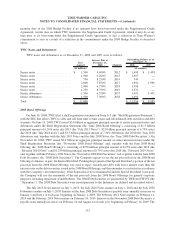

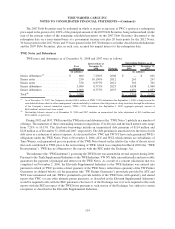

7. DEBT AND MANDATORILY REDEEMABLE PREFERRED EQUITY

Debt and mandatorily redeemable preferred equity as of December 31, 2008 and 2007 were as follows:

Interest Rate at

December 31,

2008 Maturity 2008 2007

Outstanding Balance as of

December 31,

(in millions)

Credit facilities

(a)(b)

........................... 1.353%

(c)

2011 $ 3,045 $ 5,256

TWC notes and debentures ...................... 6.752%

(c)

2012-2038 11,956 4,985

TWE notes and debentures ...................... 7.809%

(c)

2012-2033 2,714 3,326

Capital leases and other

(d)

...................... 13 10

Total debt . ................................. 17,728 13,577

TW NY Cable Preferred Membership Units ......... 8.210% 2013 300 300

Total debt and mandatorily redeemable preferred

equity . . ................................. $ 18,028 $ 13,877

(a)

TWC’s unused committed capacity was $13.130 billion as of December 31, 2008, reflecting $5.449 billion in cash and equivalents,

$5.749 billion of available borrowing capacity under the Revolving Credit Facility (which reflects a reduction of $126 million for

outstanding letters of credit backed by the Revolving Credit Facility and $125 million for commitments of LBB, as defined and discussed

below) and $1.932 billion of borrowing capacity under the 2008 Bridge Facility (excluding $138 of commitments of LBCB, as defined and

discussed below). TWC may not borrow any amounts under the 2008 Bridge Facility unless and until the Special Dividend is declared.

(b)

Outstanding balance amount as of December 31, 2007 excludes an unamortized discount on commercial paper of $5 million (none as of

December 31, 2008).

(c)

Rate represents an effective weighted-average interest rate.

(d)

Amount includes $1 million of debt due within one year as of December 31, 2008 (none as of December 31, 2007), which primarily relates

to capital lease obligations.

Credit Facilities

As of December 31, 2008, the Company has a $6.0 billion senior unsecured five-year revolving credit facility

maturing February 15, 2011 (the “Revolving Credit Facility”) and a $3.045 billion five-year term loan facility

maturing February 21, 2011 (the “Term Facility” and together with the Revolving Credit Facility, the “Facilities”).

In addition, to finance, in part, the Special Dividend, the Company has a $1.932 billion senior unsecured term loan

facility (the “2008 Bridge Facility”), under which the Company cannot borrow any amounts unless and until the

Special Dividend is declared, and a $1.535 billion senior unsecured supplemental term loan facility between the

108

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)