Time Warner Cable 2008 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Noncontrolling Interests

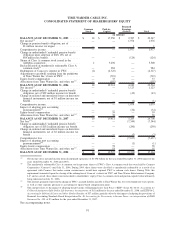

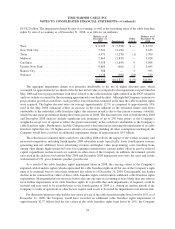

In December 2007, the FASB issued Statement No. 160, Noncontrolling Interests in Consolidated Financial

Statements—an amendment of ARB No. 51 (“FAS 160”). The provisions of FAS 160 establish accounting and

reporting standards for the noncontrolling interest in a subsidiary, including the accounting treatment upon the

deconsolidation of a subsidiary. The provisions of FAS 160 will be effective for TWC on January 1, 2009 and will be

applied prospectively, except for the provisions related to the presentation of noncontrolling interests. Beginning in

the first quarter of 2009, noncontrolling interests of $1.110 billion and $1.724 billion as of December 31, 2008 and

2007, respectively, will be reclassified to shareholders’ equity in the consolidated balance sheet. For the year ended

December 31, 2008, minority interest income of $1.022 billion, and for the years ended December 31, 2007 and

2006, minority interest expense of $165 million and $108 million, respectively, will be excluded from net income in

the consolidated statement of operations. Earnings per share for all prior periods will not be impacted.

3. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

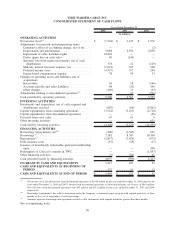

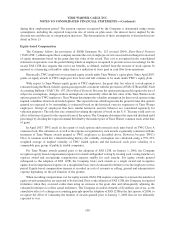

Cash and Equivalents

Cash and equivalents include money market funds, overnight deposits and other investments that are readily

convertible into cash and have original maturities of three months or less. Cash equivalents are carried at cost, which

approximates fair value.

The Company invests its cash and equivalents in a combination of money market, government and treasury

funds, as well as bank certificates of deposit, in accordance with the Company’s investment policy of diversifying its

investments and limiting the amount of its investments in a single entity or fund. Consistent with the foregoing, the

Company invested a portion of the cash proceeds of the June 2008 Bond Offering (as defined in Note 7) in The

Reserve Fund’s Primary Fund (“The Reserve Fund”). On the morning of September 15, 2008, the Company

requested a full redemption of its $490 million investment in The Reserve Fund, but the redemption request was not

honored. On September 22, 2008, The Reserve Fund announced that redemptions of shares were suspended

pursuant to a Securities and Exchange Commission (“SEC”) order requested by The Reserve Fund so that an orderly

liquidation could be effected. Through December 31, 2008, the Company has received $387 million from The

Reserve Fund representing its pro rata share of partial distributions made by The Reserve Fund. The Company has

not been informed as to when the remaining amount will be returned. However, the Company believes its remaining

receivable is recoverable. As a result of the status of The Reserve Fund, the Company has classified the remaining

$103 million receivable from The Reserve Fund as of December 31, 2008 as prepaid expenses and other current

assets in the Company’s consolidated balance sheet and within investments and acquisitions, net of cash acquired

and distributions received, in the Company’s consolidated statement of cash flows.

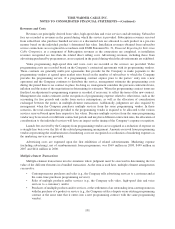

Investments

Investments in companies in which TWC has significant influence, but less than a controlling voting interest,

are accounted for using the equity method. Significant influence is generally presumed to exist when TWC owns

between 20% and 50% of the investee or holds substantial management rights.

Under the equity method of accounting, only TWC’s investment in and amounts due to and from the equity

investee are included in the consolidated balance sheet; only TWC’s share of the investee’s earnings (losses) is

included in the consolidated statement of operations; and only the dividends, cash distributions, loans or other cash

received from the investee, additional cash investments, loan repayments or other cash paid to the investee are

included in the consolidated statement of cash flows. Additionally, the carrying value of investments accounted for

using the equity method of accounting is adjusted downward to reflect any other-than-temporary declines in value.

Refer to “—Asset Impairments” below for further details.

95

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)