Time Warner Cable 2008 Annual Report Download - page 87

Download and view the complete annual report

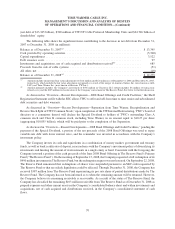

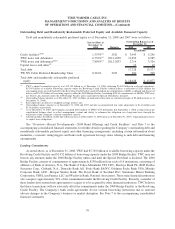

Please find page 87 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In addition, LBCB and Lehman Brothers Bank, FSB (“LBB”), subsidiaries of Lehman Brothers Holdings Inc.

(“Lehman”), are lenders under the 2008 Bridge Facility and the Revolving Credit Facility, respectively, with

undrawn commitments of $138 million and $125 million, respectively, as of December 31, 2008. On September 15,

2008, Lehman filed a petition under Chapter 11 of the U.S. Bankruptcy Code with the U.S. Bankruptcy Court for the

Southern District of New York (the “Lehman Bankruptcy”). TWC has not requested to borrow under either the 2008

Bridge Facility or the Revolving Credit Facility since the Lehman Bankruptcy, and neither LBCB nor LBB has been

placed in receivership or a similar proceeding as of February 19, 2009. While the Company believes that LBCB and

LBB are contractually obligated under the 2008 Bridge Facility and the Revolving Credit Facility, respectively, the

Company does not expect that LBCB and LBB will fund any future borrowing requests and is uncertain as to

whether another lender might assume either commitment. Accordingly, the Company’s unused committed capacity

as of December 31, 2008 excludes the undrawn commitments of LBCB and LBB. The Company believes that it

continues to have sufficient liquidity to meet its needs for the foreseeable future, including payment of the Special

Dividend, even if LBCB and/or LBB fails to fund its portion of any future borrowing requests.

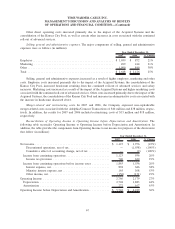

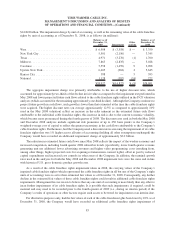

Contractual and Other Obligations

Contractual Obligations

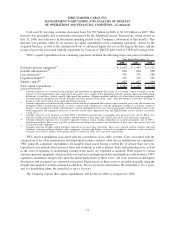

The Company has obligations under certain contractual arrangements to make future payments for goods and

services. These contractual obligations secure the future rights to various assets and services to be used in the

normal course of operations. For example, the Company is contractually committed to make certain minimum lease

payments for the use of property under operating lease agreements. In accordance with applicable accounting rules,

the future rights and obligations pertaining to firm commitments, such as operating lease obligations and certain

purchase obligations under contracts, are not reflected as assets or liabilities in the accompanying consolidated

balance sheet.

77

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)