Time Warner Cable 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

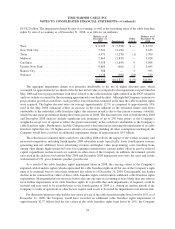

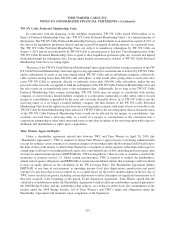

Comprehensive Income (Loss)

Comprehensive income (loss) is reported in the consolidated statement of shareholders’ equity as a component

of retained earnings (deficit) and consists of net income (loss) and other gains and losses affecting shareholders’

equity that, under GAAP, are excluded from net income (loss). For TWC, such items consist of gains and losses on

certain derivative financial instruments and changes in unfunded and underfunded benefit plan obligations. The

following summary sets forth the components of other comprehensive income (loss), net of tax, accumulated in

shareholders’ equity (in millions):

Net

Derivative

Financial

Instrument

Losses

(a)

Net

Change in

Underfunded /

Unfunded

Benefit

Obligation

Net

Accumulated

Other

Comprehensive

Loss

Balance at December 31, 2005.......................... $ — $ (7) $ (7)

2006 activity

(b)

..................................... — (123) (123)

Balance at December 31, 2006.......................... — (130) (130)

2007 activity ....................................... (1) (43) (44)

Balance at December 31, 2007.......................... (1) (173) (174)

2008 activity ....................................... (3) (290) (293)

Balance at December 31, 2008.......................... $ (4) $ (463) $ (467)

(a)

The Company uses derivative instruments to manage the risk associated with movements in foreign currency exchange rates related to

forecasted payments denominated in the Philippine peso made to vendors who provide Road Runner

TM

customer care support services.

(b)

2006 activity primarily reflects the adoption of FASB Statement No. 158, Employers’ Accounting for Defined Benefit Pension and Other

Postretirement Benefits (“FAS 158”), on December 31, 2006. Specifically, as a result of adopting FAS 158, on December 31, 2006, the

Company reflected the funded status of its plans by reducing its net pension asset by $208 million to reflect actuarial and investment losses

that had been deferred pursuant to prior pension accounting rules and recording a corresponding deferred tax asset of $84 million and a net

after-tax charge of $124 million.

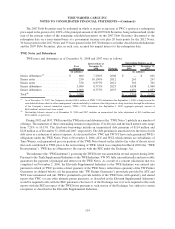

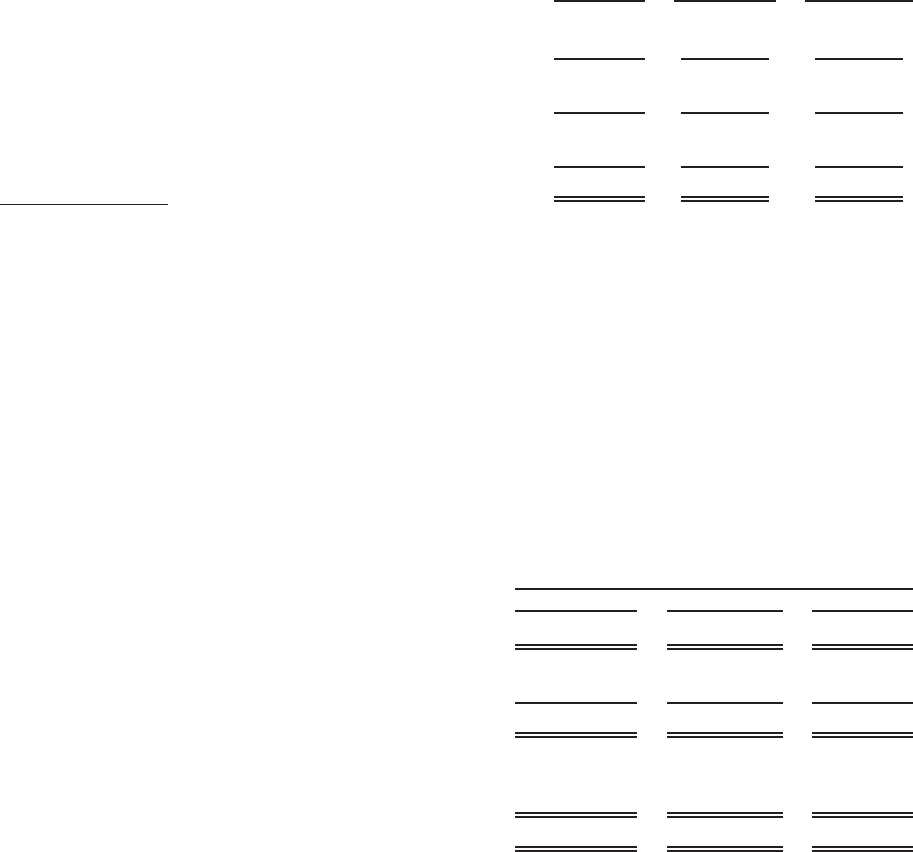

Net Income (Loss) per Common Share

Basic net income (loss) per common share is computed by dividing net income by the weighted average of

common shares outstanding during the period. Weighted-average common shares include shares of Class A

common stock and Class B common stock. Diluted net income (loss) per common share adjusts basic net income

(loss) per common share for the effects of stock options and restricted stock units only in the periods in which such

effect is dilutive. Set forth below is a reconciliation of basic and diluted net income (loss) per common share from

continuing operations (in millions, except per share data):

2008 2007 2006

Year Ended December 31,

Net income (loss) from continuing operations ........... $ (7,344) $ 1,123 $ 936

Average common shares outstanding—basic ............ 977.0 976.9 990.4

Dilutive effect of equity awards ..................... — 0.3 —

Average common shares outstanding—diluted ........... 977.0 977.2 990.4

Net income (loss) per common share from continuing

operations:

Basic ....................................... $ (7.52) $ 1.15 $ 0.95

Diluted ...................................... $ (7.52) $ 1.15 $ 0.95

105

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)