Time Warner Cable 2008 Annual Report Download - page 13

Download and view the complete annual report

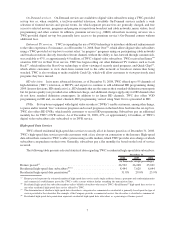

Please find page 13 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.TWC may borrow under the Supplemental Credit Agreement only to repay amounts outstanding at the final

maturity of the 2008 Bridge Facility, if any.

TWC’s obligations under the debt securities issued in the 2008 Bond Offerings and under the 2008 Bridge

Facility and the Supplemental Credit Agreement are guaranteed by TWE and TW NY. For more information about

the 2008 Bond Offerings, the 2008 Bridge Facility and the Supplemental Credit Agreement, see “Management’s

Discussion and Analysis of Results of Operations and Financial Condition—Overview—Recent Developments—

2008 Bond Offerings and Credit Facilities” and Note 7 to the accompanying consolidated financial statements.

Caution Concerning Forward-Looking Statements and Risk Factors

This Annual Report on Form 10-K includes certain “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. These statements are based on management’s current expec-

tations and beliefs and are inherently susceptible to uncertainty and changes in circumstances. Actual results may

vary materially from the expectations contained herein due to changes in economic, business, competitive,

technological, strategic and/or regulatory factors and other factors affecting the operation of TWC’s business,

including the Separation. For more detailed information about these factors, and risk factors with respect to the

Company’s operations, see Item 1A, “Risk Factors,” below and “Caution Concerning Forward-Looking State-

ments” in “Management’s Discussion and Analysis of Results of Operations and Financial Condition” in the

financial section of this report. TWC is under no obligation to, and expressly disclaims any obligation to, update or

alter its forward-looking statements, whether as a result of such changes, new information, subsequent events or

otherwise.

Available Information and Website

Although TWC and its predecessors have been in the cable business for over 40 years in various legal forms,

Time Warner Cable Inc. was incorporated as a Delaware corporation on March 21, 2003. TWC’s annual report on

Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to such reports filed

with or furnished to the Securities and Exchange Commission (“SEC”) pursuant to Section 13(a) or 15(d) of the

Exchange Act are available free of charge on the Company’s website at www.timewarnercable.com as soon as

reasonably practicable after such reports are electronically filed with the SEC.

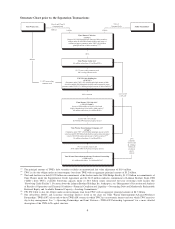

Corporate Structure

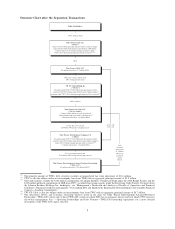

The following charts illustrate TWC’s corporate structure and its direct or indirect ownership interest in its

principal subsidiaries (i) on an actual basis as of December 31, 2008 and (ii) after giving effect to the Separation

Transactions. The subscriber numbers and RGUs, long-term debt and preferred equity balances presented below are

approximate as of December 31, 2008. Certain intermediate entities and certain preferred interests held by TWC or

subsidiaries of TWC are not reflected. The subscriber numbers and RGUs within each entity indicate the

approximate number of basic video subscribers and RGUs attributable to cable systems owned by such entity.

Basic video subscriber numbers reflect billable subscribers who receive at least TWC’s basic video service. RGUs

reflect the total of all TWC basic video, digital video, high-speed data and voice subscribers. Therefore, a subscriber

who purchases basic video, digital video, high-speed data and voice services will count as four RGUs.

3