Time Warner Cable 2008 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

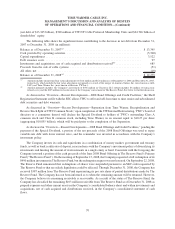

(net debt of $13.345 billion), $300 million of TW NY Cable Preferred Membership Units and $24.706 billion of

shareholders’ equity.

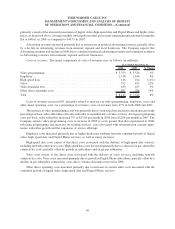

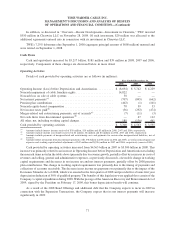

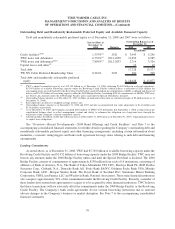

The following table shows the significant items contributing to the decrease in net debt from December 31,

2007 to December 31, 2008 (in millions):

Balance as of December 31, 2007

(a)

............................................... $ 13,345

Cash provided by operating activities............................................... (5,300)

Capital expenditures ........................................................... 3,522

Debt issuance costs ............................................................ 97

Investments and acquisitions, net of cash acquired and distributions received

(b)

................ 685

Proceeds from the sale of cable systems ............................................ (51)

All other, net . . . ............................................................. (19)

Balance as of December 31, 2008

(a)

............................................... $ 12,279

(a)

Amounts include unamortized fair value adjustments of $114 million and $126 million as of December 31, 2008 and December 31, 2007,

respectively, which include the fair value adjustment recognized as a result of the merger of America Online, Inc. (now known as AOL

LLC) and Time Warner Inc. (now known as Historic TW Inc.).

(b)

Amount primarily includes the Company’s investment of $536 million in Clearwire LLC (which includes $6 million of transaction-

related costs) and the $103 million reclassification of the Company’s investment in The Reserve Fund. See below for further discussion.

As discussed in “Overview—Recent Developments—2008 Bond Offerings and Credit Facilities,” the Shelf

Registration Statement on file with the SEC allows TWC to offer and sell from time to time senior and subordinated

debt securities and debt warrants.

As discussed in “Overview—Recent Developments—Separation from Time Warner, Recapitalization and

Reverse Stock Split of TWC Common Stock,” upon completion of the TW Internal Restructuring, TWC’s board of

directors or a committee thereof will declare the Special Dividend to holders of TWC’s outstanding Class A

common stock and Class B common stock, including Time Warner, in an amount equal to $10.27 per share

(aggregating $10.855 billion), which will be paid prior to the completion of the Separation.

As discussed in “Overview—Recent Developments—2008 Bond Offerings and Credit Facilities,” pending the

payment of the Special Dividend, a portion of the net proceeds of the 2008 Bond Offerings was used to repay

variable-rate debt with lower interest rates, and the remainder was invested in accordance with the Company’s

investment policy.

The Company invests its cash and equivalents in a combination of money market, government and treasury

funds, as well as bank certificates of deposit, in accordance with the Company’s investment policy of diversifying its

investments and limiting the amount of its investments in a single entity or fund. Consistent with the foregoing, the

Company invested a portion of the cash proceeds of the June 2008 Bond Offering in The Reserve Fund’s Primary

Fund (“The Reserve Fund”). On the morning of September 15, 2008, the Company requested a full redemption of its

$490 million investment in The Reserve Fund, but the redemption request was not honored. On September 22, 2008,

The Reserve Fund announced that redemptions of shares were suspended pursuant to an SEC order requested by

The Reserve Fund so that an orderly liquidation could be effected. Through December 31, 2008, the Company has

received $387 million from The Reserve Fund representing its pro rata share of partial distributions made by The

Reserve Fund. The Company has not been informed as to when the remaining amount will be returned. However,

the Company believes its remaining receivable is recoverable. As a result of the status of The Reserve Fund, the

Company has classified the remaining $103 million receivable from The Reserve Fund as of December 31, 2008 as

prepaid expenses and other current assets in the Company’s consolidated balance sheet and within investments and

acquisitions, net of cash acquired and distributions received, in the Company’s consolidated statement of cash

flows.

70

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)