Time Warner Cable 2008 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

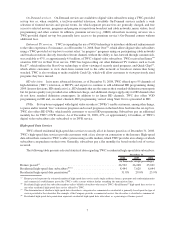

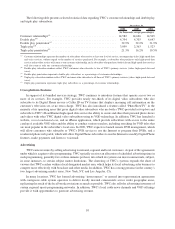

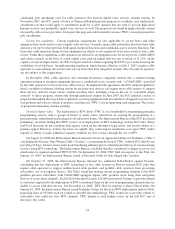

The following table presents selected statistical data regarding TWC’s customer relationships and double play

and triple play subscribers:

2008 2007 2006

December 31,

(in thousands, except percentages)

Customer relationships

(a)

........................................ 14,582 14,626 14,565

Double play

(b)

................................................ 4,794 4,703 4,647

Double play penetration

(c)

....................................... 32.9% 32.2% 31.9%

Triple play

(d)

................................................. 3,099 2,363 1,523

Triple play penetration

(e)

........................................ 21.3% 16.2% 10.5%

(a)

Customer relationships represent the number of subscribers who receive at least one level of service, encompassing video, high-speed data

and voice services, without regard to the number of services purchased. For example, a subscriber who purchases only high-speed data

service and no video service will count as one customer relationship, and a subscriber who purchases both video and high-speed data services

will also count as only one customer relationship.

(b)

Double play subscriber numbers reflect TWC customers who subscribe to two of TWC’s primary services (video, high-speed data and

voice).

(c)

Double play penetration represents double play subscribers as a percentage of customer relationships.

(d)

Triple play subscriber numbers reflect TWC customers who subscribe to all three of TWC’s primary services (video, high-speed data and

voice).

(e)

Triple play penetration represents triple play subscribers as a percentage of customer relationships.

Cross-platform Features

In support of its bundled services strategy, TWC continues to introduce features that operate across two or

more of its services. For example, TWC provides nearly two-thirds of its digital video subscribers who also

subscribe to its Digital Phone service a Caller ID on TV feature that displays incoming call information on the

customer’s television set, at no extra charge. TWC has also introduced a feature called “PhotoShowTV” in the

majority of its operating areas that gives digital video subscribers who use both a TWC-provided set-top box and

subscribe to TWC’s Road Runner high-speed data service the ability to create and share their personal photo shows

and videos with other TWC digital video subscribers using its VOD technology. In addition, TWC has launched a

website, www.twondemand.com, and an iPhone application, which provide subscribers with access to the entire

catalog of available VOD titles and the ability to conduct various searches, including searching for VOD titles that

are most popular in the subscriber’s local area. In 2009, TWC expects to launch remote DVR management, which

will allow customers who subscribe to TWC’s DVR service to use the Internet to program their DVRs, and a

residential phone web portal, which will allow Digital Phone subscribers to use the Internet to modify Digital Phone

features, make payments and listen to voicemail.

Advertising

TWC earns revenues by selling advertising to national, regional and local customers. As part of the agreements

under which it acquires video programming, TWC typically receives an allocation of scheduled advertising time in

such programming, generally two or three minutes per hour, into which its systems can insert commercials, subject,

in some instances, to certain subject matter limitations. The clustering of TWC’s systems expands the share of

viewers that TWC reaches within a local designated market area, which helps its local advertising sales business to

compete more effectively with broadcast and other media. In addition, TWC has a strong presence in the country’s

two largest advertising market areas, New York, NY, and Los Angeles, CA.

In many locations, TWC has formed advertising “interconnects” or entered into representation agreements

with contiguous cable system operators to deliver locally inserted commercials across wider geographic areas,

replicating the reach of the local broadcast stations as much as possible. TWC also sells the advertising inventory of

certain regional sports programming networks. In addition, TWC’s local cable news channels and VOD offerings

provide it with opportunities to generate advertising revenue.

10