Time Warner Cable 2008 Annual Report Download - page 103

Download and view the complete annual report

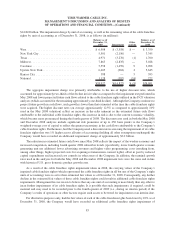

Please find page 103 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Discontinued Operations. As discussed more fully in Note 5, the Company has reflected the financial

position, results of operations and cash flows of the Transferred Systems (as defined in Note 5) as discontinued

operations for all periods presented.

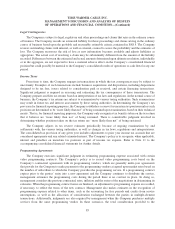

Basis of Consolidation

The consolidated financial statements include 100% of the assets, liabilities, revenues, expenses and cash

flows of TWC and all entities in which TWC has a controlling voting interest, as well as allocations of certain Time

Warner corporate costs deemed reasonable by management to present the Company’s consolidated results of

operations, financial position, changes in equity and cash flows on a stand-alone basis. The Time Warner corporate

costs include specified administrative services, including selected tax, human resources, legal, information

technology, treasury, financial, public policy and corporate and investor relations services, and approximate Time

Warner’s estimated cost for services rendered. In accordance with Financial Accounting Standards Board (“FASB”)

Interpretation No. 46 (revised 2003), Consolidation of Variable Interest Entities—an interpretation of ARB No. 51,

the consolidated financial statements include the results of Time Warner Entertainment-Advance/Newhouse

Partnership (“TWE-A/N”) only for the systems that are controlled by TWC and for which TWC holds an economic

interest. Intercompany accounts and transactions between consolidated companies have been eliminated in

consolidation.

Use of Estimates

The preparation of financial statements in conformity with U.S. generally accepted accounting principles

(“GAAP”) requires management to make estimates, judgments and assumptions that affect the amounts reported in

the consolidated financial statements and footnotes thereto. Actual results could differ from those estimates.

Significant estimates inherent in the preparation of the consolidated financial statements include accounting

for asset impairments, allowances for doubtful accounts, investments, depreciation and amortization, business

combinations, pension benefits, equity-based compensation, income taxes, contingencies and certain programming

arrangements. Allocation methodologies used to prepare the consolidated financial statements are based on

estimates and have been described in the notes, where appropriate.

Reclassifications

Certain reclassifications have been made to the prior years’ financial information to conform to the Decem-

ber 31, 2008 presentation.

2. RECENT ACCOUNTING STANDARDS

Accounting Standards Adopted in 2008

Consideration Given by a Service Provider to Manufacturers or Resellers of Equipment

On January 1, 2008, the Company adopted the provisions of Emerging Issues Task Force (“EITF”)

Issue No. 06-1, Accounting for Consideration Given by a Service Provider to Manufacturers or Resellers of

Equipment Necessary for an End-Customer to Receive Service from the Service Provider (“EITF 06-1”). EITF 06-1

provides that consideration provided to the manufacturers or resellers of specialized equipment should be accounted

for as a reduction of revenue if the consideration provided is in the form of cash and the service provider directs that

such cash be provided directly to the customer. Otherwise, the consideration should be recorded as an expense. The

adoption of the provisions of EITF 06-1 did not have a material impact on the Company’s consolidated financial

statements.

93

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)