Time Warner Cable 2008 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

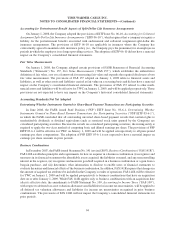

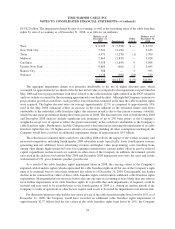

$14.822 billion. The impairment charge by unit of accounting, as well as the remaining value of the cable franchise

rights by unit of accounting as of December 31, 2008, is as follows (in millions):

Balance as of

December 31,

2007 Impairment

Other

Activity

Balance as of

December 31,

2008

West........................................ $ 6,908 $ (3,558) $ — $ 3,350

New York City ................................ 5,501 (2,156) — 3,345

Texas....................................... 4,971 (3,270) (1) 1,700

Midwest ..................................... 7,863 (2,835) — 5,028

Carolinas .................................... 5,558 (1,659) 9 3,908

Upstate New York.............................. 6,605 (962) 2 5,645

Kansas City .................................. 388 — 5 393

National ..................................... 1,128 (382) (24) 722

$38,922 $(14,822) $ (9) $24,091

The aggregate impairment charge was primarily attributable to the use of higher discount rates, which

accounted for approximately two-thirds of the decline in fair value as compared to the impairment test performed in

May 2008 and lower projected future cash flows related to the cable franchise rights utilized in the DCF valuation

analyses (which accounted for the remaining approximately one-third decline). Although the Company continues to

project future growth in cash flows, such growth is lower than that estimated at the time the cable franchise rights

were acquired. The higher discount rates (on average approximately 12.5% as compared to approximately 10%

used in the May 2008 valuation) reflect an increase in the risks inherent in the estimated future cash flows

attributable to the individual cable franchise rights; this increase in risk is due to the current economic volatility,

which became more pronounced during the fourth quarter of 2008. The discount rates used in both the May 2008

and December 2008 analyses include significant risk premiums of up to 250 basis points to the Company’s

weighted-average cost of capital to reflect the greater uncertainty in the cash flows attributable to the Company’s

cable franchise rights. Furthermore, had the Company used a discount rate in assessing the impairment of its cable

franchise rights that was 1% higher across all units of accounting (holding all other assumptions unchanged) the

Company would have recorded an additional impairment charge of approximately $3.0 billion.

The reduction in estimated future cash flows since May 2008 reflects the impact of the weaker economy and

increased competition, including fourth quarter 2008 subscriber trends (specifically, lower fourth quarter revenue

generating unit net additions) lower advertising revenues and higher video programming costs (resulting from,

among other things, higher projected costs for acquiring retransmission consent rights) offset in part by reduced

capital expenditures and increased cost controls in other areas of the Company. In addition, the terminal growth

rates used in the analyses for both the May 2008 and December 2008 impairment tests were the same and in line

with historical U.S. gross domestic product growth rates.

As a result of the cable franchise rights impairment taken in 2008, the carrying values of the Company’s

impaired cable franchise rights (which represented the cable franchise rights in all but one of the Company’s eight

units of accounting) were re-set to their estimated fair values as of December 31, 2008. Consequently, any further

decline in the estimated fair values of these cable franchise rights could result in additional cable franchise rights

impairments. Management has no reason to believe that any one unit of accounting is more likely than any other to

incur further impairments of its cable franchise rights. It is possible that such impairments, if required, could be

material and may need to be recorded prior to the fourth quarter of 2009 (i.e., during an interim period) if the

Company’s results of operations or other factors require such assets to be tested for impairment at an interim date.

For illustrative purposes only, had the fair values of each of the cable franchise rights been lower by 10% as of

December 31, 2008, the Company would have recorded an additional cable franchise rights impairment of

approximately $2.37 billion; had the fair values of the cable franchise rights been lower by 20%, the Company

98

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)