Time Warner Cable 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

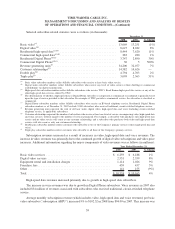

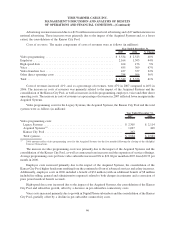

Selling, general and administrative expenses. The major components of selling, general and administrative

expenses were as follows (in millions):

2008 2007 % Change

Year Ended December 31,

Employee .................................................. $ 1,146 $ 1,059 8%

Marketing ................................................. 569 499 14%

Other . .................................................... 1,139 1,090 4%

Total . .................................................... $ 2,854 $ 2,648 8%

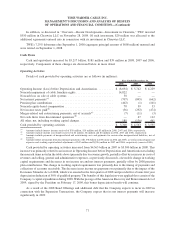

Selling, general and administrative expenses increased primarily due to higher employee and marketing costs.

Employee costs increased primarily due to headcount and salary increases and marketing costs increased primarily

due to intensified marketing efforts. Other costs in 2008 included a benefit of approximately $16 million due to

changes in estimates of previously established casualty insurance accruals. Excluding this benefit, other costs

increased primarily due to higher miscellaneous administrative costs.

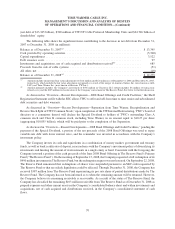

Merger-related and restructuring costs. The results for 2008 and 2007 included restructuring costs of

$15 million and $13 million, respectively. In addition, during 2007, the Company expensed non-capitalizable

merger-related costs associated with the 2006 transactions with Adelphia Communications Corporation (“Adel-

phia”) and Comcast (the “Adelphia/Comcast Transactions”) of $10 million. Beginning in the first quarter of 2009,

TWC is undertaking a significant restructuring, primarily consisting of headcount reductions, and expects to incur

restructuring charges ranging from approximately $50 million to $100 million during 2009.

Impairment of cable franchise rights. During the fourth quarter of 2008, the Company recorded a noncash

impairment of $14.822 billion to reduce the carrying value of its cable franchise rights as a result of its annual

impairment testing of goodwill and indefinite-lived intangible assets. See “Critical Accounting Policies—Asset

Impairments—Goodwill and Indefinite-lived Intangible Assets” for further details.

Loss on sale of cable systems. During 2008, the Company recorded a loss of $58 million as a result of the sale

of certain non-core cable systems, which closed in December 2008. See “Overview—Recent Developments—Sale

of Certain Cable Systems” for further details.

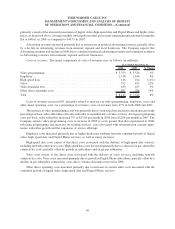

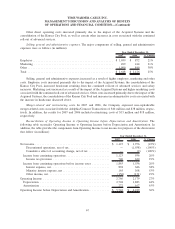

Reconciliation of Operating Income (Loss) to Operating Income (Loss) before Depreciation and Amortization. The

following table reconciles Operating Income (Loss) to Operating Income (Loss) before Depreciation and Amortization.

In addition, the table provides the components from Operating Income (Loss) to net income (loss) for purposes of the

discussions that follow (in millions):

2008 2007 % Change

Year Ended December 31,

Net income (loss) ........................................... $ (7,344) $ 1,123 NM

Income tax provision (benefit) .............................. (4,706) 740 NM

Income (loss) before income taxes ............................. (12,050) 1,863 NM

Interest expense, net ...................................... 923 894 3%

Minority interest expense (income), net........................ (1,022) 165 NM

Other expense (income), net ................................ 367 (156) NM

Operating Income (Loss) ...................................... (11,782) 2,766 NM

Depreciation ............................................. 2,826 2,704 5%

Amortization ............................................. 262 272 (4%)

Operating Income (Loss) before Depreciation and Amortization ......... $ (8,694) $ 5,742 NM

NM—Not meaningful.

61

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)