Time Warner Cable 2008 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

maturity date of the 2008 Bridge Facility if no amounts have been borrowed under the Supplemental Credit

Agreement, (ii) the date on which TWC terminates the Supplemental Credit Agreement, which it may do at any

time prior to its borrowing under the Supplemental Credit Agreement, or (iii) a reduction in Time Warner’s

commitment to zero as a result of a reduction in the commitments under the 2008 Bridge Facility as described

above.

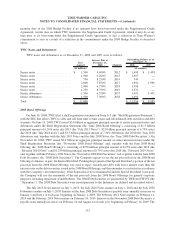

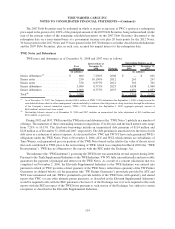

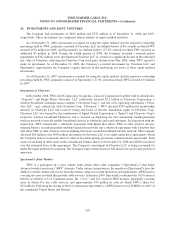

TWC Notes and Debentures

TWC notes and debentures as of December 31, 2008 and 2007 were as follows:

Face

Amount

Interest Rate at

December 31,

2008 Maturity 2008 2007

Outstanding Balance as of

December 31,

(in millions) (in millions)

Senior notes ...................... $ 1,500 5.400% 2012 $ 1,498 $ 1,498

Senior notes ...................... 1,500 6.200% 2013 1,497 —

Senior notes ...................... 750 8.250% 2014 749 —

Senior notes ...................... 2,000 5.850% 2017 1,996 1,996

Senior notes ...................... 2,000 6.750% 2018 1,998 —

Senior notes ...................... 1,250 8.750% 2019 1,231 —

Senior debentures .................. 1,500 6.550% 2037 1,491 1,491

Senior debentures .................. 1,500 7.300% 2038 1,496 —

Total ........................... $ 12,000 $ 11,956 $ 4,985

2008 Bond Offerings

On June 16, 2008, TWC filed a shelf registration statement on Form S-3 (the “Shelf Registration Statement”)

with the SEC that allows TWC to offer and sell from time to time senior and subordinated debt securities and debt

warrants. On June 19, 2008, TWC issued $5.0 billion in aggregate principal amount of senior unsecured notes and

debentures under the Shelf Registration Statement (the “June 2008 Bond Offering”), consisting of $1.5 billion

principal amount of 6.20% notes due 2013 (the “July 2013 Notes”), $2.0 billion principal amount of 6.75% notes

due 2018 (the “July 2018 notes”) and $1.5 billion principal amount of 7.30% debentures due 2038 (the “July 2038

debentures and, together with the July 2013 Notes and the July 2018 Notes, the “June 2008 Debt Securities”). On

November 18, 2008, TWC issued $2.0 billion in aggregate principal amount of senior unsecured notes under the

Shelf Registration Statement (the “November 2008 Bond Offering” and, together with the June 2008 Bond

Offering, the “2008 Bond Offerings”), consisting of $750 million principal amount of 8.25% notes due 2014 (the

“February 2014 Notes”) and $1.250 billion principal amount of 8.75% notes due 2019 (the “February 2019 Notes”

and, together with the February 2014 Notes, the “November 2008 Debt Securities” and, together with the June 2008

Debt Securities, the “2008 Debt Securities”). The Company expects to use the net proceeds from the 2008 Bond

Offerings to finance, in part, the Special Dividend. Pending the payment of the Special Dividend, a portion of the net

proceeds from the 2008 Bond Offerings was used to repay variable-rate debt with lower interest rates than the

interest rates on the debt securities issued in the 2008 Bond Offerings, and the remainder was invested in accordance

with the Company’s investment policy. If the Separation is not consummated and the Special Dividend is not paid,

the Company will use the remainder of the net proceeds from the 2008 Bond Offerings for general corporate

purposes, including repayment of indebtedness. The 2008 Debt Securities are guaranteed by TWE and TW NY (the

“Guarantors”). The 2008 Debt Securities were issued pursuant to the Indenture (as defined and described below).

The July 2013 Notes mature on July 1, 2013, the July 2018 Notes mature on July 1, 2018 and the July 2038

Debentures mature on July 1, 2038. Interest on the June 2008 Debt Securities is payable semi-annually in arrears on

January 1 and July 1 of each year, beginning on January 1, 2009. The February 2014 Notes mature on February 14,

2014 and the February 2019 Notes mature on February 14, 2019. Interest on the November 2008 Debt Securities is

payable semi-annually in arrears on February 14 and August 14 of each year, beginning on February 14, 2009. The

112

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)