Time Warner Cable 2008 Annual Report Download - page 62

Download and view the complete annual report

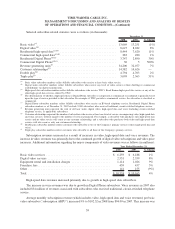

Please find page 62 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.slowdown in growth across all revenue generating unit categories, which the Company believes is partly a result of

the challenging economic environment and a general reduction in consumer spending. The Company believes it is

premature to determine if this is a long- or short-term development and that the impact of a protracted economic

downturn on its financial and subscriber results is difficult to estimate; however, the Company believes that growth

in revenue generating unit net additions, as well as growth in other digital services (e.g., digital video recorders and

video-on-demand), will slow in 2009 as compared to 2008. In addition, the Company has continued to see a decline

in its Advertising revenues from national, regional and local businesses, which it expects to continue in 2009.

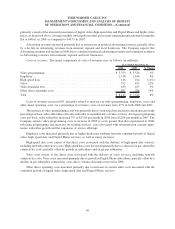

Excluding the $14.822 billion noncash impairment of cable franchise rights and the $58 million loss on sale of

certain cable systems (as discussed below), the Company expects that its year-over-year growth rate in Operating

Income will be lower in 2009 (as compared to the same measure in 2008) as a result of, among other things, slower

growth in revenues and higher video programming costs, pension expense and restructuring charges, partially offset

by various cost saving initiatives. The Company also expects that capital expenditures will decline in 2009 as

compared to 2008.

Despite the current economic environment, the Company believes it continues to have strong liquidity to meet its

needs for the foreseeable future. As of December 31, 2008, the Company had $13.130 billion of unused committed

capacity (including cash and equivalents and credit facilities containing commitments from a geographically diverse

group of major financial institutions), $10.855 billion of which TWC expects to use to finance the Special Dividend

(as defined below). Additionally, there are no significant maturities of the Company’s long-term debt prior to February

2011. See “Financial Condition and Liquidity” for further details regarding the Company’s committed capacity.

Beginning in the first quarter of 2009, TWC is undertaking a significant restructuring, primarily consisting of

headcount reductions, and expects to incur restructuring charges ranging from approximately $50 million to

$100 million during 2009.

Recent Developments

Impairment of Cable Franchise Rights

As discussed in more detail in “Critical Accounting Policies—Asset Impairments—Goodwill and Indefinite-

lived Intangible Assets,” during the fourth quarter of 2008, the Company recorded a noncash impairment of

$14.822 billion to reduce the carrying value of its cable franchise rights as a result of its annual impairment testing

of goodwill and indefinite-lived intangible assets.

Separation from Time Warner, Recapitalization and Reverse Stock Split of TWC Common Stock

On May 20, 2008, TWC and its subsidiaries, TWE and TW NY, entered into the Separation Agreement with

Time Warner and its subsidiaries, WCI, Historic TW and ATC. TWC’s separation from Time Warner will take place

through a series of related transactions, the occurrence of each of which is a condition to the next. First, Time

Warner will complete certain internal restructuring transactions not affecting TWC. Next, following the satisfaction

or waiver of certain conditions, including those mentioned below, Historic TW will transfer its 12.43% non-voting

common stock interest in TW NY to TWC in exchange for 80 million newly issued shares of TWC’s Class A

common stock (the “TW NY Exchange”). Following the TW NY Exchange, Time Warner will complete certain

additional restructuring steps that will make Time Warner the direct owner of all shares of TWC’s Class A common

stock and Class B common stock previously held by its subsidiaries (all of Time Warner’s restructuring transaction

steps being referred to collectively as the “TW Internal Restructuring”). Upon completion of the TW Internal

Restructuring, TWC’s board of directors or a committee thereof will declare a special cash dividend to holders of

TWC’s outstanding Class A common stock and Class B common stock, including Time Warner, in an amount equal

to $10.27 per share (aggregating $10.855 billion) (the “Special Dividend”). The Special Dividend will be paid prior

to the completion of TWC’s separation from Time Warner. Following the receipt by Time Warner of its share of the

Special Dividend, TWC will file with the Secretary of State of the State of Delaware an amended and restated

52

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)