Time Warner Cable 2008 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.during their employment period. The pension expense recognized by the Company is determined using certain

assumptions, including the expected long-term rate of return on plan assets, the interest factor implied by the

discount rate and the rate of compensation increases. The determination of these assumptions is discussed in more

detail in Note 13.

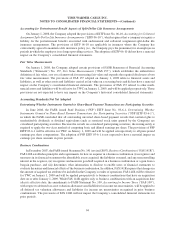

Equity-based Compensation

The Company follows the provisions of FASB Statement No. 123 (revised 2004), Share-Based Payment

(“FAS 123R”), which require that a company measure the cost of employee services received in exchange for an award

of equity instruments based on the grant date fair value of the award. That cost is recognized in the consolidated

statement of operations over the period during which an employee is required to provide service in exchange for the

award. FAS 123R also requires that excess tax benefits, as defined, realized from the exercise of stock options be

reported as a financing cash inflow rather than as a reduction of taxes paid in cash flow from operations.

Historically, TWC employees were granted equity awards under Time Warner’s equity plans. Since April 2007,

grants of equity awards to TWC employees have been and will continue to be made under TWC’s equity plans.

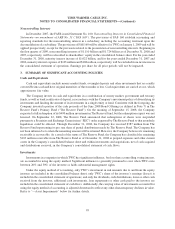

With respect to Time Warner equity grants to TWC employees, the grant date fair value of a stock option is

estimated using the Black-Scholes option-pricing model, consistent with the provisions of FAS 123R and SEC Staff

Accounting Bulletin (“SAB”) No. 107, Share-Based Payment. Because the option-pricing model requires the use of

subjective assumptions, changes in these assumptions can materially affect the fair value of the Time Warner stock

options granted to TWC employees. Time Warner determines the volatility assumption for these stock options using

implied volatilities data from its traded options. The expected term, which represents the period of time that options

granted are expected to be outstanding, is estimated based on the historical exercise experience of Time Warner

employees. Groups of employees that have similar historical exercise behavior are considered separately for

valuation purposes. The risk-free rate assumed in valuing the options is based on the U.S. Treasury yield curve in

effect at the time of grant for the expected term of the option. The Company determines the expected dividend yield

percentage by dividing the expected annual dividend by the market price of Time Warner common stock at the date

of grant.

In April 2007, TWC made its first grant of stock options and restricted stock units based on TWC Class A

common stock. The valuation of, as well as the expense recognition for, such awards is generally consistent with the

treatment of Time Warner awards granted to TWC employees as described above. However, because TWC’s

Class A common stock has a limited trading history, the volatility assumption was calculated using a 75%-25%

weighted average of implied volatility of TWC traded options and the historical stock price volatility of a

comparable peer group of publicly traded companies.

For Time Warner awards granted prior to the adoption of FAS 123R on January 1, 2006, the Company

recognizes equity-based compensation expense for awards with graded vesting by treating each vesting tranche as a

separate award and recognizing compensation expense ratably for each tranche. For equity awards granted

subsequent to the adoption of FAS 123R, the Company treats such awards as a single award and recognizes

equity-based compensation expense on a straight-line basis (net of estimated forfeitures) over the employee service

period. Equity-based compensation expense is recorded in costs of revenues or selling, general and administrative

expense depending on the job function of the grantee.

When recording compensation cost for equity awards, FAS 123R requires companies to estimate the number of

equity awards granted that are expected to be forfeited. Prior to the adoption of FAS 123R, the Company recognized

forfeitures when they occurred, rather than using an estimate at the grant date and subsequently adjusting the

estimated forfeitures to reflect actual forfeitures. The Company recorded a benefit of $2 million, net of tax, as the

cumulative effect of a change in accounting principle upon the adoption of FAS 123R in the first quarter of 2006, to

recognize the effect of estimating the number of awards granted prior to January 1, 2006 that are not ultimately

expected to vest.

100

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)