Time Warner Cable 2008 Annual Report Download - page 79

Download and view the complete annual report

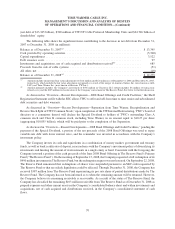

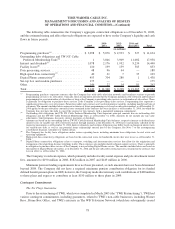

Please find page 79 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operations. In 2006, the Company recognized pretax income applicable to these systems of $285 million

($1.038 billion, net of a tax benefit). Included in the 2006 results were a pretax gain of $165 million on the

systems transferred to Comcast in connection with the Adelphia/Comcast Transactions and a net tax benefit of

$800 million comprised of a tax benefit of $814 million on the redemption of Comcast’s interest in TWC and TWE,

partially offset by a provision of $14 million on the exchange of cable systems with Comcast in connection with the

Adelphia/Comcast Transactions. The tax benefit of $814 million resulted primarily from the reversal of historical

deferred tax liabilities that had existed on systems transferred to Comcast in the redemption of Comcast’s interest in

TWC. The redemption of Comcast’s interest in TWC was designed to qualify as a tax-free split-off under

section 355 of the Internal Revenue Code of 1986, as amended, and, as a result, such liabilities were no longer

required. However, if the Internal Revenue Service were successful in challenging the tax-free characterization of

the redemption of Comcast’s interest in TWC, an additional cash liability on account of taxes of up to an estimated

$900 million could become payable by the Company.

Cumulative effect of accounting change, net of tax. In 2006, the Company recorded a benefit of $2 million, net

of tax, as the cumulative effect of a change in accounting principle upon the adoption of Financial Accounting

Standards Board (“FASB”) Statement of Financial Accounting Standards (“Statement”) No. 123 (revised 2004),

Share-Based Payment (“FAS 123R”) to recognize the effect of estimating the number of Time Warner equity-based

awards granted to TWC employees prior to January 1, 2006 that are not ultimately expected to vest.

Net income and net income per common share. Net income was $1.123 billion in 2007 compared to

$1.976 billion in 2006. Basic and diluted net income per common share were $1.15 in 2007 compared to

$2.00 in 2006.

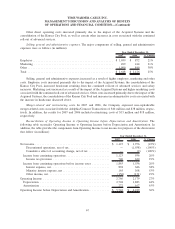

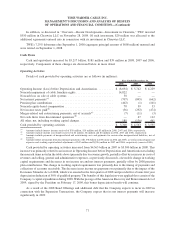

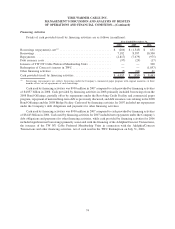

FINANCIAL CONDITION AND LIQUIDITY

Management believes that cash generated by or available to TWC should be sufficient to fund its capital and

liquidity needs for the foreseeable future, including the expected payment of $10.855 billion for the Special

Dividend. There are no significant maturities of the Company’s long-term debt prior to February 2011. TWC’s

sources of cash include cash provided by operating activities, cash and equivalents on hand, borrowing capacity

under its committed credit facilities (including the 2008 Bridge Facility, under which TWC may not borrow any

amounts unless and until the Special Dividend is declared) and commercial paper program, as well as access to

capital markets.

TWC’s unused committed capacity was $13.130 billion as of December 31, 2008, reflecting $5.449 billion of

cash and equivalents, $5.749 billion of available borrowing capacity under the Company’s $6.0 billion senior

unsecured five-year revolving credit facility (the “Revolving Credit Facility”) and $1.932 billion of borrowing

capacity under the 2008 Bridge Facility. TWC may not borrow any amounts under the 2008 Bridge Facility unless

and until the Special Dividend is declared. Borrowings under the Supplemental Credit Agreement are only available

to the Company at the final maturity of the 2008 Bridge Facility to repay amounts then outstanding under the 2008

Bridge Facility, if any, and are not included in TWC’s unused committed capacity. See “—Outstanding Debt and

Mandatorily Redeemable Preferred Equity and Available Financial Capacity—Lending Commitments” below for a

discussion regarding the Company’s decision to exclude funding commitments from subsidiaries of Lehman

Brothers Holdings Inc. in determining the amount of its unused committed capacity.

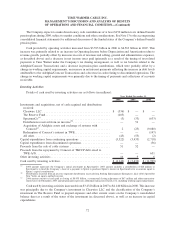

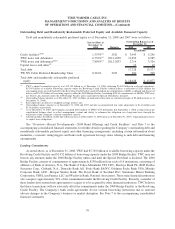

Current Financial Condition

As of December 31, 2008, the Company had $17.728 billion of debt, $5.449 billion of cash and equivalents (net

debt of $12.279 billion, defined as total debt less cash and equivalents), $300 million of mandatorily redeemable

non-voting Series A Preferred Equity Membership Units (the “TW NY Cable Preferred Membership Units”) issued

by a subsidiary of TWC, Time Warner NY Cable LLC (“TW NY Cable”), and $17.164 billion of shareholders’

equity. As of December 31, 2007, the Company had $13.577 billion of debt, $232 million of cash and equivalents

69

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)