Time Warner Cable 2008 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

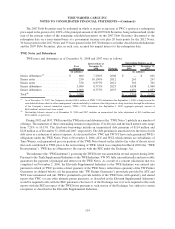

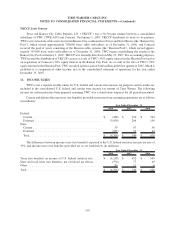

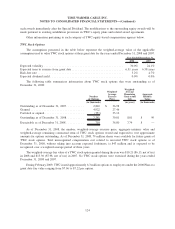

The following table sets forth the calculation of the TW Leverage Ratio for the year ended December 31, 2008

(in millions, except ratio):

Total debt as defined by the Shareholder Agreement, as amended ...................... $ 10,798

TW NY Cable Preferred Membership Units ...................................... 300

Six times annual rental expense ............................................... 1,140

Total ................................................................. $ 12,238

EBITDAR ............................................................... $ 6,376

TW Leverage Ratio ........................................................ 1.92x

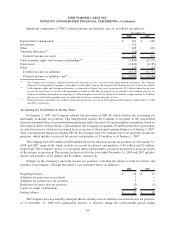

Debt Issuance Costs

For the year ended December 31, 2008, the Company capitalized debt issuance costs of $97 million in

connection with the 2008 Bridge Facility and the 2008 Bond Offerings. For the year ended December 31, 2007, the

Company capitalized debt issuance costs of $29 million in connection with the 2007 Bond Offering. These

capitalized costs are amortized over the term of the related debt instrument and are included as a component of

interest expense, net, in the consolidated statement of operations. For the year ended December 31, 2008, the

Company expensed $45 million of debt issuance costs due primarily to the reduction of the commitments under the

2008 Bridge Facility as a result of the 2008 Bond Offerings, which is included as a component of interest expense,

net, in the consolidated statement of operations.

Maturities

Annual maturities of long-term debt and mandatorily redeemable preferred equity total $1 million in 2009, $0

in 2010, $3.046 billion in 2011, $2.108 billion in 2012, $1.801 billion in 2013 and $11.002 billion thereafter.

Fair Value of Debt

Based on the level of interest rates prevailing at December 31, 2008 and 2007, the carrying value of TWC’s

debt and the TW NY Cable Preferred Membership Units exceeded the fair value by approximately $540 million as

of December 31, 2008 and the fair value exceeded the carrying value by approximately $420 million as of

December 31, 2007. Unrealized gains or losses on debt do not result in the realization or expenditure of cash and are

not recognized for financial reporting purposes unless the debt is retired prior to its maturity.

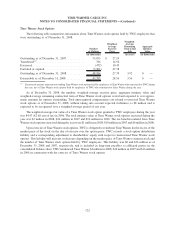

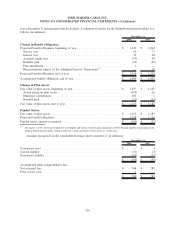

8. MERGER-RELATED AND RESTRUCTURING COSTS

Merger-related Costs

Cumulatively, through December 31, 2007, the Company expensed non-capitalizable merger-related costs

associated with the Adelphia/Comcast Transactions of $56 million, of which $10 million and $38 million was

incurred during the years ended December 31, 2007 and 2006, respectively.

As of December 31, 2007, payments of $56 million have been made against this accrual, of which $14 million

and $38 million were made during the years ended December 31, 2007 and 2006, respectively.

Restructuring Costs

Between January 1, 2005 and December 31, 2008, the Company incurred restructuring costs of $80 million as

part of its broader plans to simplify its organizational structure and enhance its customer focus, and payments of

$71 million have been made against this accrual. Of the remaining $9 million liability, $6 million is classified as a

current liability, with the remaining $3 million classified as a noncurrent liability in the consolidated balance sheet

as of December 31, 2008. Amounts are expected to be paid through 2011.

116

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)