Time Warner Cable 2008 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

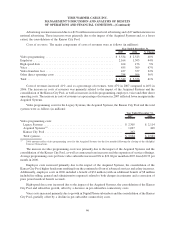

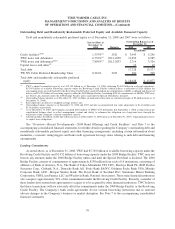

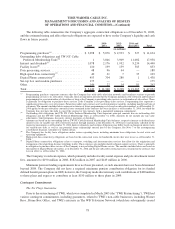

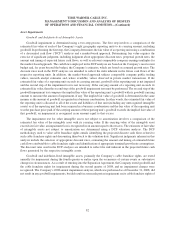

Outstanding Debt and Mandatorily Redeemable Preferred Equity and Available Financial Capacity

Debt and mandatorily redeemable preferred equity as of December 31, 2008 and 2007 were as follows:

Interest Rate at

December 31,

2008 Maturity 2008 2007

Outstanding Balance as of

December 31,

(in millions)

Credit facilities

(a)(b)

......................... 1.353%

(c)

2011 $ 3,045 $ 5,256

TWC notes and debentures ................... 6.752%

(c)

2012-2038 11,956 4,985

TWE notes and debentures

(d)(e)

................ 7.809%

(c)

2012-2033 2,714 3,326

Capital leases and other

(f)

..................... 13 10

Total debt ................................ 17,728 13,577

TW NY Cable Preferred Membership Units ....... 8.210% 2013 300 300

Total debt and mandatorily redeemable preferred

equity ................................. $ 18,028 $ 13,877

(a)

TWC’s unused committed capacity was $13.130 billion as of December 31, 2008, reflecting $5.449 billion in cash and equivalents,

$5.749 billion of available borrowing capacity under the Revolving Credit Facility (which reflects a reduction of $126 million for

outstanding letters of credit backed by the Revolving Credit Facility and $125 million for commitments of LBB, as defined and discussed

below) and $1.932 billion of borrowing capacity under the 2008 Bridge Facility (excluding $138 of commitments of LBCB). TWC may

not borrow any amounts under the 2008 Bridge Facility unless and until the Special Dividend is declared.

(b)

Outstanding balance amount as of December 31, 2007 excludes an unamortized discount on commercial paper of $5 million (none as of

December 31, 2008).

(c)

Rate represents an effective weighted-average interest rate.

(d)

Outstanding balance amount as of December 31, 2008 and 2007 includes an unamortized fair value adjustment of $114 million and

$126 million, respectively.

(e)

As of December 31, 2007, the Company classified $601 million of TWE 7.25% debentures due September 1, 2008 as long-term in the

consolidated balance sheet to reflect management’s intent and ability to refinance the obligation on a long-term basis through the

utilization of the Company’s unused committed capacity.

(f)

Amount includes $1 million of debt due within one year as of December 31, 2008 (none as of December 31, 2007), which primarily relates

to capital lease obligations.

See “Overview—Recent Developments—2008 Bond Offerings and Credit Facilities” and Note 7 to the

accompanying consolidated financial statements for further details regarding the Company’s outstanding debt and

mandatorily redeemable preferred equity and other financing arrangements, including certain information about

maturities, covenants, rating triggers and bank credit agreement leverage ratios relating to such debt and financing

arrangements.

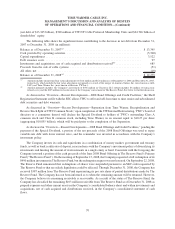

Lending Commitments

As noted above, as of December 31, 2008, TWC had $5.749 billion of available borrowing capacity under the

Revolving Credit Facility and $1.932 billion of borrowing capacity under the 2008 Bridge Facility. TWC may not

borrow any amounts under the 2008 Bridge Facility unless and until the Special Dividend is declared. The 2008

Bridge Facility consists of commitments of approximately $138 million from each of 14 institutions, consisting of

affiliates of Bank of America, N.A., The Bank of Tokyo-Mitsubishi UFJ, LTD., Barclays Bank Plc, BNP Paribas

Securities Corp., Citibank, N.A., Deutsche Bank AG, Fortis Bank SA/NV, Goldman Sachs Bank USA, Mizuho

Corporate Bank, LTD., Morgan Stanley Bank, The Royal Bank of Scotland PLC, Sumitomo Mitsui Banking

Corporation, UBS Loan Finance LLC and Wachovia Bank, National Association. These same financial institutions

also comprise approximately 70% of the commitments under the Revolving Credit Facility. Recently, a number of

these lenders have entered into agreements to acquire or to be acquired by other financial institutions. TWC believes

that these transactions will not adversely affect the commitments under the 2008 Bridge Facility or the Revolving

Credit Facility. The Company’s bank credit agreements do not contain borrowing restrictions due to material

adverse changes in the Company’s business or market disruption. See Note 7 to the accompanying consolidated

financial statements.

76

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)