Time Warner Cable 2008 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Reimbursements of Programming Expense

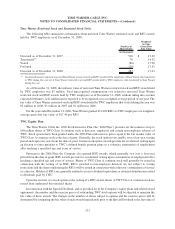

A subsidiary of Time Warner previously agreed to assume a portion of the cost of TWC’s contractual carriage

arrangements with a programmer in order to secure other forms of content from the same programmer over time

periods consistent with the terms of the respective TWC carriage contract. The amount assumed represented Time

Warner’s best estimate of the fair value of the other content acquired by the Time Warner subsidiary at the time the

agreements were executed. Under this arrangement, the Time Warner subsidiary makes periodic payments to TWC

that are classified as a reduction of programming costs in the consolidated statement of operations. Payments

received or receivable under this agreement totaled $39 million in 2008, $35 million in 2007 and $36 million in

2006.

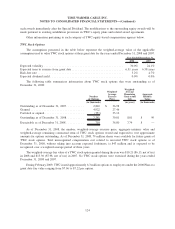

15. SHAREHOLDERS’ EQUITY

TWC is authorized to issue up to 20 billion shares of Class A common stock, par value $0.01 per share, and

5 billion shares of Class B common stock, par value $0.01 per share. As of December 31, 2008, 902 million shares of

Class A common stock and 75 million shares of Class B common stock were issued and outstanding. TWC is also

authorized to issue up to 1 billion shares of preferred stock, par value $0.01 per share; however, no preferred shares

have been issued, nor does the Company have any current plans to issue any preferred shares.

Each share of Class A common stock votes as a single class with respect to the election of Class A directors,

which are required to represent not less than one-sixth of the Company’s directors and not more than one-fifth of the

Company’s directors. Each share of the Company’s Class B common stock votes as a single class with respect to the

election of Class B directors, which are required to represent not less than four-fifths of the Company’s directors.

Each share of Class B common stock issued and outstanding generally has ten votes on any matter submitted to a

vote of the stockholders, and each share of Class A common stock issued and outstanding has one vote on any matter

submitted to a vote of stockholders. Except for the voting rights characteristics described above, there are no

differences between the Class A and Class B common stock. The Class A common stock and the Class B common

stock will generally vote together as a single class on all matters submitted to a vote of the stockholders, except with

respect to the election of directors. The Class B common stock is not convertible into the Company’s Class A

common stock. As a result of its shareholdings, Time Warner has the ability to cause the election of all Class A and

Class B directors.

As of December 31, 2008, Time Warner holds an 84.0% economic interest TWC (representing a 90.6% voting

interest), through ownership of 82.7% of TWC’s Class A common stock and all of the outstanding shares of TWC’s

Class B common stock. Refer to Note 4 for discussion pertaining to TWC’s pending separation from Time Warner.

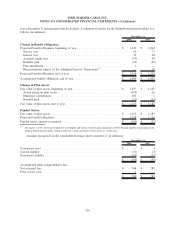

16. COMMITMENTS AND CONTINGENCIES

Prior to the TWE Restructuring, TWE had various contingent commitments, including guarantees, related to

the TWE non-cable businesses. In connection with the TWE Restructuring, some of these commitments were not

transferred with their applicable non-cable business and they remain contingent commitments of TWE. Time

Warner and its subsidiary, WCI, have agreed, on a joint and several basis, to indemnify TWE from and against any

and all of these contingent liabilities, but TWE remains a party to these commitments.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing

franchise agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and

public utilities and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2008

and 2007 totaled $288 million and $299 million, respectively. Payments under these arrangements are required only

in the event of nonperformance. TWC does not expect that these contingent commitments will result in any amounts

being paid in the foreseeable future.

131

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)