Time Warner Cable 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business.

Overview

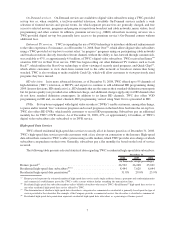

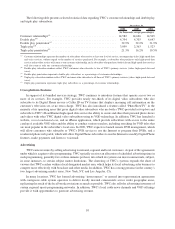

Time Warner Cable Inc. (together with its subsidiaries, “TWC” or the “Company”) is the second-largest cable

operator in the U.S., with technologically advanced, well-clustered systems located mainly in five geographic

areas – New York State (including New York City), the Carolinas, Ohio, southern California (including Los

Angeles) and Texas. As of December 31, 2008, TWC served approximately 14.6 million customers who subscribed

to one or more of its video, high-speed data and voice services, representing approximately 34.2 million revenue

generating units (“RGUs”), which reflects the total of all TWC basic video, digital video, high-speed data and voice

service subscribers.

As of December 31, 2008, TWC served approximately 13.1 million basic video subscribers. Of those,

approximately 8.6 million (or 66%) received some portion of their video services at their dwelling or commercial

establishment via digital transmissions (“digital video subscribers”). Also, as of December 31, 2008, TWC served

approximately 8.4 million residential high-speed data subscribers (or 32% of estimated high-speed data service-

ready homes passed) and approximately 3.7 million residential Digital Phone subscribers (or 14% of estimated

voice service-ready homes passed). TWC markets its services separately and in “bundled” packages of multiple

services and features. As of December 31, 2008, 54% of TWC’s customers subscribed to two or more of its primary

services, including 21% of its customers who subscribed to all three primary services. As part of an increased

emphasis on its commercial business, TWC began selling its commercial Digital Phone service, Business

Class Phone, to small- and medium-sized businesses in the majority of its operating areas during 2007, and

substantially completed the roll-out in the remainder of its operating areas during 2008. TWC believes providing

commercial services will generate additional opportunities for growth. As of December 31, 2008, TWC served

283,000 commercial high-speed data subscribers and 30,000 commercial Digital Phone subscribers. In addition,

TWC sells advertising to a variety of national, regional and local customers.

In July 2006, Time Warner NY Cable LLC (“TW NY Cable”), a subsidiary of TWC, and Comcast Corporation

(together with its subsidiaries, “Comcast”) completed their respective acquisitions of assets comprising in

aggregate substantially all of the cable assets of Adelphia Communications Corporation (“Adelphia”) (the

“Adelphia Acquisition”). In February 2007, Adelphia’s Chapter 11 reorganization plan became effective. Under

the terms of the reorganization plan, substantially all of the shares of TWC Class A common stock, par value $.01

per share (“TWC Class A common stock”), that Adelphia received as part of the payment for the systems TW NY

Cable acquired from Adelphia were distributed to Adelphia’s creditors. As a result, under applicable securities law

regulations and provisions of the U.S. bankruptcy code, TWC became a public company subject to the requirements

of the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”). On March 1, 2007, the TWC

Class A common stock began trading on the New York Stock Exchange under the symbol “TWC.” Time Warner Inc.

(“Time Warner”) currently owns approximately 84.0% of the common stock of TWC (representing a 90.6% voting

interest) and also currently owns an indirect 12.43% non-voting common stock interest in TW NY Cable Holding

Inc. (“TW NY”), a subsidiary of TWC. The financial results of TWC’s operations are consolidated by Time Warner.

Recent Developments

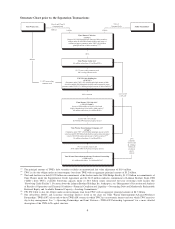

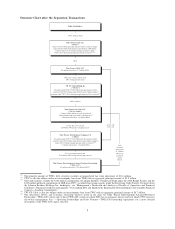

Separation from Time Warner, Recapitalization and Reverse Stock Split of TWC Common Stock

On May 20, 2008, TWC and its subsidiaries, Time Warner Entertainment Company, L.P. (“TWE”) and TW

NY, entered into a Separation Agreement (the “Separation Agreement”) with Time Warner and its subsidiaries,

Warner Communications Inc. (“WCI”), Historic TW Inc. (“Historic TW”) and American Television and Com-

munications Corporation (“ATC”), the terms of which will govern TWC’s legal and structural separation from Time

Warner. TWC’s separation from Time Warner will take place through a series of related transactions, the occurrence

of each of which is a condition to the next. First, Time Warner will complete certain internal restructuring

transactions not affecting TWC. Next, following the satisfaction or waiver of certain conditions, including those

mentioned below, Historic TW will transfer its 12.43% non-voting common stock interest in TW NY to TWC in

exchange for 80 million newly issued shares of TWC’s Class A common stock (the “TW NY Exchange”).

1