Time Warner Cable 2008 Annual Report Download - page 12

Download and view the complete annual report

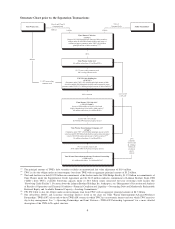

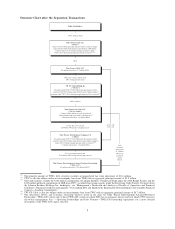

Please find page 12 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Following the TW NY Exchange, Time Warner will complete certain additional restructuring steps that will make

Time Warner the direct owner of all shares of TWC’s Class A common stock and Class B common stock previously

held by its subsidiaries (all of Time Warner’s restructuring transaction steps being referred to collectively as the

“TW Internal Restructuring”). Upon completion of the TW Internal Restructuring, TWC’s board of directors or a

committee thereof will declare a special cash dividend to holders of TWC’s outstanding Class A common stock and

Class B common stock, including Time Warner, in an amount equal to $10.27 per share (aggregating $10.855 bil-

lion) (the “Special Dividend”). The Special Dividend will be paid prior to the completion of TWC’s separation from

Time Warner. Following the receipt by Time Warner of its share of the Special Dividend, TWC will file with the

Secretary of State of the State of Delaware an amended and restated certificate of incorporation, pursuant to which,

among other things, each outstanding share of TWC Class A common stock (including any shares of Class A

common stock issued in the TW NY Exchange) and TWC Class B common stock will automatically be converted

into one share of common stock, par value $0.01 per share (the “TWC Common Stock”) (the “Recapitalization”).

Once the TW NY Exchange, the TW Internal Restructuring, the payment of the Special Dividend and the

Recapitalization have been completed, TWC’s separation from Time Warner (the “Separation”) will proceed in the

form of a pro rata dividend of all shares of TWC Common Stock held by Time Warner to holders of Time Warner’s

common stock (the “Distribution”). The Separation, the TW NY Exchange, the TW Internal Restructuring, the

Special Dividend, the Recapitalization and the Distribution collectively are referred to as the “Separation

Transactions.”

The Separation Agreement contains customary covenants, and consummation of the Separation Transactions

is subject to customary closing conditions. As of February 12, 2009, all regulatory and other necessary govern-

mental reviews of the Separation Transactions have been satisfactorily completed. Time Warner and TWC expect

the Separation Transactions to be consummated in the first quarter of 2009. See Item 1A, “Risk Factors,” for a

discussion of risk factors relating to the Separation.

In connection with the Separation Transactions, the Company has been authorized to effectuate a reverse stock

split of the TWC Common Stock at a 1-for-3 ratio.

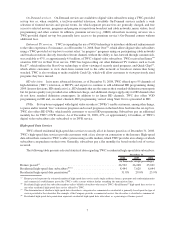

2008 Bond Offerings and Credit Facilities

On June 16, 2008, TWC filed a shelf registration statement on Form S-3 (the “Shelf Registration Statement”)

with the Securities and Exchange Commission (the “SEC”) that allows TWC to offer and sell from time to time

senior and subordinated debt securities and debt warrants. TWC issued, in total, $7.0 billion in aggregate principal

amount of senior unsecured notes and debentures under the Shelf Registration Statement in two underwritten public

offerings on June 19, 2008 and November 18, 2008 (collectively, the “2008 Bond Offerings”). Pending the payment

of the Special Dividend, a portion of the net proceeds from the 2008 Bond Offerings was used to repay variable-rate

debt with lower interest rates than the interest rates on the debt securities issued in the 2008 Bond Offerings, and the

remainder was invested in accordance with the Company’s investment policy. If the Separation is not consummated

and the Special Dividend is not paid, the Company will use the remainder of the net proceeds from the 2008 Bond

Offerings for general corporate purposes, including repayment of indebtedness.

In addition to issuing the debt securities in the 2008 Bond Offerings described above, on June 30, 2008, the

Company entered into a credit agreement with a geographically diverse group of major financial institutions for a

senior unsecured term loan facility in an initial aggregate principal amount of $9.0 billion with an initial maturity

date that is 364 days after the borrowing date (the “2008 Bridge Facility”) in order to finance, in part, the Special

Dividend. TWC may elect to extend the maturity date of the loans outstanding under the 2008 Bridge Facility for an

additional year. As a result of the 2008 Bond Offerings, the amount of the commitments of the lenders under the

2008 Bridge Facility was reduced to $2.070 billion. TWC may not borrow any amounts under the 2008 Bridge

Facility unless and until the Special Dividend is declared. The financial institutions’ commitments to fund

borrowings under the 2008 Bridge Facility will expire upon the earliest of (i) May 19, 2009, (ii) the date on which

the Separation Agreement is terminated in accordance with its terms or (iii) the completion of the Separation.

On December 10, 2008, Time Warner (as lender) and TWC (as borrower) entered into a credit agreement for a

two-year $1.535 billion senior unsecured supplemental term loan facility (the “Supplemental Credit Agreement”).

2