Time Warner Cable 2008 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

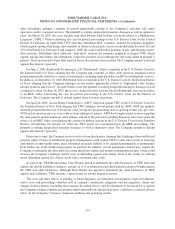

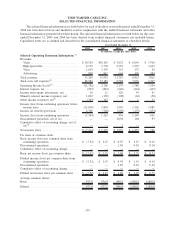

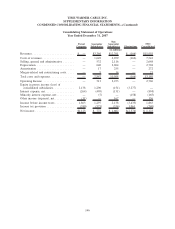

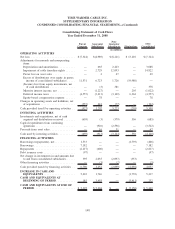

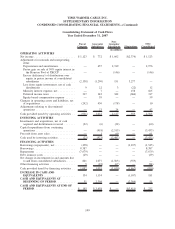

TIME WARNER CABLE INC.

SELECTED FINANCIAL INFORMATION

The selected financial information set forth below for each of the three years in the period ended December 31,

2008 has been derived from and should be read in conjunction with the audited financial statements and other

financial information presented elsewhere herein. The selected financial information set forth below for the years

ended December 31, 2005 and 2004 has been derived from audited financial statements not included herein.

Capitalized terms are as defined and described in the consolidated financial statements or elsewhere herein.

2008 2007 2006 2005 2004

Year Ended December 31,

(in millions, except per share data)

Selected Operating Statement Information:

(a)

Revenues:

Video .............................. $10,524 $10,165 $ 7,632 $ 6,044 $ 5,706

High-speed data ...................... 4,159 3,730 2,756 1,997 1,642

Voice .............................. 1,619 1,193 715 272 29

Advertising. ......................... 898 867 664 499 484

Total revenues ......................... 17,200 15,955 11,767 8,812 7,861

Total costs and expenses

(b)

................ 28,982 13,189 9,588 7,026 6,307

Operating Income (Loss)

(b)

................ (11,782) 2,766 2,179 1,786 1,554

Interest expense, net . . . .................. (923) (894) (646) (464) (465)

Income from equity investments, net ......... 16 11 129 43 41

Minority interest income (expense), net . . . .... 1,022 (165) (108) (64) (56)

Other income (expense), net

(c)

.............. (383) 145 2 1 11

Income (loss) from continuing operations before

income taxes ........................ (12,050) 1,863 1,556 1,302 1,085

Income tax benefit (provision) . . ........... 4,706 (740) (620) (153) (454)

Income (loss) from continuing operations . .... (7,344) 1,123 936 1,149 631

Discontinued operations, net of tax .......... — — 1,038 104 95

Cumulative effect of accounting change, net of

tax

(d)

.............................. — — 2 — —

Net income (loss) ....................... $ (7,344) $ 1,123 $ 1,976 $ 1,253 $ 726

Per share of common stock:

Basic income (loss) per common share from

continuing operations .................. $ (7.52) $ 1.15 $ 0.95 $ 1.15 $ 0.63

Discontinued operations .................. — — 1.05 0.10 0.10

Cumulative effect of accounting change. . . .... — — — — —

Basic net income (loss) per common share .... $ (7.52) $ 1.15 $ 2.00 $ 1.25 $ 0.73

Diluted income (loss) per common share from

continuing operations .................. $ (7.52) $ 1.15 $ 0.95 $ 1.15 $ 0.63

Discontinued operations .................. — — 1.05 0.10 0.10

Cumulative effect of accounting change. . . .... — — — — —

Diluted net income (loss) per common share . . . $ (7.52) $ 1.15 $ 2.00 $ 1.25 $ 0.73

Average common shares:

Basic ................................ 977.0 976.9 990.4 1,000.0 1,000.0

Diluted .............................. 977.0 977.2 990.4 1,000.0 1,000.0

139