Time Warner Cable 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

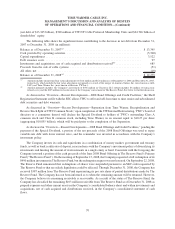

In addition, as discussed in “Overview—Recent Developments—Investment in Clearwire,” TWC invested

$550 million in Clearwire LLC on November 28, 2008. Of such investment, $20 million was allocated to the

additional agreements entered into in connection with its investment in Clearwire LLC.

TWE’s 7.25% debentures due September 1, 2008 (aggregate principal amount of $600 million) matured and

were retired on September 1, 2008.

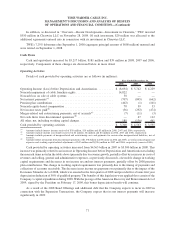

Cash Flows

Cash and equivalents increased by $5.217 billion, $181 million and $39 million in 2008, 2007 and 2006,

respectively. Components of these changes are discussed below in more detail.

Operating Activities

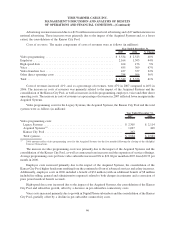

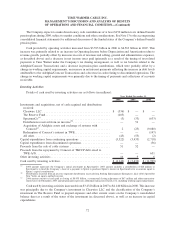

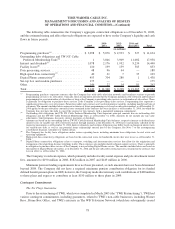

Details of cash provided by operating activities are as follows (in millions):

2008 2007 2006

Year Ended December 31,

Operating Income (Loss) before Depreciation and Amortization .......... $ (8,694) $ 5,742 $ 4,229

Noncash impairment of cable franchise rights ....................... 14,822 — —

Noncash loss on sale of cable systems ............................ 58 — —

Net interest payments

(a)

....................................... (707) (845) (662)

Pension plan contributions ..................................... (402) (1) (101)

Noncash equity-based compensation .............................. 78 59 33

Net income taxes paid

(b)

....................................... (36) (292) (474)

Merger-related and restructuring payments, net of accruals

(c)

............ (7) (11) (3)

Net cash flows from discontinued operations

(d)

...................... — 47 112

All other, net, including working capital changes. . ................... 188 (136) 461

Cash provided by operating activities ............................. $ 5,300 $ 4,563 $ 3,595

(a)

Amounts include interest income received of $38 million, $10 million and $5 million in 2008, 2007 and 2006, respectively.

(b)

Amounts include income tax refunds received of $4 million, $6 million and $4 million in 2008, 2007 and 2006, respectively.

(c)

Amounts include payments of merger-related and restructuring costs and payments for certain other merger-related liabilities, net of

accruals.

(d)

Amounts reflect net income from discontinued operations of $1.038 billion in 2006 (none in 2008 and 2007), as well as noncash gains and

expenses and working capital-related adjustments of $47 million and $(926) million in 2007 and 2006, respectively (none in 2008).

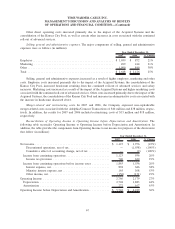

Cash provided by operating activities increased from $4.563 billion in 2007 to $5.300 billion in 2008. This

increase was primarily related to an increase in Operating Income before Depreciation and Amortization excluding

the noncash items noted in the table above (primarily due to revenue growth, partially offset by increases in costs of

revenues and selling, general and administrative expenses, as previously discussed), a favorable change in working

capital requirements and decreases in net income tax and net interest payments, partially offset by 2008 pension

plan contributions. The change in working capital requirements was primarily due to the timing of payments and

collections of accounts receivable. The decrease in net income tax payments was primarily due to the impact of the

Economic Stimulus Act of 2008, which was enacted in the first quarter of 2008 and provided for a bonus first year

depreciation deduction of 50% of qualified property. The benefits of this legislation were applicable to certain of the

Company’s capital expenditures during 2008. With the passage of the American Recovery and Reinvestment Act of

2009, signed by the President on February 17, 2009, this bonus depreciation benefit will continue.

As a result of the 2008 Bond Offerings and additional debt that the Company expects to incur in 2009 in

connection with the Separation Transactions, the Company expects that its net interest payments will increase

significantly in 2009.

71

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)