Time Warner Cable 2008 Annual Report Download - page 73

Download and view the complete annual report

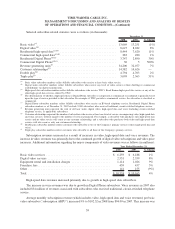

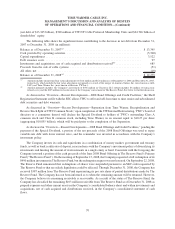

Please find page 73 of the 2008 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Income tax provision (benefit). TWC’s income tax provision (benefit) has been prepared as if the Company

operated as a stand-alone taxpayer for all periods presented. In 2008, the Company recorded an income tax benefit

of $4.706 billion and in 2007, the Company recorded an income tax provision of $740 million. The effective tax rate

was 39% in 2008, which included the impacts of the impairment of cable franchise rights and the loss on the sale of

cable systems, as compared to 40% in 2007. Absent these items, the effective tax rate for 2008 would have been

45%. The increase in the Company’s effective tax rate for 2008 (excluding the impairment of cable franchise rights

and the loss on the sale of cable systems) was primarily due to the tax impact of the 2008 impairment on the

Company’s investment in Clearwire LLC, as discussed above.

On February 19, 2009, California’s legislature approved the state’s budget, which is expected to be signed into

law during the first quarter of 2009, that, in part, changes the methodology of income tax apportionment in

California. This tax law change is likely to result in an increase in state deferred tax liabilities and a corresponding

noncash tax provision, which would be recorded in the first quarter of 2009.

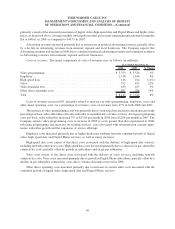

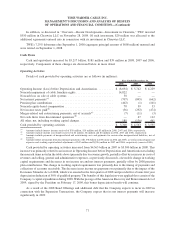

Net income (loss) and net income (loss) per common share. Net loss was $7.344 billion in 2008 compared to

net income of $1.123 billion in 2007. Basic and diluted net loss per common share were $7.52 in 2008 compared to

basic and diluted net income per common share of $1.15 in 2007. Net loss in 2008 included the impairment of cable

franchise rights and the loss on the sale of cable systems, as discussed above. Excluding these items, net income

decreased primarily due to the change in other expense (income), net, (which included the 2008 impairment on the

Company’s investment in Clearwire LLC and the 2007 TKCCP Gain) and increases in minority interest expense,

net, and interest expense, net, partially offset by an increase in Operating Income and a decrease in income tax

provision.

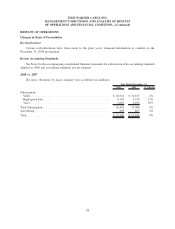

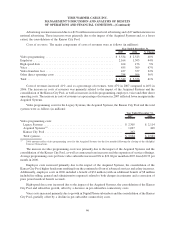

2007 vs. 2006

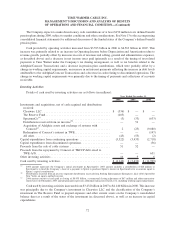

As further discussed in Notes 5 and 10 to the accompanying consolidated financial statements, the Company

completed the Adelphia/Comcast Transactions and began consolidating the results of the systems acquired in and

retained after the Adelphia/Comcast Transactions (the “Acquired Systems”) on July 31, 2006. Additionally, on

January 1, 2007, the Company began consolidating the results of certain cable systems located in Kansas City, south

and west Texas and New Mexico (the “Kansas City Pool”) upon the distribution of the assets of TKCCP to TWC and

Comcast. Accordingly, the operating results for 2007 include the results for the systems TWC owned before and

retained after the Adelphia/Comcast Transactions (the “Legacy Systems”), the Acquired Systems and the Kansas

City Pool for the full twelve-month period, and the operating results for 2006 include the results of the Legacy

Systems for the full twelve-month period and the Acquired Systems for only the five months following the closing

of the Adelphia/Comcast Transactions and do not include the consolidation of the results of the Kansas City Pool.

The impact of the incremental seven months of revenues and expenses of the Acquired Systems on the results for

2007 is referred to as the “impact of the Acquired Systems” in this report. Additionally, the Company has reflected

the financial position, results of operations and cash flows of the systems transferred to Comcast in connection with

the Adelphia/Comcast Transactions as discontinued operations for all periods presented.

63

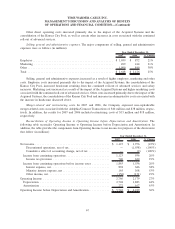

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION—(Continued)