Time Warner Cable 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Finite-lived Intangible Assets

In determining whether finite-lived intangible assets (e.g., customer relationships) are impaired, the account-

ing rules do not provide for an annual impairment test. Instead, they require that a triggering event occur before

testing an asset for impairment. Such triggering events include the significant disposal of a portion of such assets or

the occurrence of an adverse change in the market involving the business employing the related asset. The

Redemptions were a triggering event for testing such assets for impairment. Once a triggering event has occurred,

the impairment test employed is based on whether the intent is to hold the asset for continued use or to hold the asset

for sale. If the intent is to hold the asset for continued use, the impairment test first requires a comparison of

undiscounted future cash flows against the carrying value of the asset. If the carrying value of such asset exceeds the

undiscounted cash flow, the asset would be deemed to be impaired. Impairment would then be measured as the

difference between the fair value of the asset and its carrying value. Fair value is generally determined by

discounting the future cash flows associated with that asset. If the intent is to hold the asset for sale and certain other

criteria are met (e.g., the asset can be disposed of currently, appropriate levels of authority have approved the sale or

there is an actively pursuing buyer), the impairment test involves comparing the asset’s carrying value to its fair

value. To the extent the carrying value is greater than the asset’s fair value, an impairment loss is recognized for the

difference.

Significant judgments in this area involve determining whether a triggering event has occurred and the

determination of the cash flows for the assets involved and the discount rate to be applied in determining fair value.

There was no impairment of finite-lived intangible assets in 2006 or in connection with testing done as a result of the

Redemptions.

Equity-based Compensation Expense

The Company accounts for equity-based compensation in accordance with FAS 123R. The provisions of

FAS 123R require a company to measure the cost of employee services received in exchange for an award of equity

instruments based on the grant-date fair value of the award. That cost is recognized in the statement of operations

over the period during which an employee is required to provide service in exchange for the award. See Notes 1 and

4 to the accompanying consolidated financial statements for additional discussion.

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing

model, consistent with the provisions of FAS 123R and SAB No. 107, Share-Based Payment. Because option-

pricing models require the use of subjective assumptions, changes in these assumptions can materially affect the fair

value of the options. The assumptions presented in the table below represent the weighted-average value of the

applicable assumption used to value stock options at their grant date.

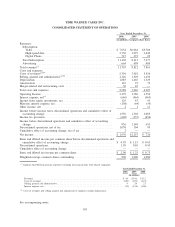

2006 2005 2004

Year Ended December 31,

Expected volatility ................................ 22.3% 24.5% 34.9%

Expected term to exercise from grant date .............. 5.07 years 4.79 years 3.60 years

Risk-free rate ................................... 4.6% 3.9% 3.1%

Expected dividend yield............................ 1.1% 0.1% 0%

The two most significant judgments involved in the selection of fair value assumptions are the expected

volatility of Time Warner’s common stock and the expected term to exercise from grant date. In estimating expected

volatility, the Company looks to the volatility implied by long-term traded Time Warner options (i.e., terms of two

years). Because Time Warner options granted to TWC employees have terms greater than two years, the volatility

implied by the traded Time Warner options is adjusted to reflect the expected life of the options. In estimating the

expected term of stock options granted to an employee, the Company utilizes a mathematical model which

considers factors such as historical employee exercise patterns and volatility of Time Warner common stock to

94

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)