Time Warner Cable 2006 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.PART I

Item 1. Business.

Overview

Time Warner Cable Inc., together with its subsidiaries (“TWC” or the “Company”), is the second-largest cable

operator in the U.S. and is an industry leader in developing and launching innovative video, data and voice services.

As of December 31, 2006, TWC had cable systems that passed approximately 26 million U.S. homes in well-

clustered locations and had approximately 14.6 million customer relationships (after giving effect to the distribution

of the assets of Texas and Kansas City Cable Partners, L.P. (“TKCCP”) to its partners on January 1, 2007).

Approximately 85% of these homes passed were located in one of five principal geographic areas: New York state,

the Carolinas, Ohio, southern California and Texas. As of February 1, 2007, Time Warner Cable was the largest

cable system operator in a number of large cities, including New York City and Los Angeles.

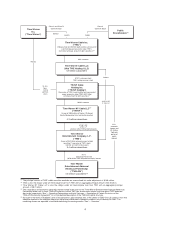

As part of TWC’s strategy to expand its cable footprint and improve the clustering of its cable systems, on

July 31, 2006 Time Warner NY Cable LLC (“TW NY”), a subsidiary of TWC, and Comcast Corporation

(“Comcast”) completed their respective acquisitions of assets comprising, in the aggregate, substantially all of the

cable systems of Adelphia Communications Corporation (“Adelphia”). TW NY paid for the Adelphia assets

acquired by it with approximately $8.9 billion in cash (after certain purchase price adjustments) and shares of

TWC’s Class A common stock, par value $.01 per share (“TWC Class A common stock”) representing approx-

imately 16% of TWC’s outstanding common stock. Immediately prior to the Adelphia acquisition, TWC and its

subsidiary, Time Warner Entertainment Company, L.P. (“TWE”), redeemed Comcast’s interests in TWC and TWE,

respectively, with the result that Comcast no longer has an interest in either company. In addition, immediately after

the acquisition of the Adelphia assets, TW NYexchanged certain cable systems with subsidiaries of Comcast. These

transactions (referred to generally herein as the “Transactions”) resulted in a net increase of 3.2 million basic video

subscribers served by TWC’s cable systems, consisting of approximately 4.0 million subscribers in acquired

systems and approximately 0.8 million subscribers in systems transferred to Comcast. Cable systems acquired by

TWC from Adelphia or from Comcast in the Transactions are referred to herein as the “Acquired Systems,” and

systems owned or operated by TWC since prior to the Transactions are referred to herein as the “Legacy Systems.”

On February 13, 2007, Adelphia’s plan of reorganization under Chapter 11 of title 11 of the United States Code

became effective and, under applicable securities law regulations and provisions of the U.S. bankruptcy code, TWC

became a public company subject to the requirements of the Securities Exchange Act of 1934 on the same day.

Under the terms of the plan, as of February 20, 2007, approximately 75% of the shares of TWC Class A common

stock that Adelphia received as part of the payment for its assets in July 2006 have been distributed to Adelphia’s

creditors. The remaining shares are expected to be distributed during the coming months as remaining disputes are

resolved by the bankruptcy court, including 4% of such shares that are being held in escrow in connection with the

asset acquisition. It is expected that the TWC Class A common stock will begin to trade on the New York Stock

Exchange (“NYSE”) on or about March 1, 2007.

Time Warner Inc. (“Time Warner”) holds an 84% economic interest in TWC (representing a 90.6% voting

interest). The financial results of TWC’s operations are consolidated by Time Warner. See “TWC’s Governing

Documents — Management and Operation of TWC.”

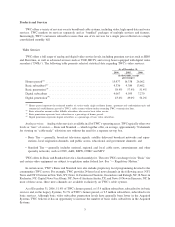

As the marketplace for basic video services has matured, the cable industry has responded by introducing new

services, including enhanced video services like high definition television (“HDTV”) and video-on-demand (“VOD”),

high-speed Internet access and Internet protocol (“IP”)-based telephony. As of December 31, 2006, approximately

7.3 million (or 54%) of TWC’s 13.4 million basic video customers subscribed to digital video services, 6.6 million (or

26%) of high-speed data service-ready homes subscribed to a residential high-speed data service such as TWC’s Road

Runner service and 1.9 million (or 11%) of voice service-ready homes subscribed to Digital Phone, TWC’s newest

service. TWC launched Digital Phone broadly in the Legacy Systems during 2004 and it is available in some of the

Acquired Systems on a limited basis. As of December 31, 2006, in the Legacy Systems, approximately 56% of TWC’s

9.5 million basic video customers subscribed to digital video services and over 30% of high-speed data service ready

homes subscribed to a residential high-speed data service. The customer data contained in this Item 1 include

subscribers in managed, but unconsolidated, Kansas City Pool systems (as defined below), which were distributed to

1