Time Warner Cable 2006 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

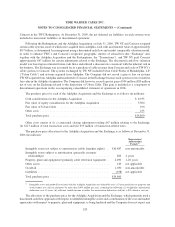

granted in prior periods to certain retirement-age-eligible employees with no subsequent substantive service

requirement (e.g., no substantive non-compete agreement). As a result, stock-based compensation expense for the

year ended December 31, 2005 reflects approximately $5 million, net of tax, related to the accelerated amortization

of the fair value of options granted in prior years to certain retirement-age-eligible employees with no subsequent

substantive service requirement. In May 2005, the staff of the SEC announced that companies that previously

followed the contractual vesting period approach must continue following that approach prior to adopting FAS 123R

and apply the recent accounting interpretation to new grants that have retirement eligibility provisions only upon

adoption of FAS 123R. As a result, stock-based compensation expense related to awards granted subsequent to

March 31, 2005 through December 31, 2005 have been determined using the contractual vesting period. For the year

ended December 31, 2005, the impact of applying the contractual vesting period approach as compared to the

approach noted in the accounting interpretations is not significant. Upon adoption of FAS 123R on January 1, 2006,

the Company accelerated the amortization of the fair value of options and RSUs granted to retirement-age-eligible

employees.

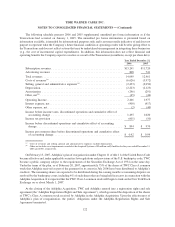

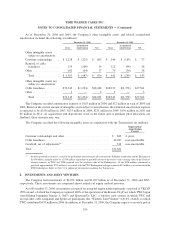

Other information pertaining to each category of stock-based compensation appears below.

Stock Option Plans

The fair value of each option grant is estimated on the date of grant using the Black-Scholes option-pricing

model, consistent with the provisions of FAS 123R and SAB No. 107, Share-Based Payment. Because option-

pricing models require the use of subjective assumptions, changes in these assumptions can materially affect the fair

value of the options. The assumptions presented in the table below represent the weighted-average value of the

applicable assumption used to value stock options at their grant date. In determining the volatility assumption, the

Company considers implied volatilities from traded options, as well as quotes from third-party investment banks.

The expected term, which represents the period of time that options granted are expected to be outstanding, is

estimated based on the historical exercise experience of the Company’s employees. The Company evaluated the

historical exercise behaviors of five employee groups, one of which related to retirement-eligible employees while

the other four of which were segregated based on the number of options granted when determining the expected

term assumptions. The risk-free rate assumed in valuing the options is based on the U.S. Treasury yield curve in

effect at the time of grant for the expected term of the option. The Company determines the expected dividend yield

percentage by dividing the expected annual dividend by the market price of Time Warner common stock at the date

of grant.

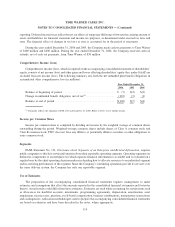

2006 2005 2004

Year Ended December 31,

Expected volatility ................................ 22.3% 24.5% 34.9%

Expected term to exercise from grant date .............. 5.07 years 4.79 years 3.60 years

Risk-free rate ................................... 4.6% 3.9% 3.1%

Expected dividend yield............................ 1.1% 0.1% 0.0%

117

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)