Time Warner Cable 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

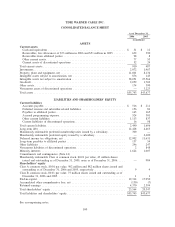

values. The remaining useful lives assigned to such assets were generally shorter than the useful lives assigned to

comparable new assets, to reflect the age, condition and intended use of the acquired property, plant and equipment.

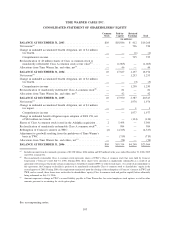

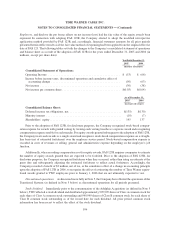

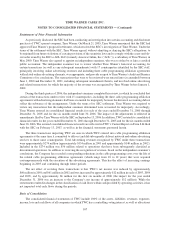

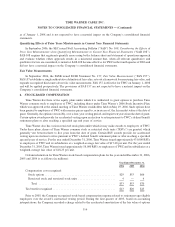

As of December 31, 2006 and 2005, the Company’s property, plant and equipment and related accumulated

depreciation included the following (in millions):

2006 2005

Estimated

Useful Lives

As of December 31,

Land, buildings and improvements

(a)

.................... $ 910 $ 634 10-20 years

Distribution systems ................................ 10,531 7,397 3-25 years

(b)

Converters and modems ............................. 3,630 2,772 3-4 years

Vehicles and other equipment ......................... 1,835 1,220 3-10 years

Construction in progress ............................. 637 521

17,543 12,544

Less: Accumulated depreciation ....................... (5,942) (4,410)

Total .......................................... $11,601 $ 8,134

(a)

Land is not depreciated.

(b)

Weighted-average useful lives for distribution systems are approximately 12 years.

Asset Retirement Obligations

FASB Statement No. 143, Accounting for Asset Retirement Obligations, requires that a liability be recognized

for an asset retirement obligation in the period in which it is incurred if a reasonable estimate of fair value can be

made. The Company has certain franchise and lease agreements containing provisions requiring the Company to

restore facilities or remove equipment in the event the agreement is not renewed. The Company anticipates that

these agreements will be renewed on an ongoing basis; however, a remote possibility exists that such agreements

could be terminated unexpectedly, which could result in the Company incurring significant expense in complying

with such agreements. Should a franchise or lease agreement containing a provision referenced above be

terminated, the Company would record an estimated liability for the fair value of the restoration and removal

expense. As of December 31, 2006, no such liabilities have been recorded as the franchise and lease agreements are

expected to be renewed and any costs associated with equipment removal provisions in the Company’s lease

agreements are either not estimable or are insignificant to the Company’s results of operations.

Intangible Assets

TWC has a significant number of intangible assets, including customer relationships and cable franchises.

Customer relationships and cable franchises acquired in business combinations are accounted for under the

purchase method of accounting and are recorded at fair value on the Company’s consolidated balance sheet. Other

costs incurred to negotiate and renew cable franchise agreements are capitalized as incurred. Customer relation-

ships acquired are amortized over their estimated useful life (4 years) and other costs incurred to negotiate and

renew cable franchise agreements are amortized over the term of such franchise agreements.

Asset Impairments

Investments

TWC’s investments are primarily accounted for using the equity method of accounting. A subjective aspect of

accounting for investments involves determining whether an other-than-temporary decline in value of the invest-

ment has been sustained. If it has been determined that an investment has sustained an other-than-temporary decline

109

TIME WARNER CABLE INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)