Time Warner Cable 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.respect of 5% of the limited partnership units of the Partnerships (plus any such units not purchased in any prior

year) based on an aggregate price for all limited partnership units at the higher of (i) $250 million in the case of Six

Flags Georgia and $374.8 million in the case of Six Flags Texas (the “Base Valuations”) and (ii) a weighted average

multiple of EBITDA for the respective Park over the previous four-year period; (d) ground lease payments; and

(e) either (i) the purchase of all of the outstanding limited partnership units by Six Flags through the exercise of a

call option upon the earlier of the occurrence of certain specified events and the end of the term of each of the

Partnerships in 2027 (Six Flags Georgia) and 2028 (Six Flags Texas) (the “End of Term Purchase”) or (ii) the

obligation to cause each of the Partnerships to have no indebtedness and to meet certain other financial tests as of the

end of the term of the Partnership. The aggregate amount payable in connection with an End of Term Purchase of

either Park will be the Base Valuation applicable to such Park, adjusted for changes in the consumer price index

from December 1996, in the case of Six Flags Georgia, and December 1997, in the case of Six Flags Texas through

December of the year immediately preceding the year in which the End of Term Purchase occurs, in each case,

reduced ratably to reflect limited partnership units previously purchased.

In connection with the 1998 sale of Six Flags Entertainment Corporation to Six Flags Inc. (formerly Premier

Parks Inc.) (“Six Flags”), Six Flags, Historic TW Inc. (formerly known as Time Warner Inc., “Historic TW”) and

TWE, among others, entered into a Subordinated Indemnity Agreement pursuant to which Six Flags agreed to

guarantee the performance of the Guaranteed Obligations when due and to indemnify Historic TW and TWE,

among others, in the event that the Guaranteed Obligations are not performed and the Six Flags Guarantee is called

upon. In the event of a default of Six Flags’ obligations under the Subordinated Indemnity Agreement, the

Subordinated Indemnity Agreement and related agreements provide, among other things, that Historic TW and

TWE have the right to acquire control of the managing partner of the Parks. Six Flags’ obligations to Historic TW

and TWE are further secured by its interest in all limited partnership units that are purchased by Six Flags.

Additionally, Time Warner and WCI have agreed, on a joint and several basis, to indemnify TWE from and

against any and all of these contingent liabilities, but TWE remains a party to these commitments. In the event that

TWE is required to make a payment related to any contingent liabilities of the TWE Non-cable Businesses, TWE

will recognize an expense from discontinued operations and will receive a capital contribution from Time Warner

and/or its subsidiary WCI for reimbursement of the incurred expenses. Additionally, costs related to any acquisition

and subsequent distribution to Time Warner would also be treated as an expense of discontinued operations to be

reimbursed by Time Warner.

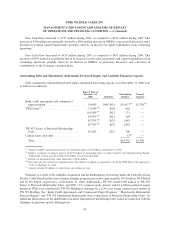

To date, no payments have been made by Historic TW or TWE pursuant to the Six Flags Guarantee. In its

quarterly report on Form 10-Q for the quarter ending September 30, 2006, Six Flags has reported a maximum

limited partnership unit obligation for 2007 of approximately $277 million. The Company believes the current fair

values of the Parks are in excess of this amount.

TWC has cable franchise agreements containing provisions requiring the construction of cable plant and the

provision of services to customers within the franchise areas. In connection with these obligations under existing

franchise agreements, TWC obtains surety bonds or letters of credit guaranteeing performance to municipalities and

public utilities and payment of insurance premiums. Such surety bonds and letters of credit as of December 31, 2006

and 2005 amounted to $328 million and $245 million, respectively. Payments under these arrangements are

required only in the event of nonperformance. TWC does not expect that these contingent commitments will result

in any amounts being paid in the foreseeable future.

TWC is required to make cash distributions to Time Warner when employees of the Company exercise

previously issued Time Warner stock options. For more information, see “Market Risk Management — Equity

Risk” below.

91

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)