Time Warner Cable 2006 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

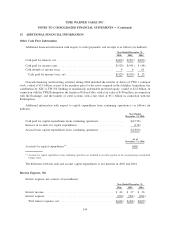

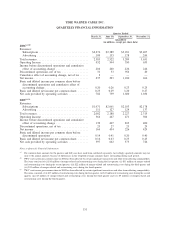

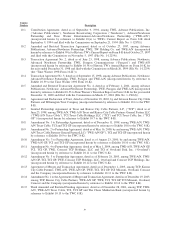

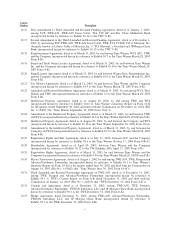

TIME WARNER CABLE INC.

QUARTERLY FINANCIAL INFORMATION

March 31, June 30, September 30, December 31,

Quarter Ended

(unaudited)

(in millions, except per share data)

2006

(a)(b)

Revenues:

Subscriptions ................................ $2,276 $2,389 $3,031 $3,407

Advertising ................................. 109 133 178 244

Total revenues ................................. 2,385 2,522 3,209 3,651

Operating Income .............................. 452 544 550 633

Income before discontinued operations and cumulative

effect of accounting change ..................... 204 260 226 246

Discontinued operations, net of tax ................. 31 33 954 20

Cumulative effect of accounting change, net of tax ...... 2 — — —

Net income ................................... 237 293 1,180 266

Basic and diluted income per common share before

discontinued operations and cumulative effect of

accounting change ............................ 0.20 0.26 0.23 0.25

Basic and diluted net income per common share........ 0.23 0.29 1.20 0.27

Net cash provided by operating activities ............. 782 759 1,020 1,034

2005

(a)(c)

Revenues:

Subscriptions ................................ $1,971 $2,061 $2,103 $2,178

Advertising ................................. 111 127 124 137

Total revenues ................................. 2,082 2,188 2,227 2,315

Operating Income .............................. 364 447 471 504

Income before discontinued operations and cumulative

effect of accounting change ..................... 139 407 203 400

Discontinued operations, net of tax ................. 25 27 23 29

Net income ................................... 164 434 226 429

Basic and diluted income per common share before

discontinued operations ........................ 0.14 0.41 0.20 0.40

Basic and diluted net income per common share........ 0.16 0.43 0.23 0.43

Net cash provided by operating activities ............. 597 642 575 726

Notes to Quarterly Financial Information

(a)

Per common share amounts for the quarters and full years have each been calculated separately. Accordingly, quarterly amounts may not

sum to the annual amounts because of differences in the weighted-average common shares outstanding during each period.

(b)

TWC’s net income per common share in 2006 has been affected by certain significant transactions and other items affecting comparability.

The items consisted of (i) $10 million of merger-related and restructuring costs during the first quarter, (ii) $11 million of merger-related

and restructuring costs during the second quarter, (iii) $22 million of merger-related and restructuring costs during the third quarter and

(vi) $13 million of merger-related and restructuring costs during the fourth quarter.

(c)

TWC’s net income per common share in 2005 has been affected by certain significant transactions and other items affecting comparability.

The items consisted of (i) $17 million of restructuring costs during the first quarter, (ii) $13 million of restructuring costs during the second

quarter, (iii) $3 million of merger-related and restructuring costs during the third quarter and (vi) $9 million of merger-related and

restructuring costs during the fourth quarter.

151