Time Warner Cable 2006 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2006 Time Warner Cable annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

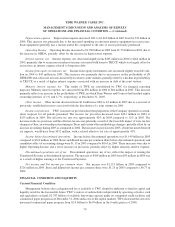

12.4% non-voting common stock interest in TW NY Holding. Following these transactions, TW NYalso exchanged

certain cable systems with Comcast and TW NY paid Comcast approximately $67 million for certain adjustments

related to the Exchange. See “Bank Credit Agreements and Commercial Paper Programs,” “Mandatorily Redeem-

able Preferred Equity” and “TW NY Mandatorily Redeemable Non-voting Series A Preferred Membership Units”

for additional information on the indebtedness incurred and preferred membership units issued in connection with

the Adelphia Acquisition and the Redemptions.

TWC is a participant in a wireless spectrum joint venture with several other cable companies and Sprint (the

“Wireless Joint Venture”), which was a winning bidder in an FCC auction of certain advanced wireless spectrum

licenses. In 2006, TWC paid approximately $633 million related to its investment in the Wireless Joint Venture. The

licenses were awarded to the Wireless Joint Venture on November 29, 2006. Under the joint venture agreement,

Sprint has the ability to exit the venture upon 60 days’ notice and to require that the venture purchase its interests for

an amount equal to Sprint’s capital contributions to that point. In addition, under certain circumstances, the cable

operators that are members of the venture have the ability to exit the venture and receive, subject to certain

limitations and adjustments, advanced wireless spectrum licenses covering their operating areas. There can be no

assurance that the venture will successfully develop mobile and related services.

On October 2, 2006, TWC received approximately $630 million from Comcast for the repayment of debt owed

by TKCCP to TWE-A/N that had been allocated to the Houston Pool.

Cash Flows

Operating Activities

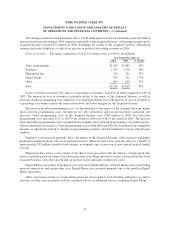

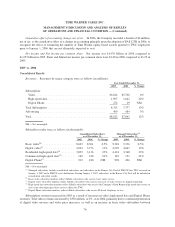

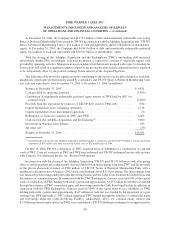

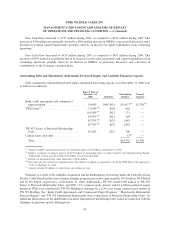

Details of cash provided by operating activities are as follows (in millions):

2006 2005 2004

Year Ended December 31,

OIBDA ................................................ $4,229 $3,323 $2,955

Net interest payments ..................................... (662) (507) (492)

Net income taxes (paid) refunded

(a)

........................... (525) (535) 13

Noncash equity-based compensation .......................... 33 53 70

Net cash flows from discontinued operations

(b)

.................. 112 237 240

Merger-related and restructuring payments, net of accruals

(c)

........ (3) 30 —

Pension plan contributions .................................. (101) (91) (150)

All other, net, including other working capital changes ............. 512 30 25

Cash provided by operating activities ........................ $3,595 $2,540 $2,661

(a)

Includes income tax refunds received of $4 million, $6 million and $61 million in 2006, 2005 and 2004, respectively.

(b)

Reflects net income from discontinued operations of $1.038 billion, $104 million and $95 million in 2006, 2005 and 2004, respectively,

net of noncash gains and expenses and working capital-related adjustments of $(926) million, $133 million and $145 million in 2006,

2005 and 2004, respectively.

(c)

Includes payments for merger-related and restructuring costs and payments for certain other merger-related liabilities, net of accruals.

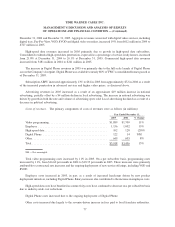

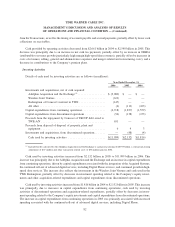

Cash provided by operating activities increased from $2.540 billion in 2005 to $3.595 billion in 2006. This

increase was primarily related to an increase in OIBDA (attributable to the impact of the Acquired Systems and

revenue growth in the Legacy Systems (particularly high margin high-speed data revenues), partially offset by

increases in costs of revenues and selling, general and administrative expenses) and a decrease in working capital

requirements, partially offset by lower net cash flows from discontinued operations and an increase in merger-

related and restructuring payments. The decrease in working capital requirements was primarily due to impacts

81

TIME WARNER CABLE INC.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS

OF OPERATIONS AND FINANCIAL CONDITION — (Continued)